Jatin currently serves as the Head of Analytics at Coverfox Insurance, training the team on new techniques and industry-best practices. A passionate photographer and avid biker, he enjoys his weekends exploring nearby places and food joints.

Jatin is a Management alumni of IIM Calcutta. He has had over 11 years of experience in building and managing the analytics wing for various organizations. Jatin has worked across diverse industries such as Insurance, Consulting, FMCG, and e-Commerce.

The man has been instrumental in developing numerous solutions which has resulted in a visible business impact. Besides, he has been an active contributor to the analytics community, especially in the arena of R & Python. Analytics India Magazine interacted with Jatin Solanki, the Head of Analytics at Coverfox to find out the company’s strategy towards propelling the adoption of analytics. The detailed interview is presented as follows.

Analytics India Magazine: Please talk about factors that spurred the conception of Coverfox. How has the journey been so far in the analytics-driven insurance services space?

Jatin Solanki: Insurance agents or rather brokers are traditional terms, who sell complicated insurance products to the customers by using jargons. Till early 2010, buying insurance meant getting follow up call 5-6 times in a day, and signing numerous pages before the final policy was issued. With the increasing adoption of digitalization, there was a need for a more robust, transparent, and simple portal for buying insurance products which led to the foundation of Coverfox. Started in mid-2014 by Varun Dua (ex-Tata AIG) and Devendra Rane (IIT – B alumni), the company was set up to ease the process of buying insurance, with added focus on customer experience.

Let me throw some light on the analytics journey. Being a tech-startup, the required talent was available internally, and freedom to select your own warehouse and processor was a boon. Though the setup journey was choppy, we did manage to build a robust analytics engine which assisted the business to access real-time information and take efficient business decisions. I wouldn’t know much about competitors, but Coverfox is in great position when it comes to making analytics-driven decision. With the help of Rane (CTO) & team, data architecture has been robust and easy for denormalization to provide in-depth analysis. We use R & Python for all building analytics solution and an in-house visualization tool, developed for real-time monitoring.

AIM: Please talk about the state of analytics in India. How is Coverfox transforming the space and propelling the adoption and use of analytics?

JS: Being into the analytics space for almost a decade now, I have witnessed tremendous transformation from business intelligence to using advanced analytics, for driving business decisions and developing various marketing campaigns. The talent pool is limited which drives the nicheness in the market, and demand is surging as we progress. In the past, analytics, or let me coin the term “MIS team” were used to publish reports/analysis, which was later consumed for internal action.

The team in Coverfox is trying to leverage analytics in every possible corner of the organization. Right from customer prioritization to developing marketing campaigns, we have used all relevant models to solve the business problem statements, which has further resulted in visible impact across the functions. The key to success is the solid collaboration between business/marketing/product and analytics team to integrate the solution within the system. Recently, we have also developed a recommendation engine, which has been a great success internally, and we plan to optimize the engine in the coming months.

AIM: Coverfox lets customers compare insurance plans from top insurers before selecting one. Please explain how analytics is exactly made use of in your offerings to help your customers.

JS: We at Coverfox believe in transparency and would continue to provide vanilla solutions to the customers. Based on the customer feedback/suggestion, one of the most crucial stage in the buying process is to select the right insurer and the appropriate coverage (sum assured). The team here has built a recommendation engine which uses the clustering technique over the internal algorithm to enable the buying stage. Currently, only the phase 1 is implemented and by April 2017 we will roll out phase 2, which will be a complete game-changer. Also, once the customer starts the journey with Coverfox, we are not in a flurry to call him and start pitching the product. Every customer is profiled, and as per the scoring logic the call is triggered and the relevant features are explained to the customers. Here is the list of areas where analytics has blessed the development till now (only consumer facing):

- Cross – selling: Not everything is offered to everyone and emailer/SMS are not more static

- Retention or policy renewal

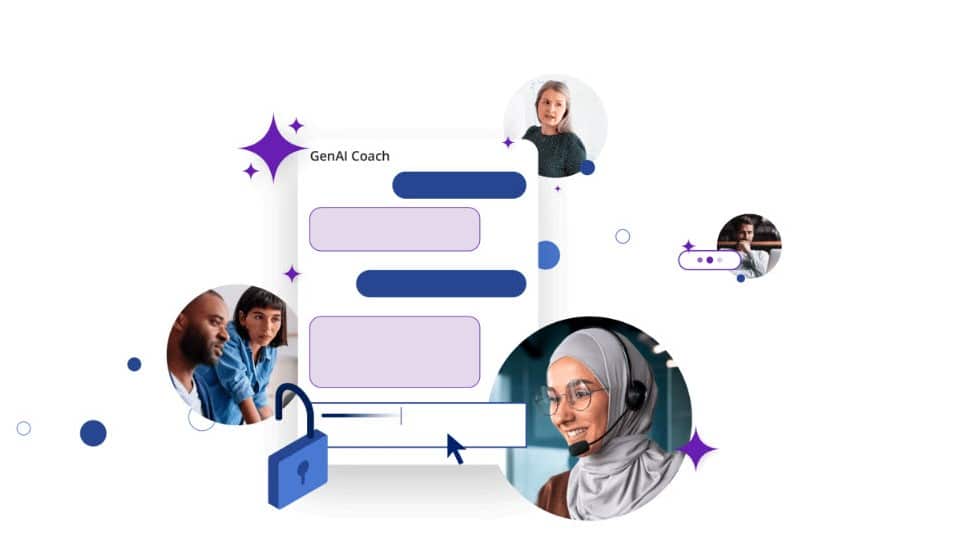

- Chatbot: This is one of the latest offerings we are working on which will be based on artificial intelligence. The bot will assist the customers during the buying and post sales process.

AIM: Please talk about the leadership board at Coverfox. Also, walk us through the work culture at Coverfox.

JS: Leadership board comprises a mix of young & experienced talent. From the initial days, the focus has been on building a data-driven organization rather than considering gut-based decisions. Since we believe in our tech expertise, a lot of expansion is happening on the technology side. We are working with insurance companies to focus on demographics, where special products can be made. So, data analytics and machine learning is just one part of the puzzle. Since the company largely comprises of young individuals, the culture is very open (likewise start-up) where we encourage a lot of inputs and knowledge sharing. This benefits both the organization and individuals.

AIM: Would you like to highlight any other key offerings where analytics is being predominantly used?

JS: The penetration of analytics is visible in the arena of Insurance and Banking sectors. One of the insurance company based out in China is primarily using analytics in the pricing and claim settlement logics. Every year they launch innovative products, which are based on customized pricing obtained from various analytical techniques. On the claim zone, the company has currently deployed a model to automate the underwriting process and settlement too. It is really encouraging and exciting to see the way company is using the power of analytics to solve multiple dimension business problems.

AIM: What is the roadmap that lies ahead for Coverfox in the analytics-driven insurance space?

JS: Let me not complicate things for you. Currently, we are focusing on optimizing the recently deployed model. Furthermore, Coverfox is also planning to deploy the chatbot at full scale, where the company can benefit from consistency and lowering the manpower cost. This requires a prodigious amount of understanding from our call center expert, who will assist in carving out the model in the most acute manner. On the other hand, we plan to integrate one of the best ETL tools which can help the team go deeper in crafting business analysis and regular reporting.

AIM: Would you like to place a note of advice for all the aspiring startups and entrepreneurs trying to make it big in analytics-driven insurance space?

JS: Being a regulated industry, I would advise entrepreneurs to understand the core business before developing solutions, otherwise the adoption will be a challenge. Insurance domain is very competitive and here we can’t have a price war to acquire volumes. It’s the feature/experience that will sell in the market. This is completely different from the e-Commerce game.