Industrial Data Research Corp. (http://www.idrcglobal.com) is a specialist consultancy present in Germany, India and Russia.

Industrial Data Research Corp. (http://www.idrcglobal.com) is a specialist consultancy present in Germany, India and Russia.

IDRC enables it clients to achieve operational improvements, measured tangibly as improved financial returns, by employing analytics, quantitative modeling, and scientific computing. IDRC’s clients include FIs, Consultancies (including IT & Research firms), and Corporates.

IDRC builds & upgrades client’s analytics practices (e.g. valuations & risk quant, data-driven business insights, investment research, econometrics, quant-led process and operations mgmt.) delivered through IDRC’s QRC(TM) and ProcessAnalytics(TM) frameworks.

We talk with Amit Batra from IDRC in this exclusive interview.

[dropcap style=”1″ size=”2″]AIM[/dropcap]Analytics India Magazine: What are some of the main tenets (philosophies, goals, attributes) of analytics approach and policies at your organization?

[dropcap style=”1″ size=”2″]AB[/dropcap]Amit Batra: Thank you, Bhasker for inviting me to speak about this.

Industrial Data Research Corp. (IDRC) is an analytics consulting firm. IDRC believes that analytics, defined as quant modeling, data analytics, and scientific computing, can be harnessed to change lives, change organizations, and change the world. We believe that analytics will render a huge positive impact worldwide in this century to boost productivity, improve efficiency, and curbing wastage across the board. Analytics is a social force, which is already, and can further be applied in diverse areas – from finance, marketing, retail, e-commerce to developmental economics, conservation, ecology…

IDRC aims to be industry agnostic, with our current stronghold of finance & economics as just the starting point. We are already delivering projects in a diverse set of areas.

Analytics is already applied by clients, sometimes even unknowingly, but through special expertise and special focus, IDRC ‘makes it work’ for the clients. We insist on measuring the success of implementing a model, or an analysis, or a simulation, or a computation, in terms of improved financial returns, top-line or bottom-line, of our clients. Linking our activity strictly to such a tangible measure is where we think we differentiate ourselves from our competition.

Each client engagement, by design, is supposed to always have an IDRC partner’s direct involvement. We get an adrenaline rush through ‘what comes out’, and so treat each project as special. Besides, we aim to fill the ‘quality’ gap, in markets such as India, where there is a dismal penetration of PhD level analysts. We aim to do so by matching the project requirements with, albeit the most expensive, the highest-quality, specialized & specifically trained analysts.

As a spin-off from IDRC’s consulting practice, we aim to establish ‘Social Analytics Institute’ to house and nurture innovation in social space. This will connect industry, academia and individuals, and enable systematic evaluation and promotion of ideas. [quote style=”1″]Goal here is to go beyond thought exchange, into actually housing, commercially evaluating, nurturing, hand-holding the ideas to become ‘social products’.[/quote]

AIM: Please brief us about some business solutions you work on and how you derive value out of it.

AB: Let me share two recent examples, which also illustrate the diversity of application of IDRC’s analytical consultancy –

[pullquote align=”left”]We regularly share interesting updates with a growing community of our LinkedIn followers –https://www.linkedin.com/company/industrial-data-research-corporation[/pullquote]IDRC recently set up a Quant Research Center, QRC for a cab company client. We have thus achieved efficient zoning, visual ‘demand heat maps’, and optimum holding locations for the taxis, all leading to a progressively improving utilization of the fleet.

IDRC delivered research on momentum-based investment strategies and their application in bond and equity trading, aimed at developing software tools to determine the value of the analysis of chart techniques. Momentum-driven returns refer to the general principle, according to which stocks, which have historically outperformed over a period of length m, will do so in future.

For those willing to take a deep-dive, the overall research framework is formally defined as follows: Say U is the universe of charts (sequences of prices over the interval [0, T] of m stocks. We demonstrated that momentum (L, S) works, if for all t in [0, T] the average return for all stocks with over-average performance in the historic time period, L, the performance in period, S, is also above average. We demonstrated that under very mild conditions, for any time series of returns, and independently of the market, there exist L and S, where momentum works. However we also demonstrated that there also have to be H not equal to L, and K not equal to S, in which momentum does not work. Based on these basic considerations the IDRC project empirically determined the values of L and S in different markets.

AIM: How does a typical requirement gathering to delivery cycle looks like for you?

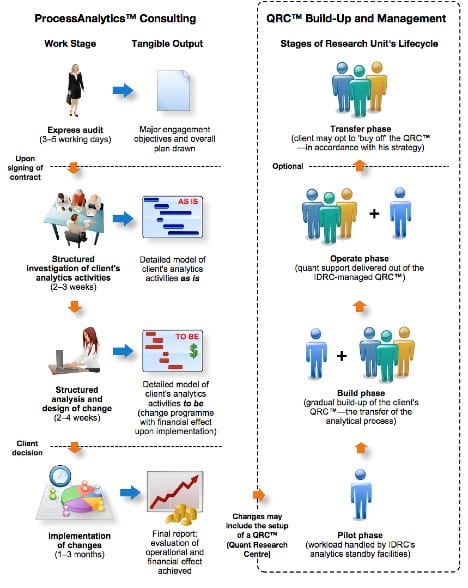

AB: IDRC has two inter-locking client-servicing frameworks, ProcessAnalytics and Quant Research Center, QRC. These cover a spectrum of needs clients may have with regard to their analytics activities. The ProcessAnalytics solution supports one-time interventions and overhauls of client’s analytics activities; these may be aimed at resolving quality issues and/or cutting costs. For example, IDRC’s experts may come in to streamline/augment service deliveries by KPOs/IT companies to their finance and economics clientele, representing either side.

The QRC solution comprises the standards, practices and experience, which allow IDRC to build flexible, cost-effective, scalable and robust research groups (that complement and assist clients’ own research and analytics teams). The QRC solution also allows to upgrade/consolidate client’s existing in-house analytics teams and processes. The U-shaped model of the service process (Ed. displayed below) highlights the major stages of work within each of the two service frameworks and the principal tangible outcomes resulting from each stage.

Work is organised around deliverables. The overall process starts with an Express Audit, which takes around 3–5 working days and aims at determining the major dimensions of the client engagement.

Client-centred service process: unifying view of IDRC’s services

AIM: Please brief us about the size of your analytics division and what is hierarchal alignment, both depth and breadth.

[pullquote align=”right”]IDRC currently has there partners, Dr. Thomas Maier, and Mr. Alexey Pan, and me (the detail bios are available on IDRC page http://www.idrcglobal.com/team).[/pullquote]AB: IDRC has as a typical consulting structure. IDRC is a synergized sum-total of its partners’ consulting practices.

As I speak, we are on the last stages of signing-up two more extremely talented people. Both of them will be based out of India. We will announce the news shortly.

IDRC partners often employ analysts matching the client-project analysis requirement with the analysts’ skills.

AIM: Would you like to share any example of an Insight that generated a huge positive impact for your clients?

AB: In early 2009, IDRC prophesied that global BFSI Quant Middle Office (QMO) as the next big wave to arrive on the Indian shores. This meant that well prepared shared services captive cost centers and private KPOs would be able to hugely profit from it.

However, most of them weren’t (and still aren’t) well prepared!

IDRC presented these thoughts to a pioneer Indian Knowledge Process Outsourcing (KPO) company, with an aim to develop just such an expertise.

This client-partner firm has operations across four countries, and a global sales presence. The firm specialized in low-end research support, such as data aggregation & cleansing and periodic reports. At that time, with stiff competition the firm was also fast loosing differentiation. Its existing clients demanded more sophisticated services in quantitative analytics space. The existing in-house analyst teams and the sales force where not equipped or trained to deliver on these tasks.

IDRC worked with firm’s sales directors globally to upgrade business positioning, and embarked the firms into areas including asset valuations, risk quantifications, proprietary index publication, and structuring.

IDRC also consolidated and extended pre-sales pitches & collaterals, and executed a quant sales campaign with firms’ sales directors across geographies, targeting FIs and analytics developers.

Through these sales campaign, we on-boarded for the KPO, new engagements with banks and hedge funds, generating fresh revenue streams for the KPO. IDRC facilitated the HR to identify and hire a team of best-in-market, top-notch analysts over, what was, a mammoth effort of screening resumes and conducting interviews. IDRC deployed Quant Research Center (christened Quant Incubator) within the KPO, and mentored the group’s client deliveries.

Thus with IDRC retrofitting and injecting effort, the KPO delivered its most analytically sophisticated (and most expensive) services, regaining the pioneer status, becoming an attractive employer, with a larger top-line.

AIM: Do you think it’s possible to become too married to the data that comes out of analytics? Where do you draw the line?

AB: IDRCs approach is to provide smart solutions. The real value added is not provided by just crunching data and presenting the outcome. It is about understanding the sources of input and the final use of the output, and regularly & continuously optimizing (or re-calibrating) the whole structure.

In many cases, especially in research-driven projects, it is absolutely necessary to keep the bird-perspective on the project. You always must keep in mind what the actual goal of the whole project is. For example when analyzing investment strategies via back-testing you have to keep in mind all the selection biases which might occur. It is not sufficient to create a wonderfully back-tested strategy, it is also crucial to address the selection problem as well as to fit the strategy in the reality. Smart back-testing mitigates the problems of backfill bias, survivorship bias, non-synchronous data, and so on, and therefore provides much more value for the client.

However to be able to offer those services to the client your organization must be able to have access to people with wider knowledge than just the statistical models.

Bringing together different areas of expertise is thus one of the cornerstones of IDRC’s work.

AIM: What are some of the data measurement points that are becoming more important for organizations?

AB: Especially for European banks and asset managers, the regulatory reforms will force them to present a huge amount of data in real time to the regulator.

Outside of finance, this is an age defined by across the board belt-tightening, thinning margins, market volatilities, and also a global emergence of lean ‘e-tailers’. Data-driven decisions towards an efficient supply chain including demand prediction, and deeper consumer insight therefore are, not just ‘good to have’, rather essential.

AIM: What are the most significant challenges you face being in the forefront of analytics space?

AB: Analytics is a new-wave, and an inter-disciplinary field. This means that fresh graduates, even postgraduates are not well equipped to deliver. IDRC tackles this by going for PhD-level analyst talent. This already means that in a place like India, there’s a scarcity of talent.

In the sales process, we also come across senior manager’s skepticism that I already spoke about. Many see analytics in same light as labor-arbitrage outsourcing proposition. I attribute this to their ignorance.

Though improving fast, we also find lack of industry standards with regard to software tools, APIs, streaming-data as bit annoying.

AIM: How did you start your career in analytics?

AB: I am trained as an engineer and a researcher. Hence analytics, quant modeling, and scientific computing have been the way of life for the last 11 years (smile).

AIM: What do you suggest to new graduates aspiring to get into analytics space?

AB: Two important points come to the mind –

First, university students should develop an area of specialization earlier in their careers and be able to show their expertise in that field, e.g. by own work, publications or repeatable practical knowledge.

Second, graduates should also focus on their soft skills not just on the technical side. Communication skills and social skills are especially paramount.

Combining these two points, it is of tremendous importance to develop a, kind of, ‘can-do’ mentality when faced with practical work, where the challenge might be to formulate the question, or to bring a fuzzy problem into a resolvable structure.

[quote style=”1″]This is IDRC’s message to the universities as well, which should design course materials in training programs more aligned with the zeitgeist.[/quote]

AIM: What kind of knowledge worker do you recruit and what is the selection methodology? What skill sets do you look at while recruiting in analytics?

AB: Analysts are our foot-soldiers. Hence we seek the very best. We look for exceptional people, and compensate them very well. We consider this an investment and a sign our commitment towards the success of our client-projects. We do not cut-corners in this respect.

We usually consider people with 5+ years of relevant work experience and a PhD in mathematics, computing, economics, statistics or like. Exceptionally, we also consider people holding postgraduates degrees with relevant work experience and certifications such as CFA and FRM.

We rarely employ fresh graduates. This is unfortunate but we think that more often than not fresh graduates require the kind of hand-holding or training that our bandwidth does not allow.

From a good knowledge worker, we expect a creativity and attitude of a being a ‘solution generator’. It is easier to take the projects to the point where all information is available. We judge candidate’s response to imprecise specifications, and fuzzy, unstructured problems.

Good people skills, language skills (speaking & writing), and presentation skills are a must. Additionally we judge people based on their reading habits, and several other behavioral aspects.

AIM: How do you see Analytics evolving today in the industry as a whole? What are the most important contemporary trends that you see emerging in the Analytics space across the globe?

AB: Consider these –

Extremely powerful and general purpose analytics tools and frameworks are being developed and becoming accessible. One can now create magic using assortment of Matlab, Excel VBA, Mathematica, Perl, Hadoop, Spotfire, Tableau etc.

Parallel computing, which used to be a niche sound in universities and research labs, is now a commodity.

Mobile computing and the growing ‘internet of things’, is rendering data generation growth on a logarithmic scale.

Theoretical faculties are converging into inter-disciplinary area, techniques of simulations, agent-based modeling, and behavioral sciences are gaining sophistication.

Every business is feeling the heat and we predict an emergence of a ‘culture of analytics’. We predict that businesses will have an integrated analytics arm providing feedback on the decisions by real-time churn of data.

[quote style=”1″]We also predict that stricter and somewhat consistent codes & regulations will emerge with respect to which data can be collected, and the transparency of the whole thing. This is especially true in the social-media space.[/quote]

AIM: Anything else you wish to add?

AB: Well, thanks for this opportunity again Bhasker. I have spoken much, but let me quickly touch back on key points where IDRC differentiates from competitors –

First, we make sure that by employing IDRC, the mid & senior management save time, and the outcome is reflected in financial returns. If these are not met, we don’t call it the completion. Our QRCTM offering is flexible and scalable. Moreover, we don’t stop improving. IDRC partners frequently revisit the model, free of cost, with an aim to cannibalize the revenues and make processes leaner and streamlined.

IDRC thinks, lives, and breathes analytics, and offers to integrate within client’s day-to-day operations. Thank you.

[divider top=”1″]

[spoiler title=”Biography of Amit Batra” open=”0″ style=”2″]

Amit has more than 7 years of experience as an analytics leader. He has build & manage specialized analyst teams for clients in firm of intelligence units or COEs, augmenting delivery capabilities for consultancies, KPOs and IT firms in quant, analytics and scientific computing heavy projects.

Amit is a graduate from IIT Bombay.[/spoiler]