Forex or the foreign exchange market is a decentralised system for foreign currency trading and exchange. Foreign exchange is the process of changing one country’s currency into another country’s currency for trading, commerce, or tourism. The rise to the foreign exchange services and trading was due to the varying values of individual currencies. In the world trade market Forex is regarded as the largest and most liquid asset market. National currencies have an exchange rate fixed in pairs, e.g. USD/JPY. Commercial and investment banks carry out most of the trading process on behalf of their clients.

Currency trading is completely conducted electronically over computer networks between institutions, banks, brokers, and individual traders (mostly trading through brokers or banks) around the globe, that is known as over-the-counter (OTC). The market is open 24 hours a day and five trading days a week. Currencies are traded in the major financial centres of London(U.K), New York(U.S), Tokyo(Japan), Zurich(Switzerland), Frankfurt(Germany), Hong Kong(China), Singapore, Paris(France) and Sydney(Australia)—across almost every time zone. This means that when the trading day ends in the U.S., it begins in Singapore and Hong Kong. The forex market is almost active the entire day, with price quotes rapidly changing.

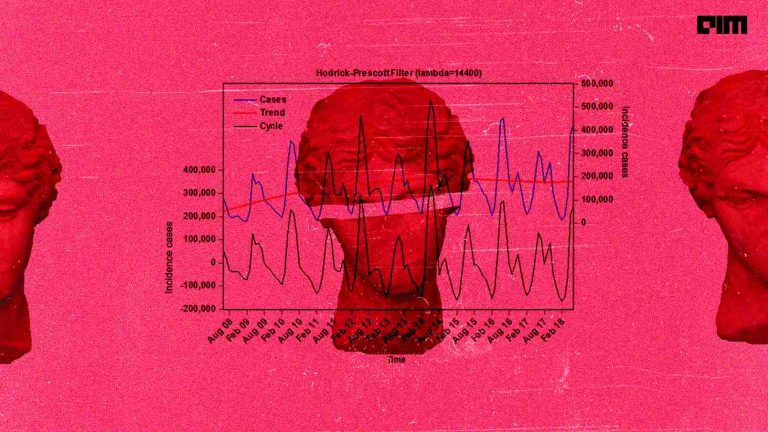

Time Series Analysis

AI now rules the world with use cases in almost all business sectors. Finance is one such widespread area where time series is used for analytics and prediction. Exchange Rate is one of the daily economic topics that is observed by everyone. We will be analyzing the exchange rate pattern over a time span to be able to forecast it in the future.

The dataset used for demonstration is the Forex pair EUR/USD dataset which holds the record from 1971 to 2019. Dataset link.

# importing libraries

import pandas as pd import numpy as np import seaborn as sns import matplotlib.pyplot as plt

# dataset exploration setting date as index

df = pd.read_csv('../input/eurusd-daily/eu.csv', index_col=0, parse_dates=True, skipinitialspace=True)

df.drop('date', axis='columns', inplace=True)

df.head()

df.tail()

df.shape, df.info()

<class 'pandas.core.frame.DataFrame'> DatetimeIndex: 12115 entries, 1971-01-04 to 2019-05-09 Data columns (total five columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 open 12115 non-null float64 1 high 12115 non-null float64 2 low 12115 non-null float64 3 close 12115 non-null float64 4 volume 12115 non-null int64 dtypes: float64(4), int64(1) memory usage: 567.9 KB ((12115,5), None)

# checking null values

df.isna().sum()

open 0 high 0 low 0 close 0 volume 0 dtype: int64

# statistical analysis

df.describe()

Market Trends

# data visualisation

# visualizing trend for closing price

plt.figure(figsize=(15,6))

plt.plot(df.close)

plt.title('Euro vs USD')

plt.legend()

plt.show()

# visualizing trend for volume

plt.figure(figsize=(15,6))

plt.plot(df.volume)

plt.title('Euro vs USD')

plt.legend()

plt.show()

#boxplot

df.drop('volume', axis=1).boxplot()

#generating heatmap

sns.heatmap(df.corr())

# Resampling yearly analysis on volume

df.resample('Y').mean().plot.bar(y=['volume'], figsize=[25,10])

# Resampling yearly analysis on closing price

df.resample('Y').mean().plot.bar(y=['close'], figsize=[25,10])

# lag plot comparing before and after values on volume

from pandas.plotting import lag_plot lag_plot(df['volume'].tail(500))

# lag plot comparing before and after values on closing price

from pandas.plotting import lag_plot lag_plot(df['close'].tail(500))

Complete notebook link is here.

Conclusion

In this article, we have successfully implemented the time series analysis trends over the Forex historical dataset pair EUR/USD for visualising market scenario over the past 30 years depending on various attributes such as opening price, closing price, lowest price, highest price and volume.