In May 2015, we conducted a survey of analytics leaders in India to learn their views and plans with respect to their companies, and their outlook for growth of analytics industry. Continuing with that study, we bring to you the annual Analytics India Leaders Outlook study for this year.

The 2016 Analytics India Leaders outlook survey, which is the focus of this study, conducted a total of 50 online interviews in the month of April 2016, among key decision makers in analytics industry in India. The purpose of the study is to gain clearer insight into the confidence level of business leaders from Indian analytics industry and to provide these executives with information regarding the perspectives and actions of their peers.

Overall, the responses have been extremely positive and sentiment looked better than the last year. As analytics move even further past the just being a buzz towards real adoption by enterprises, their leaders’ optimism about the growth and demand continues to climb for the second year in a row. Looking out over 2015, these leaders are significantly more optimistic about the analytics in India.

Business Confidence

All respondents expect the demand of Analytics at their organization to increase over the next 12 months. Thus, there is extremely high level of confidence in the industry currently.

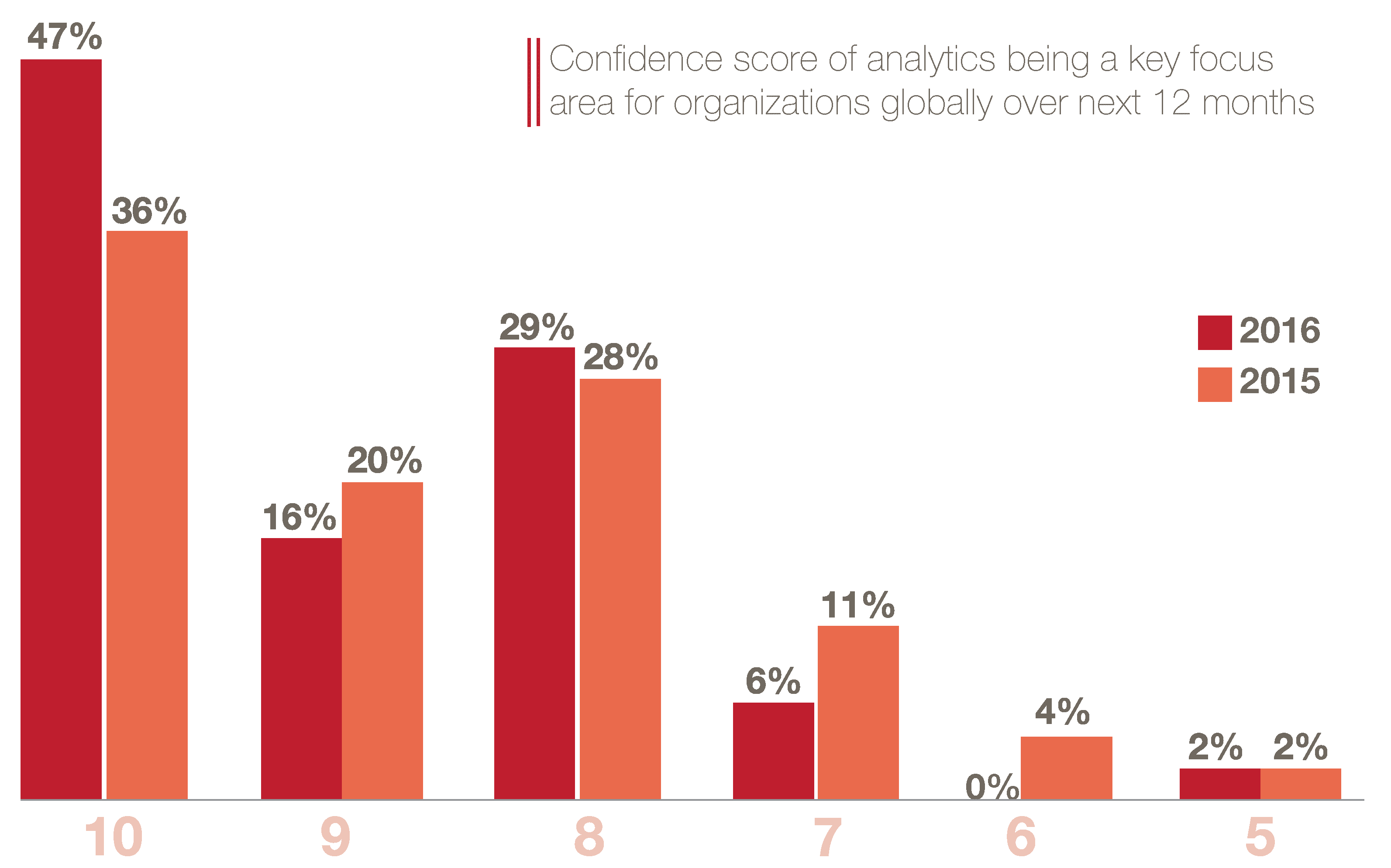

Next, we asked the leaders to rate on a scale of 1-10, if they are confident on analytics being a key focus area for organizations globally over next 12 months –

- 47% respondent gave a perfect 10/10 score. This is higher than 36% from last year.

- Just 1 respondent gave a score of less than 7 out of 10

- Average Confidence score was 9.0/10, higher than last year score of 8.6/10

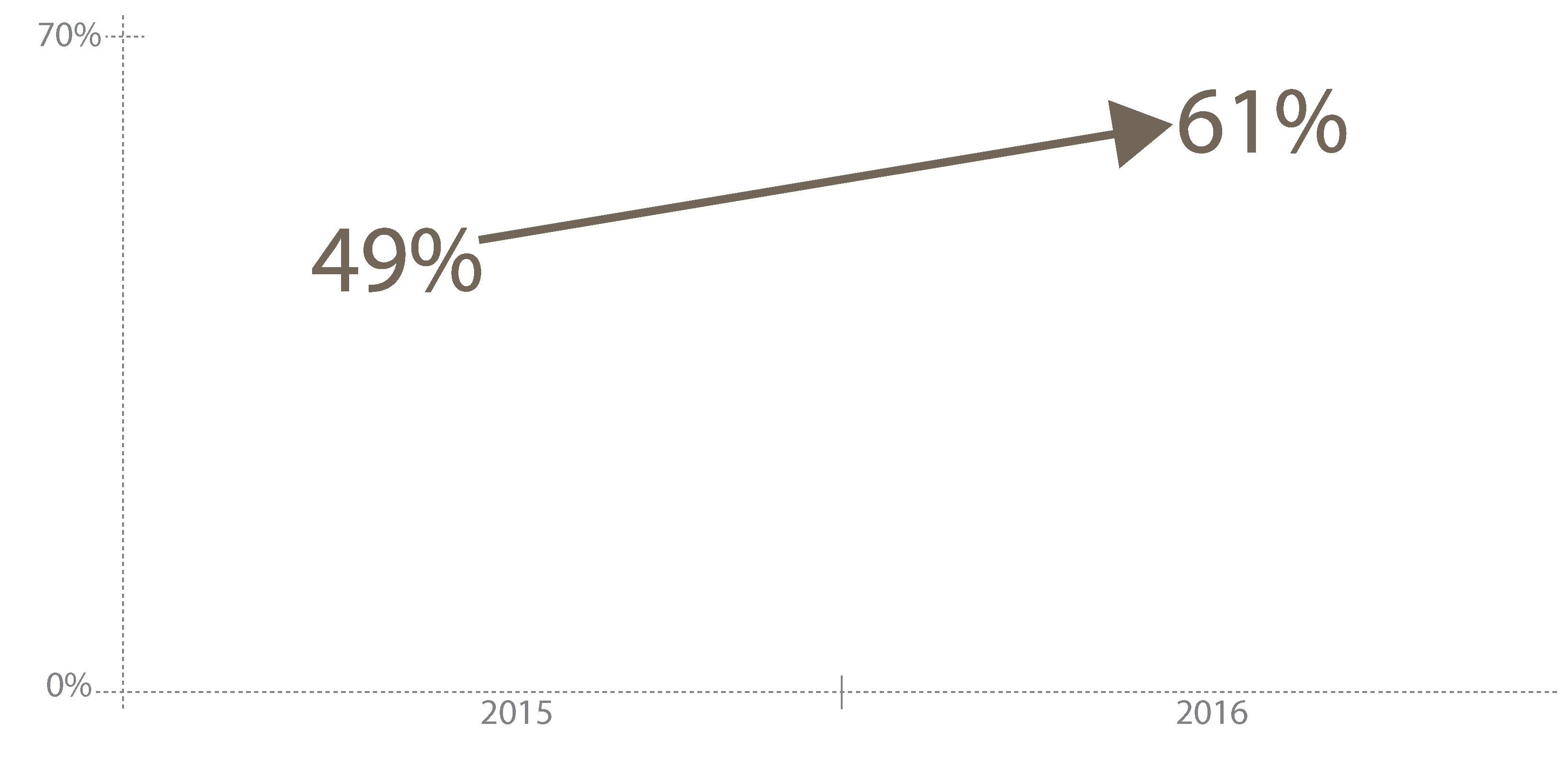

- Also, we calculated the Net Sentiment Score (Calculated as difference of % with score of 10s & 9s and Score from 0 through 6s), at 61%. This is much higher score than 49% of 2015.

- Analytics leaders in India exhibit a large positive outlook towards the industry compared to last year.

- 94% of decision makers plan to increase their analytics workforce in next 12 months. This is slightly lesser than 96% from last year.

- Just 6% say that they have no hiring plan for the coming year.

Key Challenges

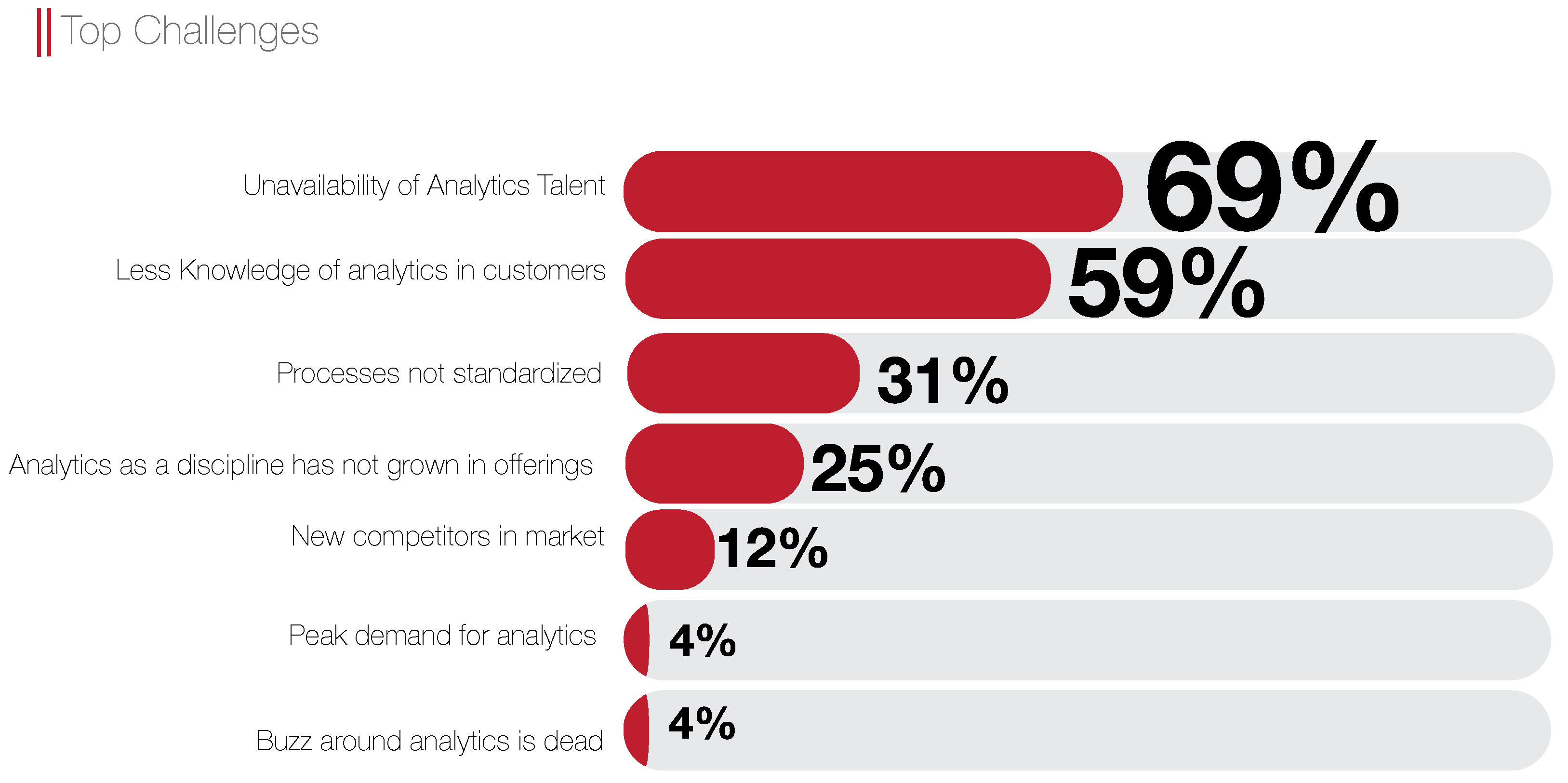

69% decision makers believe that ‘Unavailability of Analytics Talent’ is the major challenge that they face. The percentage is almost same from last year, where 67% decision makers believed that shortage of analytics talent is their biggest challenge.

This is in line with our earlier findings and is widely documented and spoken about. There is a huge demand for Analytics professionals across levels. The pool of resources is not sufficient to fulfil the current requirements. While the industry is collaborating with several institutes and organizations to fulfil these demands, the quality of professionals and experience still remains challenge.

- 59% of leaders believe that ‘Little knowledge of analytics among customers’ is a major challenge for them. This has also remained unchanged from last year of 58%.

- Obviously, we have not done enough to propagate analytics understanding to a wider audience in the market. While Analytics and big data has been a buzz word around the network, very few understand how they can in-cash on it. And even fewer can identify the key areas within their business to apply it to.

- Few leaders are wary of competition; just 12% believe it’s a challenge for them (down from 18% last year).

- The biggest change came in how leaders perceive the demand of analytics. Only 4% believe that analytics demand has peaked, as opposed to 20% last year. It’s evident that the current optimism is due to an increased demand for analytics.

- Some leaders pointed other challenges like Data preparation takes too much time, difficulties in implementing new techniques into current infrastructure & cheap quality products being called Analytics offered at a cheap price.

Growth Area

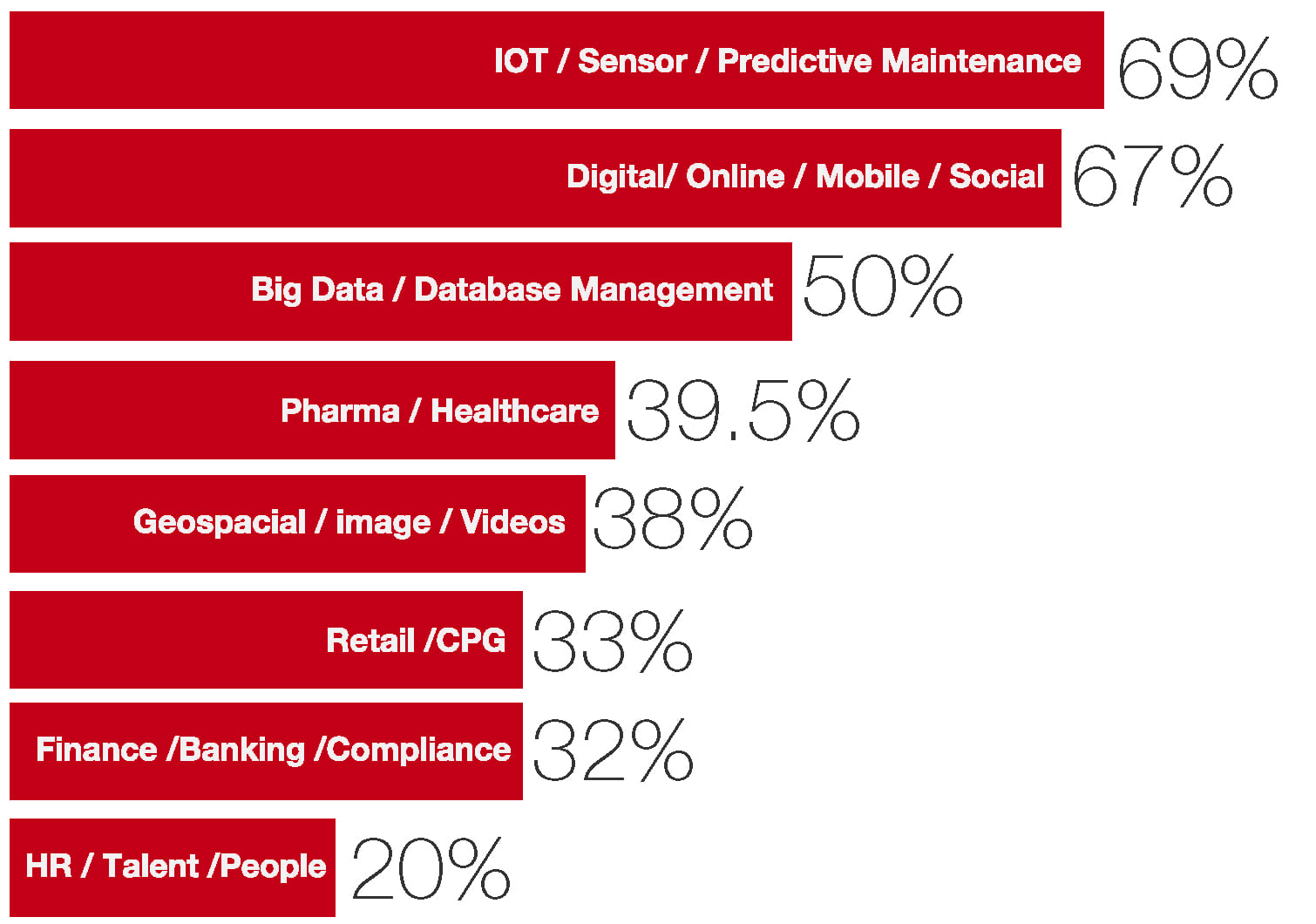

We asked our respondent on what according to them are the biggest growth industries for analytics in next 12 months.

- ‘IOT / Sensor/ Predictive Maintenance’ is considered as a top area of growth in analytics by 69% of respondent. This has seen the biggest increase since last year – from 49% last year to 69% this year.

- ‘Digital/ Online/ Mobile/ Social’ comes at a close second at 67%.

- ‘Retail / CPG’ has gone down as a growth area for analytics – from 49% last year to 33% this year. So, as opposed to 1 in 2 analytics leaders believing Retail and CPG to be growth area last year, just 1 in 3 thinks to be the same this year.

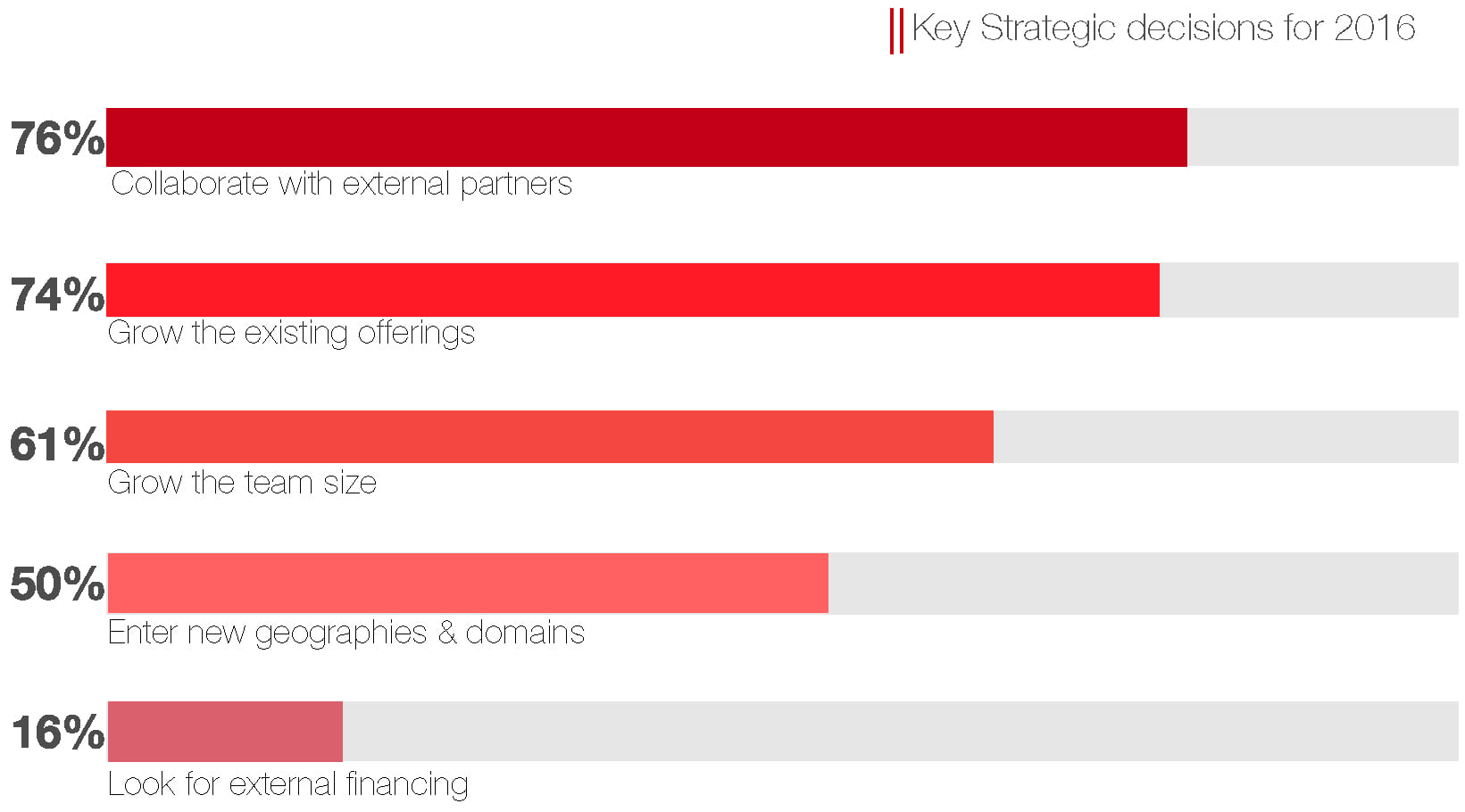

Key strategic decisions

We asked our respondents on the key strategy decisions that they plan for the coming year in order to grow their business.

- 76% analytics leaders plan to collaborate with external partners.

- 74% are planning to grow their existing offerings.

- Just 16% plan to look for external financing in the coming year.

% of Advanced Analytics

We asked an added question, not directly related to the business outlook of the leaders. This is more to do on how the analytics organizations in India are composed.

We asked our respondents the percentage of work in their organization that involves advanced analytics.

- The biggest bucket comprised of 10-25% i.e. 20% respondents claim that the percentage of advanced analytics work in their organization as compared to other analytics work is in the range of 10-25%.

- Using this information, we calculated the average % advanced analytics happening in India. This comes out to be approximately 38%.

- Assuming there is no bias in this data, 38% showcases an extremely high amount of advanced analytics work happening from India.

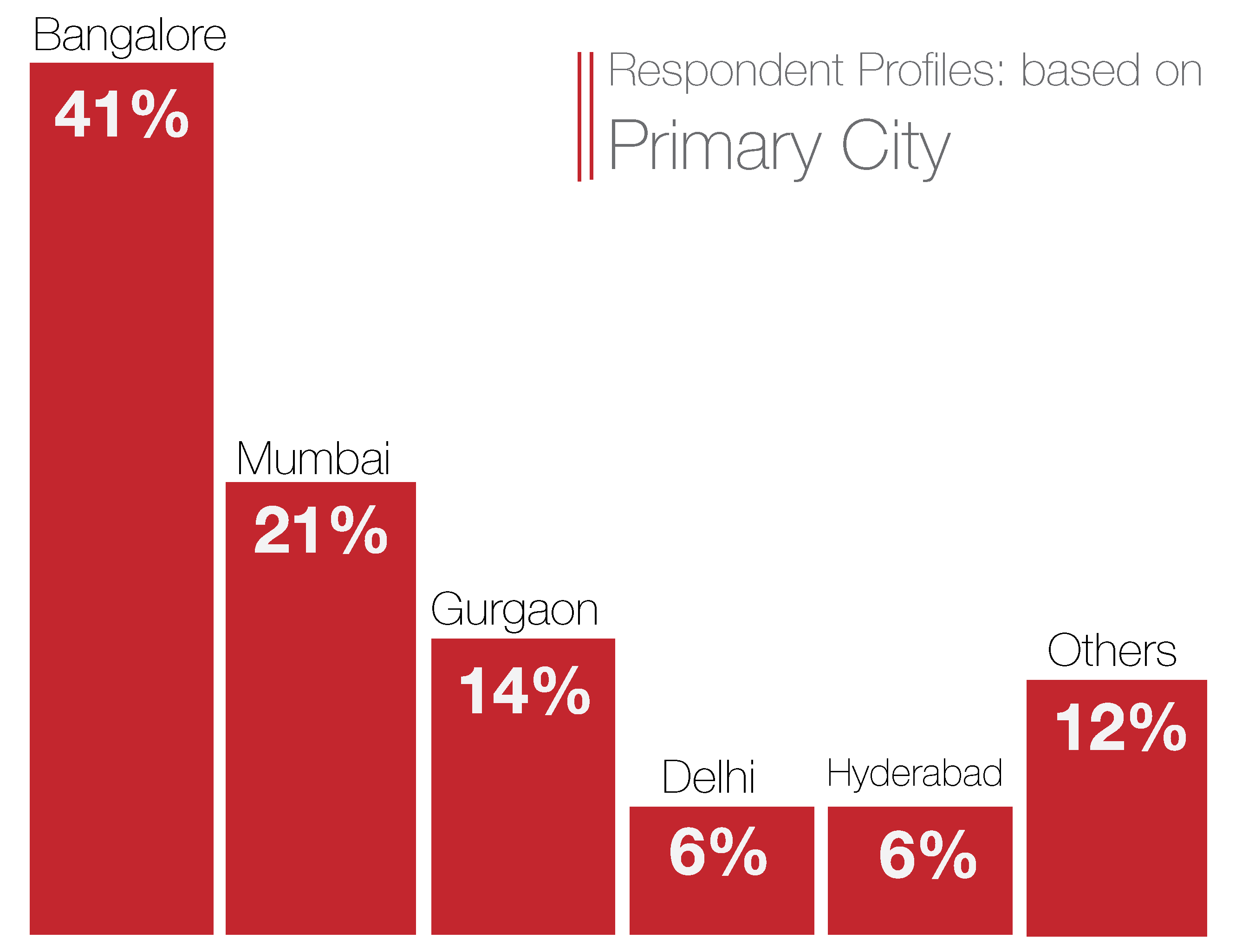

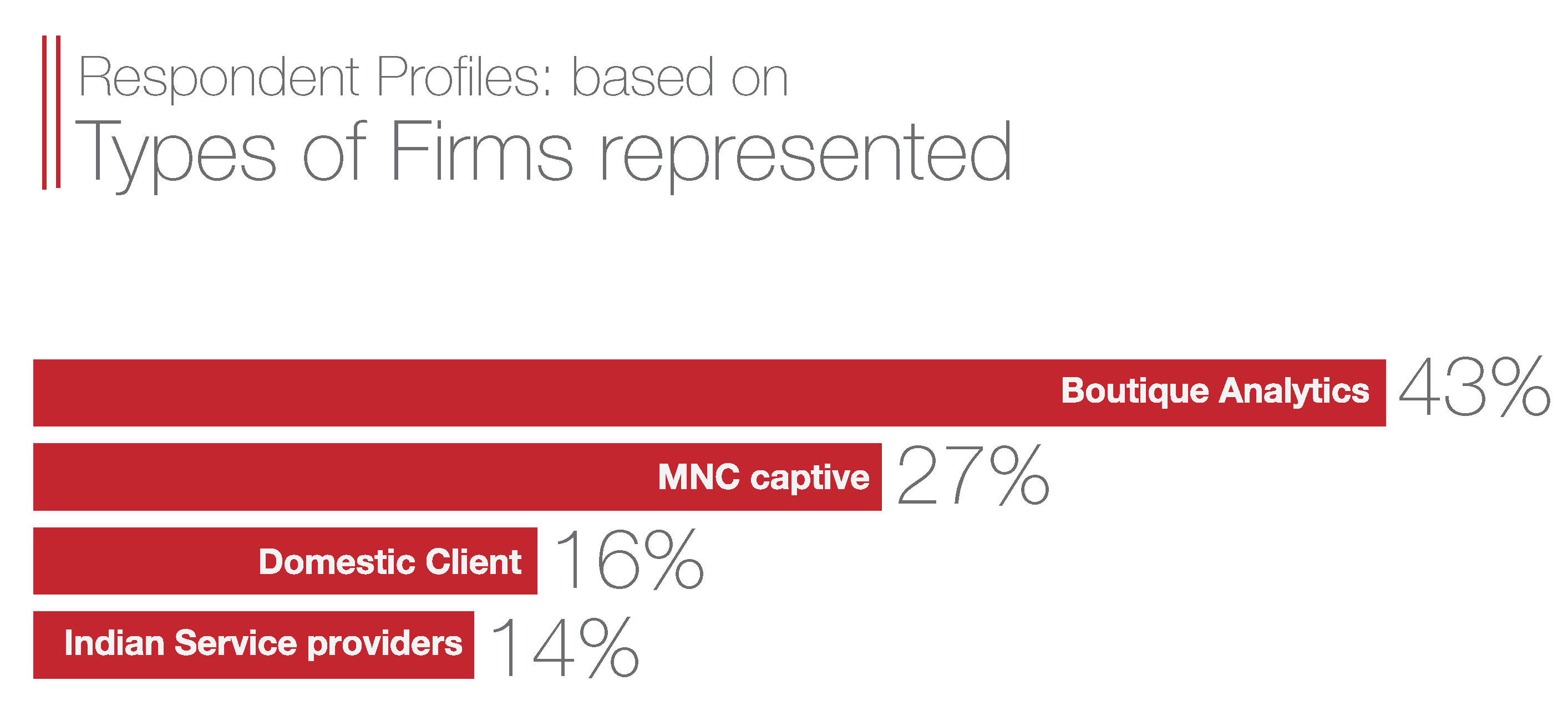

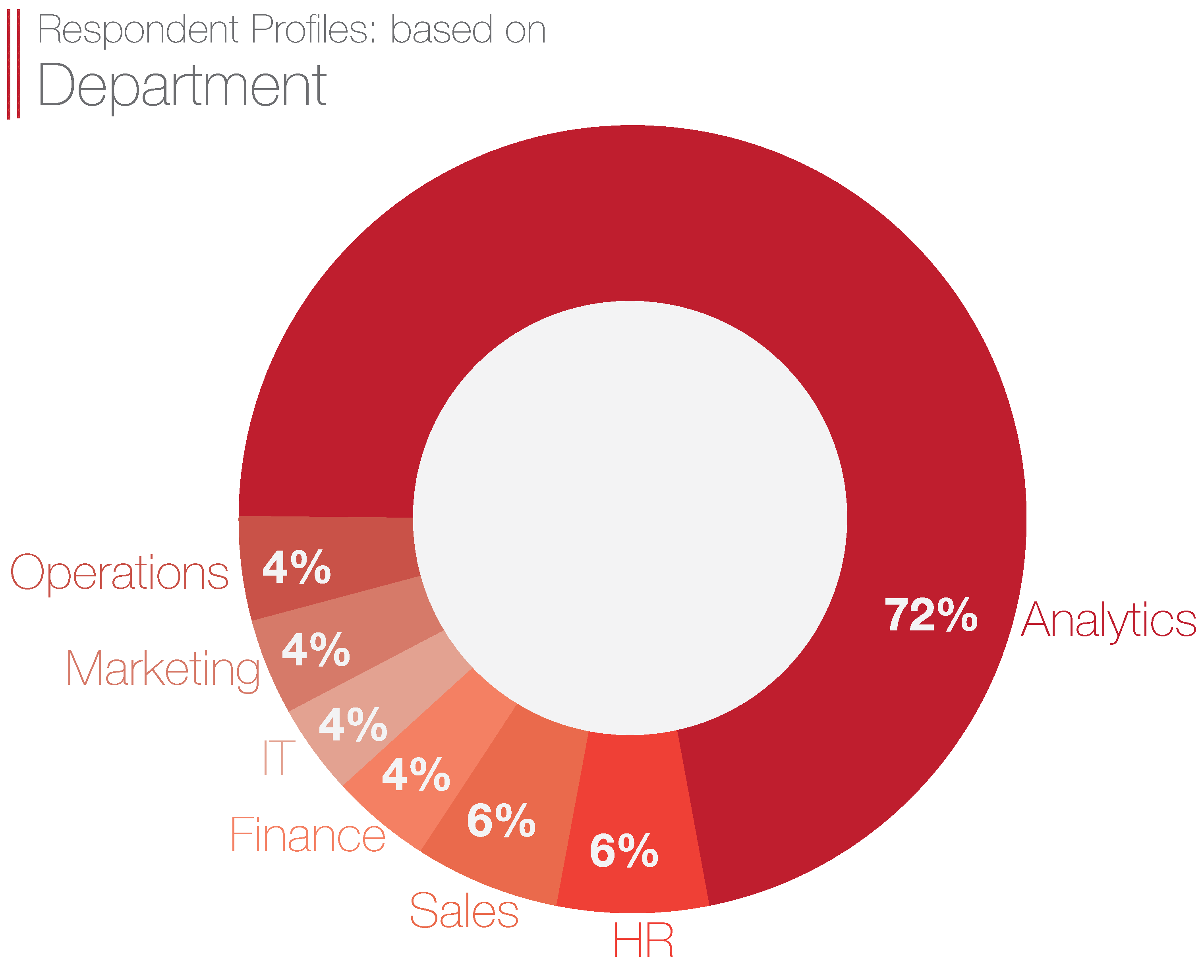

Respondents’ Profiles

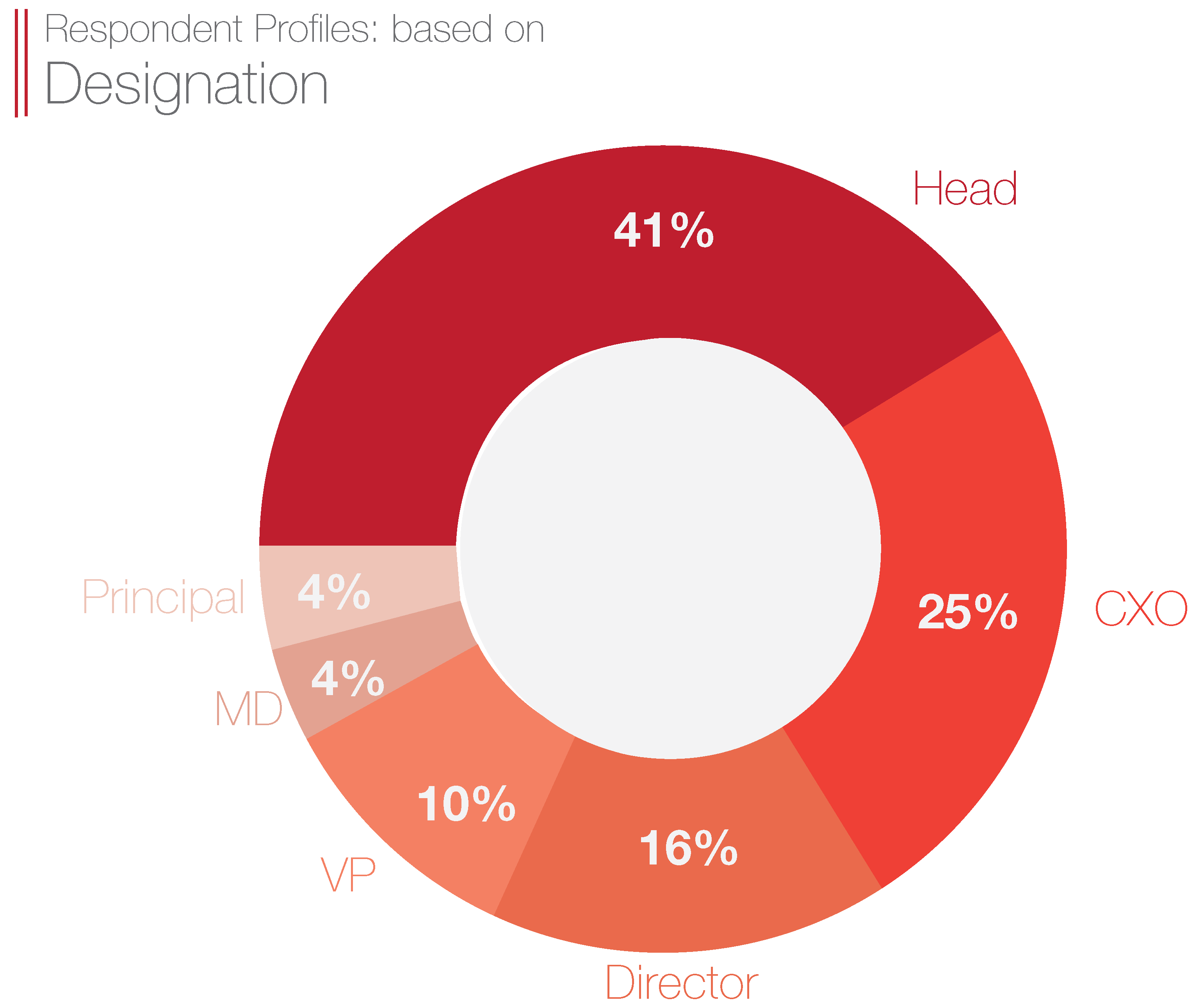

Here’s the profile of our respondents.