BIG DATA ANALYTICS IS BIG NEWS! Data is growing at a tremendous rate with an increase in digital universe from 281 Exabyte’s (in year 2007) to 8000 Exabyte’s (in year 2015). The banking and financial services (BFS) industry has been one of the biggest adopters of Big Data technologies such as Hadoop.. Here, Veristorm Enterprise Solutions takes advantage of high-performance, streamlined data transfer solution which is easy to deploy and quicker than ever, and the performance gains achieved are remarkable.

BIG DATA ANALYTICS IS BIG NEWS! Data is growing at a tremendous rate with an increase in digital universe from 281 Exabyte’s (in year 2007) to 8000 Exabyte’s (in year 2015). The banking and financial services (BFS) industry has been one of the biggest adopters of Big Data technologies such as Hadoop.. Here, Veristorm Enterprise Solutions takes advantage of high-performance, streamlined data transfer solution which is easy to deploy and quicker than ever, and the performance gains achieved are remarkable.

vStorm enterprise provides a single unified data integration platform to get all enterprise data on same platform where companies are storing external data. Leveraging vStorm Enterprise Solutions a bank can get a head start into using big data analytics for building out a recommendation engine, managing customer satisfaction and churn as well as manager fraud and credit risk.

Background

As work started on writing this paper, big data analytics is one of the IT industry’s hottest topics. A lot of the financial institutions/banks are currently shifting their marketing focus from traditional marketing focus that are outbound in nature to more point-of-impact real time fact-driven channel based marketing concepts.

The traditional marketing concepts were mostly focused around communication channels like direct emails to reach out to prospect customer base but given that the world today is interconnected & so are the customers, banks can’t just rely on only direct communication mode to interact with customers.

The Challenge

The dynamics have changed rapidly over time and the current market state has created challenges & major pain points leading to a dilemma faced by C-level executives. The reasons for banks not realizing the full potential of available data, tools and technologies are not very hard to find out. One of the reasons is that all the available data is not available on the same platform and there continue to be silos across departments, product lines, geographies, etc.

The current environment can’t only be treated as a technology shift – it has also changed the mentality of the customers too. The electronic media has exposed the customers to a whole new environment wherein electronic footprints are providing customers with varied new information almost every moment & opening up unlimited access to information bank almost about everything they need to make exercise their choice.

Banks best friends – vStorm and Spark

A number of companies have been researching ways to help enterprises address the above challenges. It is not that solutions do not exist. Hadoop has helped banks significantly in addressing data storage issue. But most of traditionally available tools and solutions suffer from the same issue. They require long projects running into months and years for implementation cycle.

We at MathLogic, have scanned the market and two complimentary tool set seems to make sense. First one is a GUI based point and click tool to move data from Mainframe or any other open systems like Oracle, DB2,SQL Server, Teradata and other disparate sources into Hadoop from Veristorm (vStorm Enterprise). The second is the tool set for analysis from UC Berkeley which is fast gaining acceptance as the universal tool for analysis (Spark – in particular we think Spark over Hadoop would be the game changer for banking Industry).

The vStorm Advantage

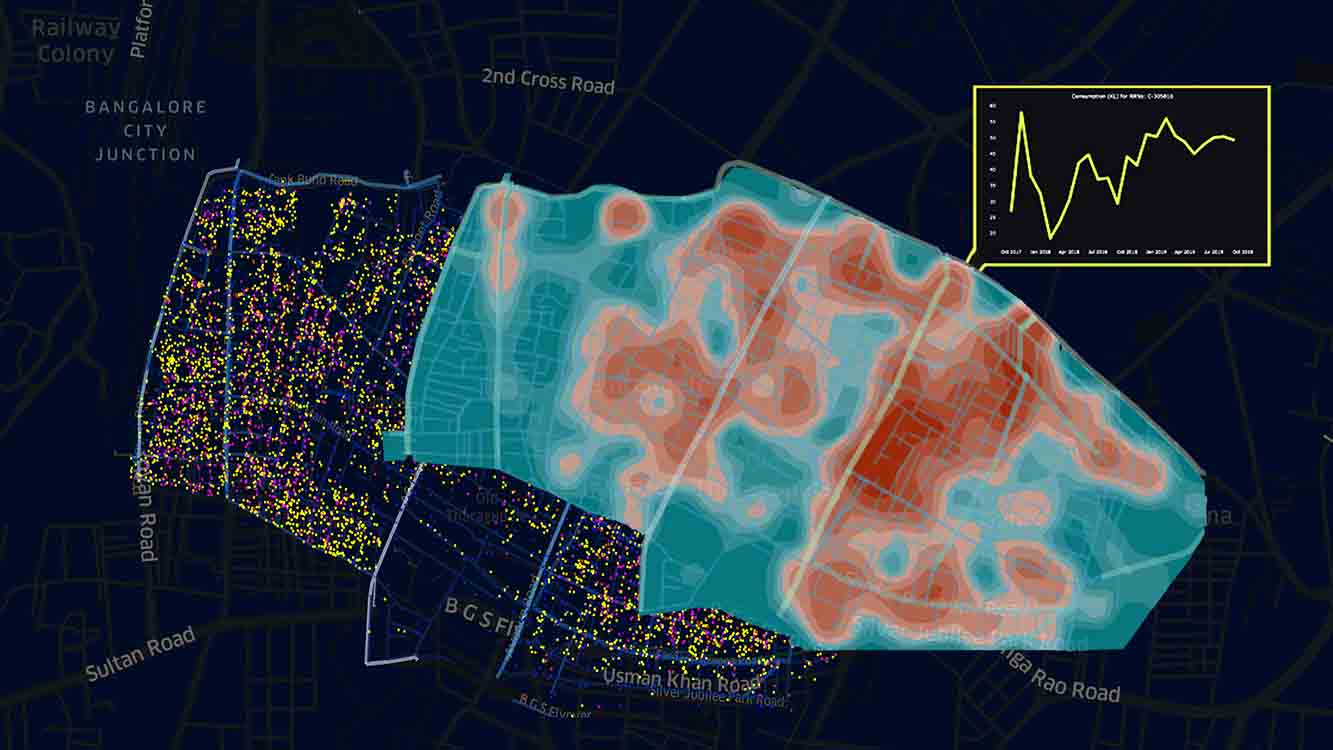

vStorm Enterprise can send data to external sources for processing. Using vStorm Enterprise, distributed Hadoop configurations can work with Cloudera, Hortonworks, and BigInsights platforms & organizations like IBM is using Infosphere applications along with vStorm as the platform of choice. Thus it makes the Analytics procedure much easier to get a holistic view of the customer data. A Single view of the customer is an absolute necessity in today’s world to be able to have the right analytics models built & implemented.

Figure 1: Leverage vStorm Enterprise

vStorm- Spark combine as Predictive Analytics platform

A closer look at Figure 1 shows that data from historical process is gathered and collated into Hadoop , the analysts or data scientists can now build robust predictive analytics models /decision engines that can solve the business puzzle and enhance business value. They can use Spark as the single tool to analyze structured/ unstructured and streaming data on the go.

Use cases for Banks

In a highly competitive market is driving firms to compete aggressively for customers’ wallet: increasing focus on customer acquisition, retention and profitability. While getting a complete view of customer relationship across the enterprise is very important, it is equally essential to use it to offer customized products and service to profitable clients will increase client loyalty and result in increased wallet share & reduce losses by minimizing the risk exposure.

Real time Recommended Offer: Target new product & services to the right customers by implementing Analytics engine that supports flexible & integrated processes by better understanding customer needs, preference, buying patterns & motivations. The recommended offer campaign is meant to provide the customer a complete new personalized experience by communicating consistent message across channels to increase customer delight through each interaction. Instant access to customer activity real-time & analyzing customer profile from past history can be really helpfully in triggering an offer to the customer commensurate with his behavior, current location & accessibility to exercise that offer increases customer satisfaction to a huge extent.

Potential Benefits: – Enhanced customer satisfaction, increase customer-value & engagement level, personalized touch, Increased revenue from existing customer base

Call to Action

At a given point of time, when firms have the right vision and goals, they work as a team, and hold tools in a loving embrace that can shine a light well into the future, the prospects around big data is astronomical. With people continuing to see the myriad of possibilities, they will figure out ever creative ways to leverage the data IT makes available.

To find out more about how your business can gain in smoothing your operations and maintaining structured channels across key businesses with FN MathLogic Consulting Services, do reach out to us at info@fnmathlogic.com (www.fnmathlogic.com).