This is the fourth part in a series of articles on Customer Life Stage modelling. The first part defined the term Customer Life Stage Model (you can read it at https://analyticsindiamag.com/part-1-customer-life-cycle-a-misleading-term/ ). The second part attempted to create a 3 dimensional model (you can read it at https://analyticsindiamag.com/part-2-creating-the-customer-life-stage-model/ ). The third part identified the typical customer life stage path for a client (you can read it at https://analyticsindiamag.com/part-3-traversing-the-customer-life-stage/ ).

In this part, we will detail each cell that forms part of the customer life stage path of interest. We will derive our approach from the IDEF0 methodology. This methodology was innovated for use in the manufacturing scenario and eventually became a de-facto standard for process documentation. The methodology became popular during the business process re-engineering era about a decade back. Having been trained in BPR consulting, the IDEF0 has been my favourite mode of representing any process. The same approach lends itself very well to our topic of interest.

For more details on IDEF0, kindly refer to http://en.wikipedia.org/wiki/IDEF0.

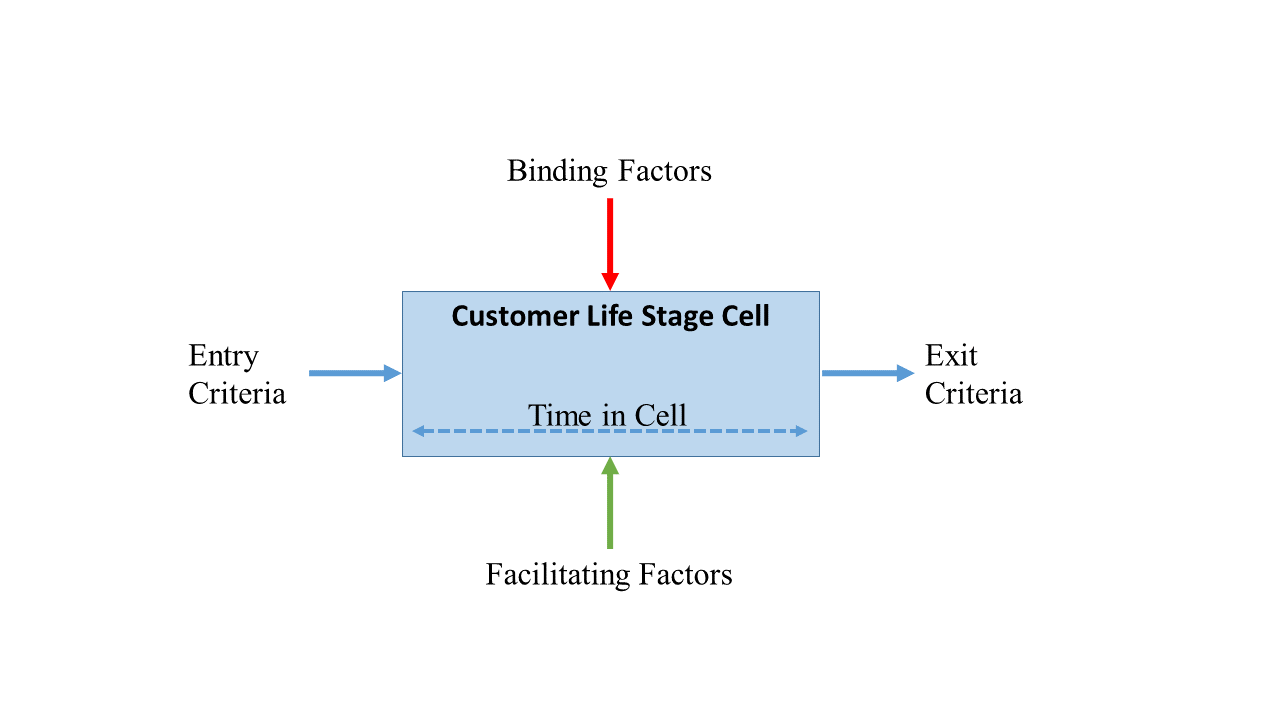

Each cell needs to be detailed as described in the following diagram:

To define each cell, we need to describe all the criteria and factors as displayed in the above diagram. From our sample path, let us consider cell A1:B2:C2. The following diagram defines the cell:

The cell A1:B2:C2 is described as follows:

| Entry Criteria | – |

|

| Exit Criteria | – |

|

| Binding Factors | – |

|

| Facilitating Factors | – |

|

| Time in Cell | – |

|

The entry and exit criteria are self-explanatory. The point of note is the definition of entry criteria requires all the conditions to be satisfied {note the “and” at the end of each criteria}. The exit criteria requires only one of the conditions to be satisfied {note the “or” at the end of each criteria}.

The binding factors are events or behavior that keep the customer in the current cell. These are often constraints that need to be addressed if the customer is to progress on the life stage path. In our example, we notice that the account is credited with the salary at the end of the month and immediately the amount is withdrawn out. Maybe, the customer has this account only because the bank had a partnership with his employer that required him to open the account for his salary credit. Another factor could be the behavior that the customer uses only one ATM to conduct only one type of transaction which is withdrawal. This could imply that the ATM is close to the work location and hence the customer opened a savings account so there will be easy access to his money. I had done exactly this when I opened an account with HSBC Bank. I was posted at the southernmost end of Mumbai by my office. The only ATM in the area was of HSBC Bank. Hence, I opened an account in the bank and used the ATM to withdraw money for my expenses. Once, I was transferred from the location, I shut down the usage of the account. The next factor shows a lack of usage of net banking.

The facilitating factors are events or behaviours that will satisfy one of the exit criteria. This may be a direct action such as opening of a term deposit. It could also be a behavior that will eventually lead to the one of the exit criteria being fulfilled. For example, having the customer pay the utility bills through the savings account will require him to keep additional balance in the account so that the payment can be serviced. Similarly, having the customer to accept and activate a debit card will provide an option for using the card for payment at merchant outlets and again thereby requiring an additional amount to be maintained in the account.

The time in cell for our case is pretty straight forward. Since, we have vintage as one of the dimensions of our model, it defines the maximum amount of time the customer can belong to a cell. When time is not a dimension, this can be typical average of the time that the customer spends in the cell.

The binding and facilitating factors are identified from statistical models. We build one model for each of the exit criteria. The input variables could be demographic, transactions or behavior. The significant variables that contribute to the target criteria will end up either as binding or as facilitating factors.

From the business perspective, the factors need to be influenced. This is where marketing or customer management comes in. So every communication we do with the customer is towards achieving one of the exit criteria.

In the next and concluding part, we zoom out now from the cell level to the entire model. It will highlight the significance of the model to customer relationship management and to all statistical analysis and campaign management activity.