|

Listen to this story

|

Recently, Minister of State for Electronics and Information Technology (MeitY) Rajeev Chandrasekhar announced that the government is planning to launch a new production-linked incentive (PLI) scheme to support manufacturers of IT hardware and computer servers.

The government believes that the IT Hardware manufacturing sector in India is at a disadvantage compared to other countries. MeitY believes that the sector is hindered by a lack of proper infrastructure, domestic supply chain and logistics, resulting in a disability of 8.5% to 11% when compared to other major manufacturing economies.

To level the playing field and boost domestic manufacturers, MeitY has announced a new production-linked incentive (PLI) scheme to support the growth of IT hardware and computer server manufacturers. The scheme aims to give a much-needed fillip to the electronics manufacturing sector and make it more competitive in the global market.

According to government data, production-linked incentive (PLI) schemes for PCB assembly will be provided at a rate of 3% until April 2023 and 2% from April 2023 to April 2024. The same PLI scheme will apply to battery packs, power adapters, and cabinets/chassis/enclosures. After April 2024, the incentive will be further reduced to 1%.

As per Khusbu Jain, Partner, Ark Legal, “The high penetration of Chinese products, particularly in the tech hardware sector, in the Indian market poses a challenge for the government’s ‘Digital India’ initiative. As India aims to become a data-centric nation with all data stored locally, it is crucial to have locally manufactured hardware”.

Khusbu believes that as India’s import dependency on Chinese products remains alarming, the implementation of this PLI scheme will aim towards developing manufacturing capabilities in India which will help achieve its Aatmanirbhar Bharat scheme by reducing its import reliance, mostly on China.

“With the implementation of production-linked incentive (PLI) schemes,” says Khusbu, “the ‘Digital India’ initiative can be given a boost while supporting local manufacturers. Within the next five years, we can expect to see an increase in domestic design.”

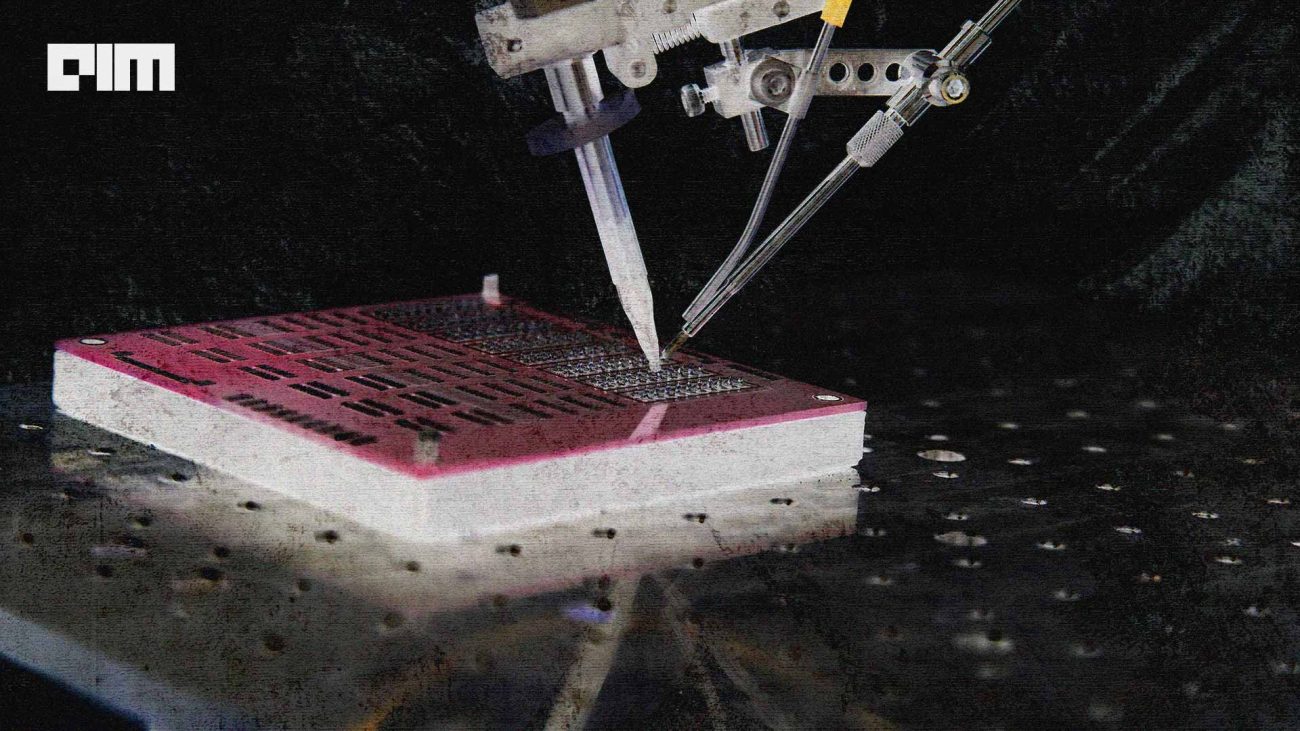

PCB woes and worries

The announcement from Chandrasekhar comes at a moment when the Directorate General of Trade Remedies (DGTR) have recently issued a notification about the initiation of an anti-dumping investigation on imports of printed circuit boards (PCBs) originating in or imported from China and Hong Kong, upon the request of the Indian Printed Circuit Association (IPCA).

As per IPCA, the quality of PCBs manufactured in India is at par with international standards. DGTR also believes that the two products are technically and commercially substitutable and the consumers have used and are using the two products interchangeably.

It is worth noting that during the April–October period, India imported PCBs worth $478 million from China and Hong Kong, accounting for 55% of the total imports.

According to IPCA, there are over 200 manufacturers of PCBs in India, primarily consisting of micro, small, and medium enterprises that are dispersed throughout the country. However, due to the ongoing dumping of PCBs by other countries in India, IPCA expresses concern that these micro and small enterprises are facing significant challenges.

Problems with manufacturing

While the PLI scheme is a great initiative for local businesses, as we have seen in the smartphone sector, PLI for the IT sector can be successful too. But the question is, when will the manufacturing sector get pushed into electronics in India?

For instance, the Indian government has offered many incentives to companies manufacturing in the semiconductor industry, still we’ve not seen much of a development in the sector.

On the matter, Sravan Kundojjala, director at Strategy Analytics, told Analytics India Magazine that this is attributed to a variety of factors. “First and foremost, setting up a semiconductor plant requires huge capital expenditure, while the profitability is very low, at least during the initial period”.

This, Kundojjala believes, is due to the fact that “it takes time for companies to get to the break-even point and ramp up the number of wafer starts per month”.

If India wants to compete with the likes of China and Vietnam, it also needs to compete with the favourable subsidy structures in areas like machinery used for manufacturing along with research and development.

In addition, while India is providing several benefits to local manufacturers through schemes like PLI, it still lacks when it comes to tax exemptions.

Furthermore, the Indian government also shares the belief that even with its vast economies of scale and a leadership position in electronics manufacturing, China’s dumping margin (DVAR) remains high—ranging from 25% to 40% across various product categories—despite producing electronic products worth $1 trillion.

As a result, China’s imports remain substantial despite its scale and competitiveness. The electronic exports in China are estimated to be around $700 billion while its imports are estimated to be around $500 billion. Therefore, the government believes that even with increased value-addition, large-scale imports may still be necessary.