What To Expect From The New US-India Artificial Intelligence Initiative

The Indo-US Science and Technology Forum launched the US India Artificial Intelligence Initiative on March 17 to foster the science and technology relationship between the

The Indo-US Science and Technology Forum launched the US India Artificial Intelligence Initiative on March 17 to foster the science and technology relationship between the

In 2012, Gote Nyman, a retired professor from the University of Helsinki, said an explosion of apps and services that get information directly from individuals

“Data is the new oil” is a maxim we have heard far too often. Data indeed has massive potential in the information economy and can

This is the 12th article in the weekly series of Expert’s Opinion, where we talk to academics who study AI or other emerging technologies and

Machine learning (ML) can handle many complex tasks than just output singular decisions based on a labelled training dataset. Reinforcement learning (RL), a subset of

Imagine you have spent hours on data analysis at your boss’s behest. You put in a lot of effort to make your final product accurate,

Last year, Srinivasa Gowda made international headlines when he ran 142m in 13.42 seconds at an annual buffalo race (Kamabala) in the wet fields of

The attrition rate of analytics professionals in India almost halved amid the pandemic, AIMResearch found. ‘Analytics India Attrition Study’ is an annual report published by

The COVID-19 pandemic has accelerated the pace of AI adoption, but many industry insiders find the speed of adoption a bit overwhelming, according to a

This is the 11th article in the weekly series of Expert’s Opinion, where we talk to academics who study AI or other emerging technologies and

Explainability is one of the most challenging tasks in ensuring AI transparency. Explainable AI refers to the tools and techniques to understand the decision-making process

“All media exist to invest our lives with artificial perceptions and arbitrary values.” Marshall McLuhan The word disinformation is a cognate for the Russian dezinformatsia,

In July 2019, the DNA Technology (Use and Application) Regulation Bill was passed in the Lok Sabha to create a regulatory framework for obtaining, storing,

According to a recent report published by the International Labour Organisation (ILO), digital labour platforms erode the worker’s rights and quality of life. The ILO

Adversarial inputs, also known as machine learning’s optical illusions, are inputs to the model an attacker has intentionally designed to confuse the algorithm into making

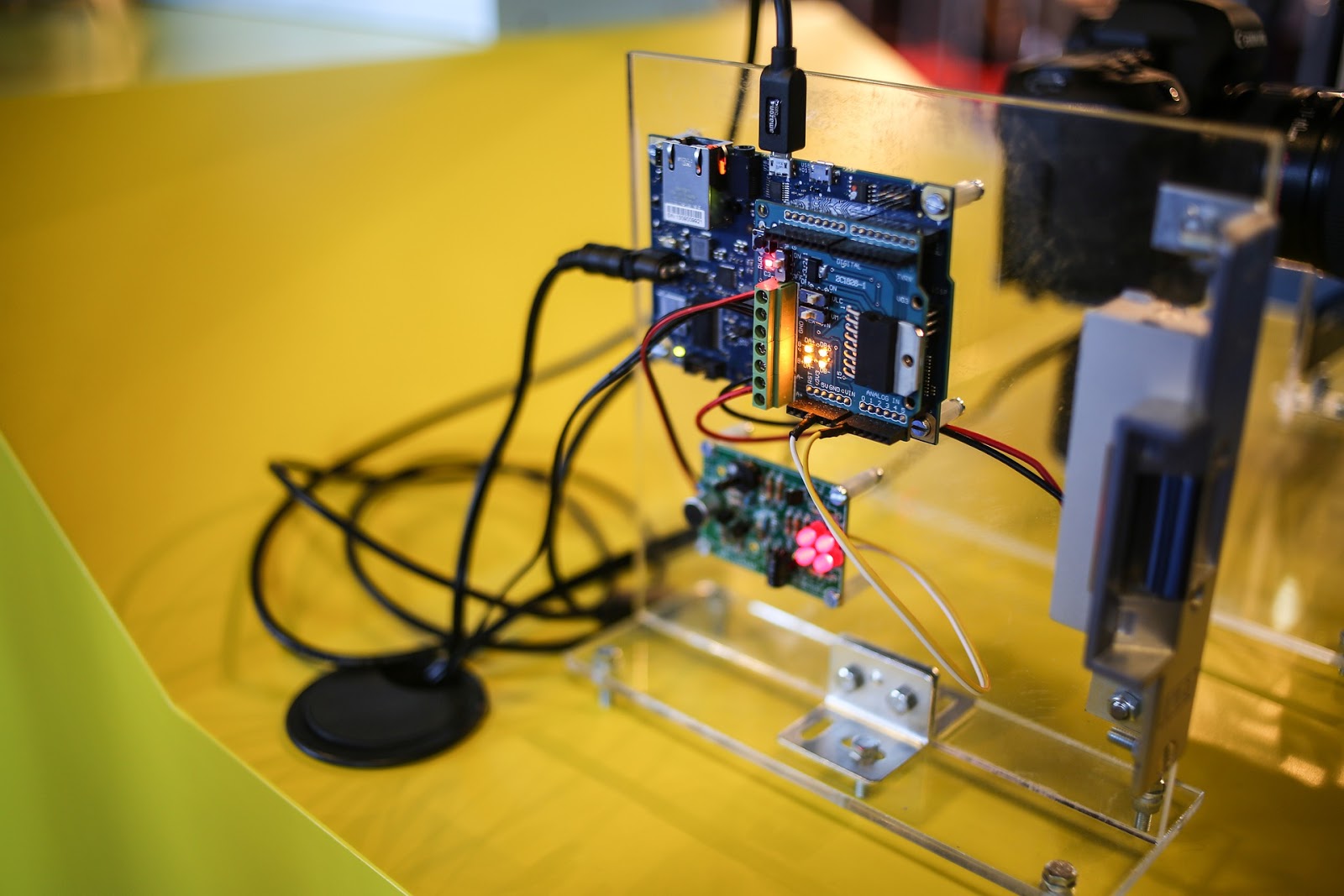

Raspberry Pi is all set to ramp up its machine learning abilities, co-founder Eton Upton said at tinyML Summit 2021. Upton said the in-house chip-development

This is the 10th article in the weekly series of Expert’s Opinion, where we talk to academics who study AI or other emerging technologies and

Accenture is all set to acquire the industrial and robotics automation firm Pollux, headquartered in Joinville, Brazil. Accenture said the acquisition would expand its capabilities

“Aspen, it’s time for bed,” rings out a virtual voice. Aspen is disappointed as he replies, “I don’t want to go to bed” and looks

The National Security Commission on Artificial Intelligence (NSCAI) recently published the Final Report for 2021 outlining an integrated national strategy to empower the US in

When Sundar Pichai appeared before the US Congress in 2018, he was asked why the word ‘idiot’ returned Donald Trump’s images on Google search. Pichai

Data Science, Machine Learning, and Artificial Intelligence are the significant drivers of the fourth industrial revolution. Since data powers all these fields, they are often

Startups are the places where tomorrow is invented, where emerging technologies like AI and machine learning thrive. All forward-looking countries count on startups to turbocharge

According to several news reports, IBM is mulling its Watson Health business unit’s sale in the wake of IBM CEO Arvind Krishna’s plan to focus

Serena Williams, Lionel Messi, and Lebron James are called GOATs (greatest of all time) in their respective fields for a reason. Fans use phrases like

This is the ninth article in the weekly series of Expert’s Opinion, where we talk to academics who study AI or other emerging technologies and

Data science is a highly multidisciplinary field. And to run data teams profitably, organisations need versatile leaders and managers. While analytics leaders’ job entails managing

Recently, MIT scientists developed a machine learning-based approach to identify drugs that can be repurposed to fight COVID-19 in the elderly. Below, we look at

Recently, Microsoft announced limited access to its Neural Text-To-Speech (TTS) AI that enables developers to create custom synthetic voices. So far, AT&T, Duolingo, Progressive, and

The analytic team sizes of 21% Indian firms grew in the last 12 months amid the pandemic, AIMResearch found. The report, titled ‘Impact of Pandemic

Join the forefront of data innovation at the Data Engineering Summit 2024, where industry leaders redefine technology’s future.

© Analytics India Magazine Pvt Ltd & AIM Media House LLC 2024

The Belamy, our weekly Newsletter is a rage. Just enter your email below.