|

Listen to this story

|

The Indian analytics market has seen considerable growth since Analytics India Magazine (AIM) began researching and studying the domain eight years ago. The explosive growth in the industry is due to the increase in internet users. As per the World Bank, internet penetration in India doubled from 20% in 2018 to 41% in 2019 and is expected to add over 900 million users by 2025.

In addition, due to the pandemic, companies’ business models across sectors have changed significantly. Higher demand for tech-driven solutions prompted these organisations to begin their digital transformation journey. Similarly, AI-driven advanced reporting, healthcare business intelligence, and electronic records drove growth in the healthcare sector. Further, organisations which adopted the remote working model had to implement advanced analytics to understand the new trends during the pandemic.

This growth has supported the analytics industry with a significant increase in data collection that can help companies tap different opportunities in various sectors and demographics.

This report presents a comprehensive view of the analytics industry by analysing the different trends across multiple cities, geographies, sectors, salary brackets, experience levels, gender, and usage of key technologies in the industry. The detailed analysis of the industry helps the reader develop a clear overview of the key trends and scope of the analytics industry.

This report can be studied by recruiters, industry policymakers, companies, and data science experts or aspirants to get the overall view of the analytics industry.

For previous years’ report:

All past reports:

2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015

Key Highlights

- The analytics industry recorded a substantial increase of 34.5% on a year-on-year basis in 2022, with the market value reaching USD 61.1 billion.

- The overall Analytics industry is projected to reach a size of $201.0 Billion by 2027 at a CAGR of 26.9%.

- The US contributed 50.7% of total share for India’s outsourced analytics market in 2022.

- More than one in three (33.7%) of the analytics professionals working in the Indian analytics market have a work experience of 2-5 years.

- Almost a third (31.0%) of analytics professionals work in companies with 1-200 employees.

- BFSI emerged as a top contributor of analytics market share of Non-IT sectors for a consecutive year, with a share of 34.1% of the total market.

- Bangalore continues to be the top destination for analytics professionals, with a share of 26.5% of the total market.

- Women make up 29.9% of the Analytics workforce in 2022, a 1.8pp increase (on a y-o-y basis) in terms of their representation.

- Around 49.7% of analytics professionals working in India are engineering undergraduates in 2022.

Analytics India Market Projection

The analytics industry recorded a substantial increase of 34.6% on a year-on-year basis in 2022, with the market value reaching USD 61.1 billion. Moreover, further growth is predicted in terms of the revenue generated by the analytics or data science industry. According to our analysis, the industry will grow to USD 201.0 billion by 2027 at a CAGR of 26.9%.

The rise in revenue is largely driven by the increase in data generation at an individual and organisational level, which helps companies improve operations, provide better customer service, create personalised marketing campaigns, and leverage data to further revenue and profits. In addition, the growth in median salary, the maturing of the analytics functions across companies, and the increased funding of $1,108 million in Indian AI start-ups are indicative of the overall development of the Indian analytics market and India’s efforts in the field.

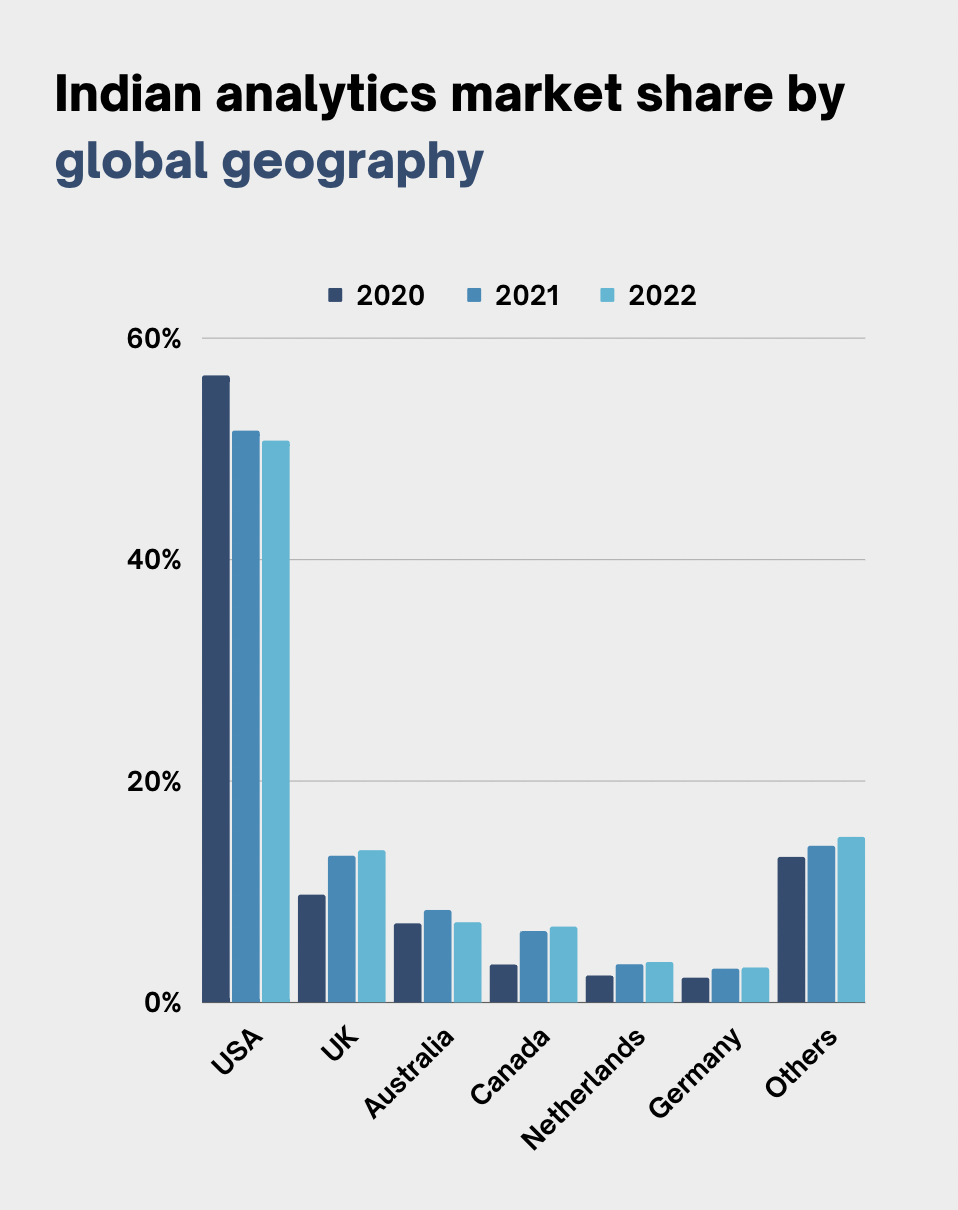

Indian analytics market share by global geography

1/2

More than half (50.7%) of the of outsourced analytics market share in India is generated from the US.

6.0pp

The market share for top major markets in Europe (UK, Netherlands, Germany) grew by 6.0pp from 2020 to 2022.

2.0

The market share for Canada grew by more than 2.0 times from 2020 to 2022.

The US contributed 50.7% of the total share of India’s analytics outsourced market. However, the overall share of the region has come down by 5.9pp from 2020 to 2022. On the other hand, the market share contribution of the United Kingdom and Canada has increased from 9.7% and 3.4% in 2021 to 13.7% and 6.8%, respectively, in 2022. Similarly, other countries such as the Netherlands and Germany have also witnessed an increase in their overall contribution to India’s analytics market.

The share of the European market has been on the rise since 2020. The United Kingdom, the Netherlands, Germany, Ireland, and other countries are key contributors to the rise. The market share for the UK, Netherlands, and Germany markets grew by 4.0pp, 1.1pp and 0.9pp, respectively, from 2020 to 2022. The growth in the region is largely driven by large first-generation outsourced contracts won by Indian IT Service companies like TCS, Infosys, Wipro and others.

The outsourced contracts from the European market are of the first generation, which translates into higher profit than contracts from the USA market. As a result, the market share of European countries is on the rise.

The market share from outsourced contracts in other regions increased by 1.8pp from 13.1% in 2020 to 14.9% in 2022. Other major countries contributing are Mexico, Singapore, Brazil, Sweden, and UAE.

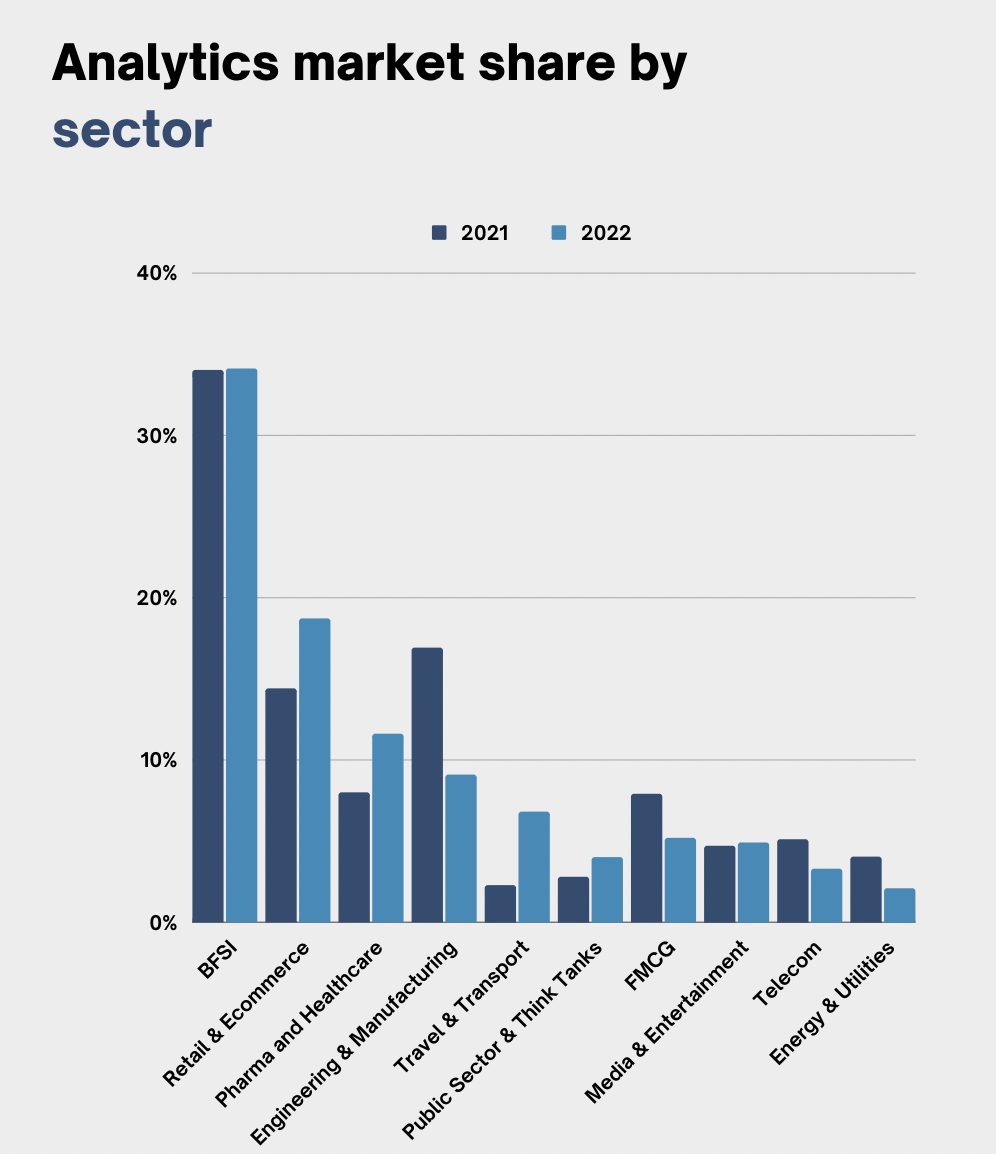

Analytics market share by sectors

1/3

BFSI accounts for more than one-third (34.1%) of the total non-IT analytics market share in India.

3.0

Market share generated by analytics functions in Travel and Hospitality grew by roughly 3.0 times on a y-o-y basis.

4.3pp

The share of analytics market share generated by Retail & eCommerce increased by 4.3pp.

The IT sector remains a top contributor to the market, with a share of 49.8% of the total market size in the Analytics industry. However, this report has excluded IT from the pack of sectors for a better comparison of other sectors with each other. In this case, BFSI emerges as a top contributor for the consecutive year, with a share of 34.1% of the total market.

Early adopters of analytics, such as BFSI and Retail & eCommerce have made significant progress in terms of their analytics maturity.

This is followed by the modern-day tech-enabled Retail & eCommerce sector, whose market share increased by 4.3pp on a y-o-y basis from 14.4% in 2021 to 18.7% in 2022. Pharma and Healthcare have also witnessed an increase of 3.6pp on a y-o-y basis from 8.0% in 2021 to 11.6% in 2022.

Travel & Hospitality, which was one of the worst-hit sectors during the pandemic, has witnessed the greatest increase in the share in the post-covid world. The market share increased by three times over the previous year, from 2.3% to 6.8% in 2022. The growth in the sectors is driven by the reopening of economic activities and ease in travel restrictions across the globe.

In addition, the rise in the share of the Public Sector & Think Tanks is nearly 1.5 times on a y-o-y basis, whereas Media & Entertainment saw a marginal increase in their market share from 4.7% in 2021 to 4.9% in 2022.

However, traditional industries, including FMCG, Engineering & Manufacturing, Telecom, and Energy & Utilities, saw a drop in overall share from the previous year. The decline in the overall share is 2.7pp, 7.7pp, 1.8pp, and 1.9pp, respectively.

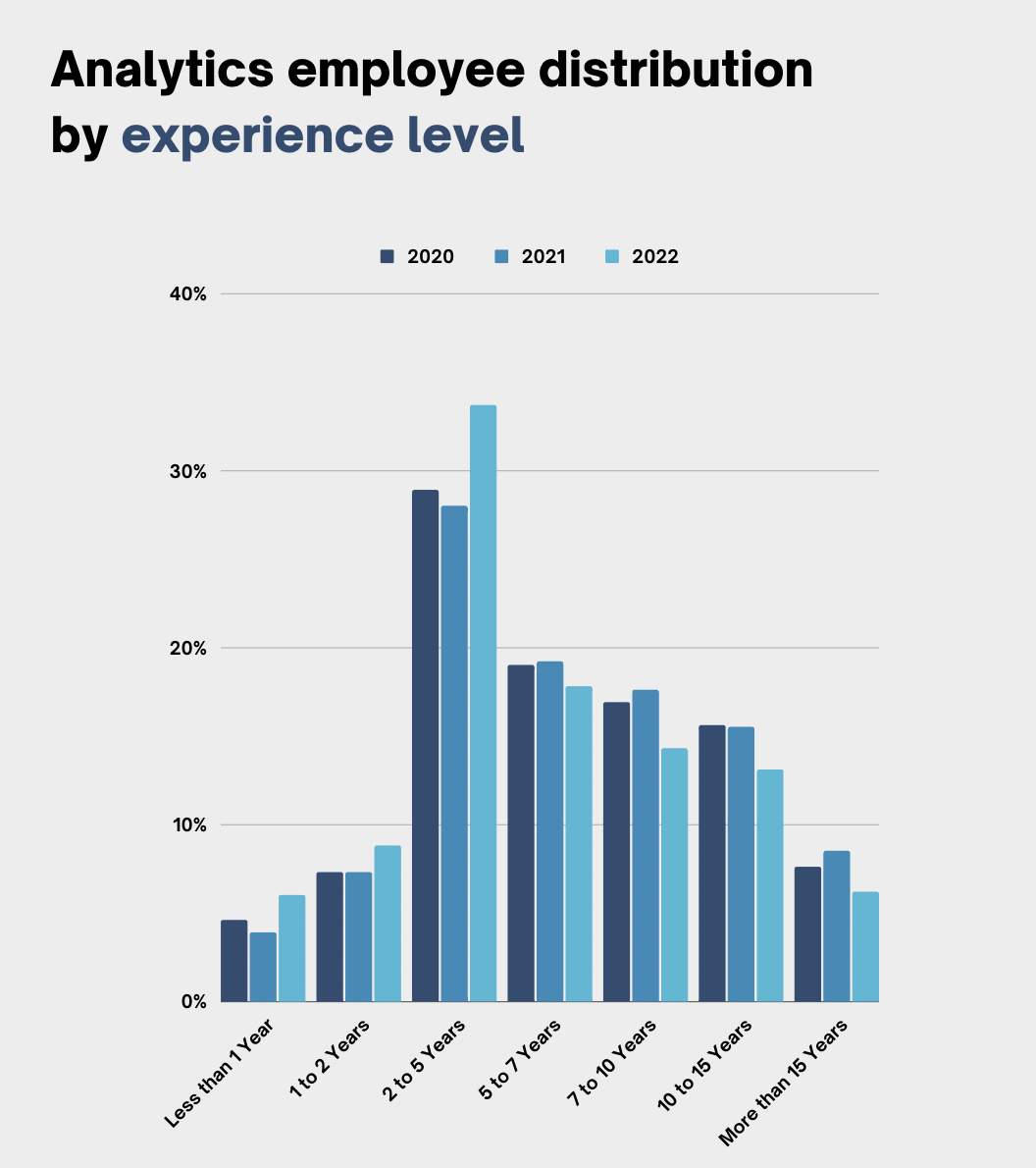

Analytics employees distribution by experience level

33.7%

More than one out of three (33.7%) analytics professionals in India have a work experience of 2 to 5 years.

2.1pp

The share of analytics employees with less than one year of experience grew by 2.1pp on a y-o-y basis.

2.3pp

The share of analytics professionals with more than 15 years of experience decreased by 2.3pp.

At 33.7%, professionals with 2 to 5 years of experience accounted for the majority of analytics employees in India.

The share of professionals with less than five years of experience witnessed an uptick in their share on a y-o-y basis. The share of professionals with less than one year of experience increased by 1.5 times, followed by professionals in the 1-2 and 2-5 years of experience category (both increased by 1.2 times).

The companies are focusing more on strengthening their talent pipeline by increasing the share of fresh recruits.

On the other hand, professionals with more than five years of experience have seen a decline in their share. On a y-o-y basis, the largest decline in the share was witnessed by the professionals with 7 to 10 years of experience (3.2pp), followed by professionals with 10 to15 years of experience (2.4pp). The share of analytics professionals with more than 15 years of experience also decreased by 2.3pp.

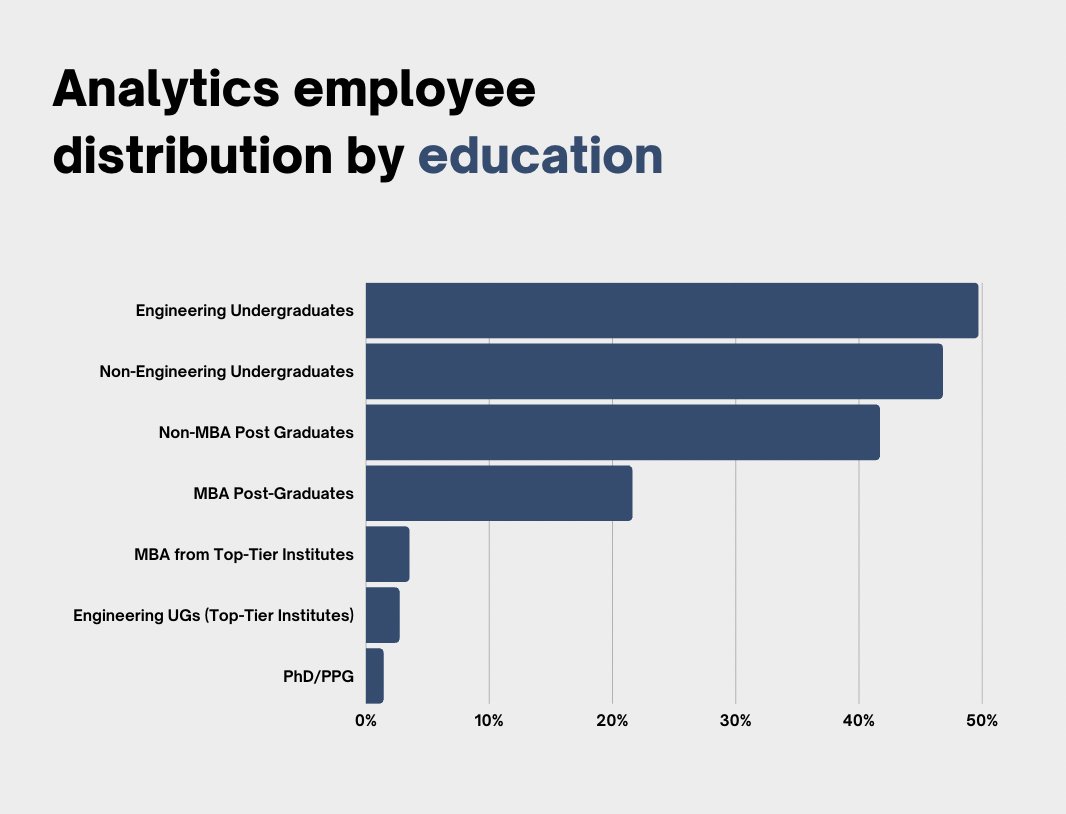

Analytics employee distribution by education

1/2

Almost one out of two (49.7%) professionals in analytics hold an undergraduate engineering degree.

1/5

More than one in five (21.6%) of analytics professionals hold an MBA degree.

1.4%

Only 1.4% of analytics professionals in India hold a PhD.

The share of engineering undergraduates is highest in the analytics industry, with almost one out of two (49.7%) analytics professionals having a bachelor’s degree in engineering. Around 2.7% of the total analytics professionals are engineering graduates from top-tier universities. Around 46.8% of analytics professionals have non-Engineering bachelor’s degrees.

The job roles in the analytics domain demand good knowledge of mathematics, statistics, and programming which has fuelled the demand for engineering undergraduates over other degrees.

Similarly, around 21.6% of the analytics professionals have an MBA degree in 2022, and 41.7% have non-MBA postgraduate degrees. Around 3.5% are MBA postgraduates from top-tier universities.

PhD graduates in analytics or data science make up 1.4% of the total professionals in 2022.

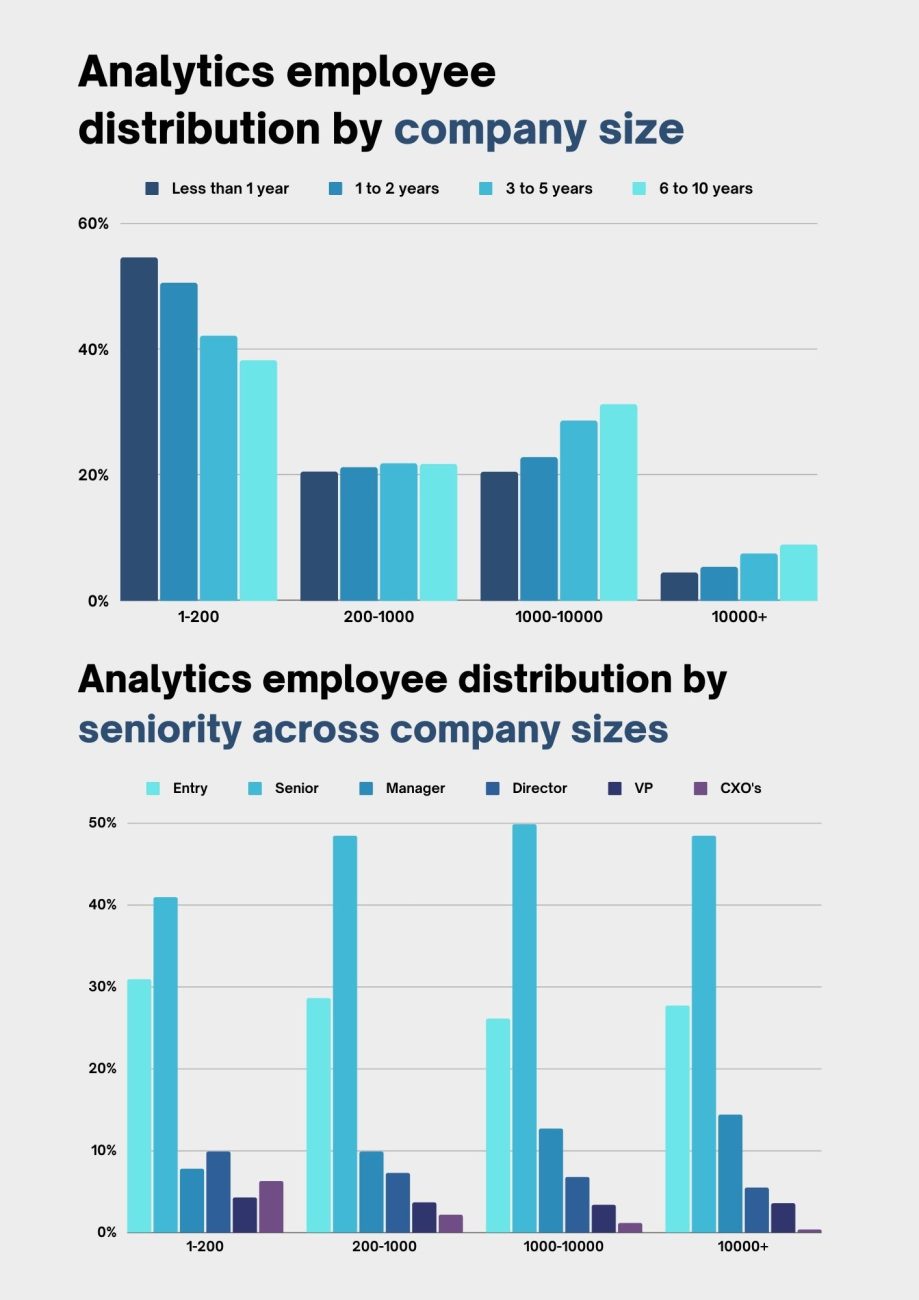

Analytics employee distribution by company size

5.9pp

The total share of analytics employees working for companies with more than 10,000 employees increased by 5.9pp on a y-o-y basis.

6.3%

Companies with 1-200 employees hire the highest number of CXOs compared to other company sizes. CXOs account for 6.3% of their total employees in these organisations.

2.0

The ratio of Senior associates to Entry-level professionals, at almost 2 times, is the highest for companies sized of 1,000 to 10,000.

Companies with more than 10,000 employees saw a significant surge (5.9pp) in their analytics employee share compared to other firms. At the same time, small companies with 1-200 employees witnessed the highest y-o-y decline (4.5pp) in the share of their employees. This was followed by companies with 1,000 to 10,000 employees that saw a drop of 1.6pp. Companies with 200 to 1000 employees saw a marginal increase (0.3pp) in the share of their employee size.

By seniority, the share of Senior associates is the highest across all the company sizes. It varies from 40.9% in companies with 1-200 employees to 49.8% in companies with 1,000-10,000 employees. The share of Managers is highest in companies with more than 10,000 employees. In contrast, the Directors’ share is highest in companies between 1-200 employees.

According to market estimates, in the last few months, the Indian tech startups, including a few unicorns, have laid off a significant number of their employees. But, the same is not the case with Big IT companies in India as they are on a hiring spree despite the global downturn.

Analytics employee distribution by gender

Women make up 29.9% of the Analytics workforce in 2022, a marginal increase of 1.8pp on a y-o-y basis. This representation falls considerably in senior positions. While women make up more than a third (37.4%) of the analytics workforce with less than 1 year of experience, less than one in eight (12.3%) analytics professionals with more than 15 years of experience are women.

The lower number of female STEM graduates and an overall lower representation in the tech industry is reflected even in the analytics and data science functions.

Below we mention some of the reasons that have contributed further to gender disparity in the analytics industry:

- The tech industry, by and large, is male-dominated, which has resulted in fewer role models for women to look up to.

- The lack of mentorship and leadership for women in STEM education.

- Women dropping out of the workforce mid-career.

- Gender bias in recruiting.

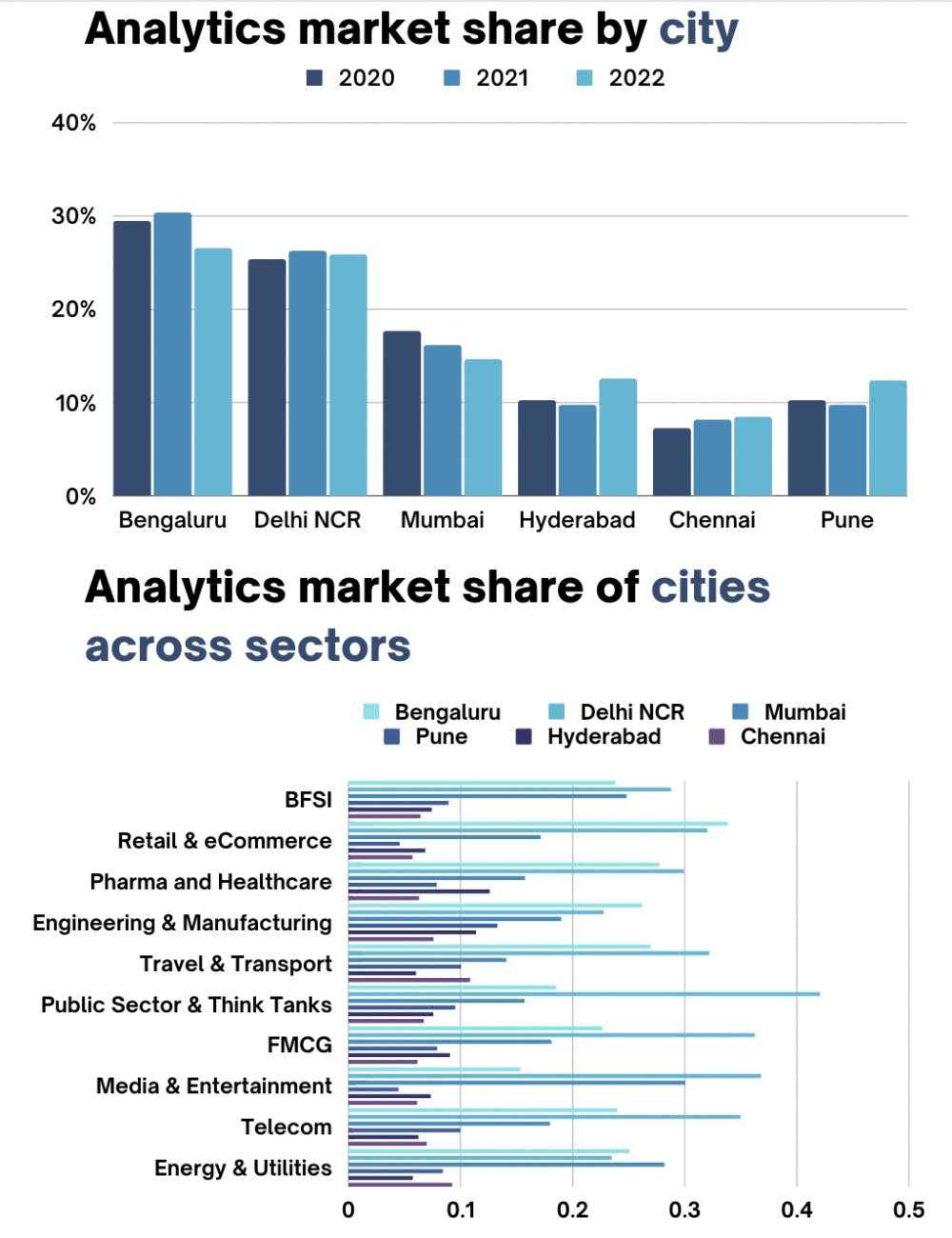

Analytics market share by city

1st

Bangalore continues to be the top destination for analytics professionals, with a share of 26.5% of the total market.

2.8pp

Hyderabad analytics market witnessed an increase of 2.8pp on a y-o-y basis from 9.7% in 2021 to 12.5% in 2022.

The financial capital of India, Mumbai continues to have the third-largest market share of the analytics industry. However, the city’s share has been in a downtrend for the last couple of years, whereas the share of neighbouring city Pune is on the rise. As a result, the share has come down to 14.6% in 2022 from 17.6% in 2020. The sectors such as Media & Entertainment, Energy & Utilities, BFSI, and other consumer companies contributed largely to the overall market.

Hyderabad also witnessed an increase of 2.8pp on a y-o-y basis from 9.7% in 2021 to 12.5% in 2022. The increase is largely driven by the rise in hiring of candidates in segments such as cloud technology, data analytics, artificial intelligence/machine learning, and cyber security. Also, GCCs setting up their operations in the city contributed to the overall increase, along with a thriving base of Pharmaceuticals & Healthcare companies. AI initiatives driven by the state of Telangana have also acted favourably in the analytics industry of Hyderabad.

Pune has witnessed considerable growth in its analytics market share. The share increased from 10.2% in 2020 to 12.3% in 2022. The growth in this market share is largely driven by the strong infrastructure and proximity to Mumbai along with the presence of some of the largest automobile manufacturers and their hi-tech technological innovation and experiments centres. The key contributing sectors to the overall growth are Engineering & Manufacturing, Travel & Transport, and Telecom.

Chennai holds sixth place in the list with 8.4% of the total analytics market share in 2022. There was an increase of 0.3pp on a y-o-y basis. The key contributors to the overall growth are Travel & Transport, Energy & Utilities, and Engineering & Manufacturing industries.

Largest employers of Indian analytics professionals

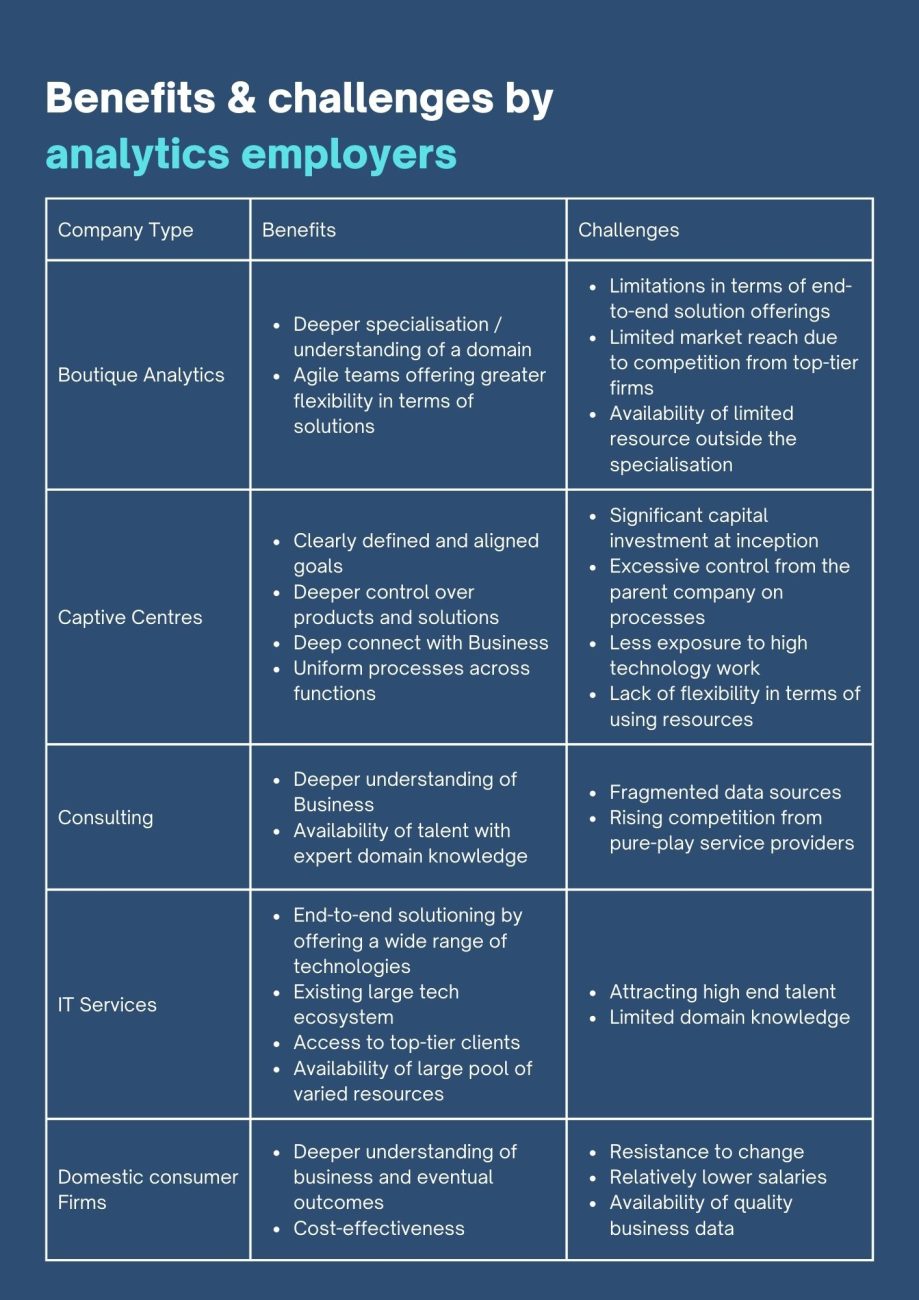

Benefits & challenges of analytics employers

Engagement of sectors across key analytics areas

1/2

Almost one in two (49.0%) analytics professionals in BFSI are working on the transformation of data into usable format through data engineering.

1.8

The adoption of data science is nearly 1.8 times higher for Pharma & Healthcare compared to Retail & eCommerce.

1/5

The usage of Computer Vision is highest in Engineering & Manufacturing as almost one in five (19.1%) analytics professionals in the sector are now working on the technology.

The section discusses the engagement of key analytics areas across sectors. The utilisation of technologies is higher among the early-adopting sectors such as BFSI and Pharma & Healthcare.

Almost one in two (49.0%) analytics professionals in BFSI are working on the transformation of data into usable format through data engineering, followed by Retail & eCommerce and Pharma (12.9%) & Healthcare (10.3%). BFSI also has high utilisation of Data Analytics (32.8%) and Big Data Analytics (30.9%). On the other hand, Pharma & Healthcare has a considerable share of its analytics employees working on Computer Vision (18.3%) and Data Science (16.8%).

Engineering & Manufacturing emerged as the largest user of Computer Vision (19.1%). Many of its analytics employees are engaged in other Machine Learning (17.1%) and Deep Learning (16.0%) applications as well.

SWOT analysis of the Indian analytics industry

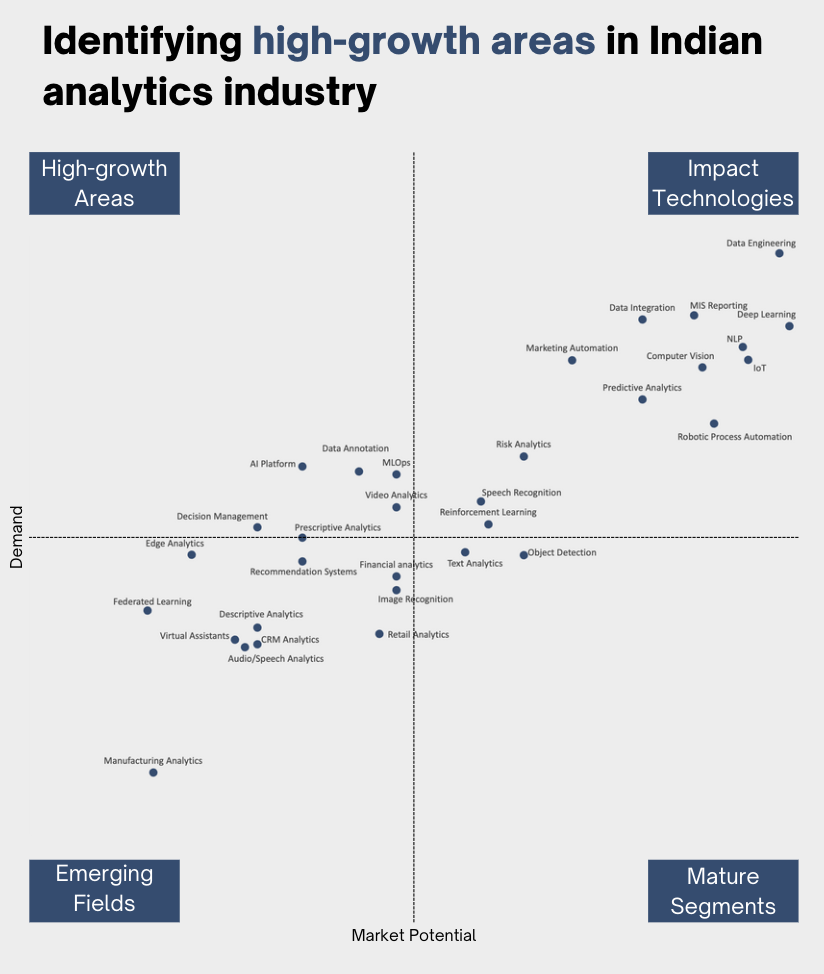

Identifying high-growth areas in the Indian analytics industry

Identification of high-growth potential areas for Analytics & data science has been made by calculating relative scores for Market Potential and Demand and plotting them on a quadrant.

Fields like Data Integration/Data Engineering or Deep Learning/Computer Vision/NLP have been in the market for a while but still, show high Demand. Similarly, there is still a high potential for growth in Robotic Process Automation and Marketing Automation despite having a significant market presence. These technologies will continue to create a high impact in the industry in the foreseeable future.

There is a high demand for AI Platforms or products. However, they have not shown their full strength in terms of Market Potential. This could be attributed to several factors like availability of talent or scalability. Talking about scalability, the demand for MLOPs engineers has soared in the last year. Hence, with such high demand, these areas show high potential for growth in the coming years.

Many processes in the Retail & eCommerce industry have now been automated. Hence, the demand for data technologies in the sector remains relatively low while also having a high market potential at the same time. The analytics functions in these companies are more mature and have achieved stability.

The manufacturing industry in India was relatively late in joining the analytics bandwagon. Analytics solutions in the sector along with other areas in the Emerging Fields quadrant are off to a good start, but currently, fewer companies are actively seeking to hire talent. It is predicted that demand for them will grow as we progress, and they will move to the High-growth areas quadrant.