What are value stocks? A value stock is a stock that trades at a lower price relative to its fundamentals, such as dividends, earnings, or sales, making it appealing to value investors. What are growth stocks? Growth stocks are considered stocks that have the potential to outperform the overall market over time because of their future potential, while value stocks are classified as stocks that are currently trading below what they are really worth and are likely, therefore, to provide a superior return.

For all their potential upsides, value stocks are considered riskier than growth stocks because of the sceptical attitude the market has toward them. For this reason, a valuestock is typically more likely to have a higher long-term return than a growth stock because of the underlying risk.

Value investors seek businesses trading at a share price that’s considered a bargain. As time goes on, the market usually recognizes the company’s proper value and the share price goes up. Value stocks could prove profitable as part of a recession investing strategy, but it’s still important to manage risk in a portfolio. High-profile proponents of value investing, including Berkshire Hathaway chairman Warren Buffett, have argued that the essence of value investing is buying stocks at less than their intrinsic value. The discount of the market price to the intrinsic value is what Benjamin Graham called the ‘margin of safety’.

According to Graham and Dodd, value investing is deriving the intrinsic value of a common stock independent of its market price. By using a company’s factors such as its assets, earnings, and dividend payouts, the intrinsic value of a stock can be found and compared to its market value. If the intrinsic value is more than the current price, the investor should buy and hold until a mean reversion occurs.

A mean reversion is a theory that over time, the market price and intrinsic price will converge towards each other until the stock price reflects its true value. By buying an undervalued stock, the investor is, in effect, paying less for it and should sell when the price is trading at its intrinsic worth. This effect of price convergence is likely to happen only in an efficient market.

Now how does a retail investor spot a value stock without necessarily going through Graham’s intrinsic value computations? Can Analytics help in this endeavour? Let us take a sample of stocks – say Nifty 50 stocks and explore them with Analytics. One could examine if these stocks are correlated amongst themselves.

Lower degree of correlation among certain stocks would imply that these would very likely follow different market cues and triggers and hence their prices would not rise and fall together. This could make them be part of a de-risked portfolio. It would also be useful to explore if the Nifty 50 stocks follow a normal or any standard distribution. This is almost never the case.

As a next step let us cluster these stocks. Let us take the prices of these 50 stocks over a ten-year time period and determine their returns rate, factoring in the dividends. A k-means clustering approach found that these 50 stocks could be clustered into 5 clusters based on their ten-year returns. Each cluster had stocks across sectors ranging from technology to engineering and infrastructure.

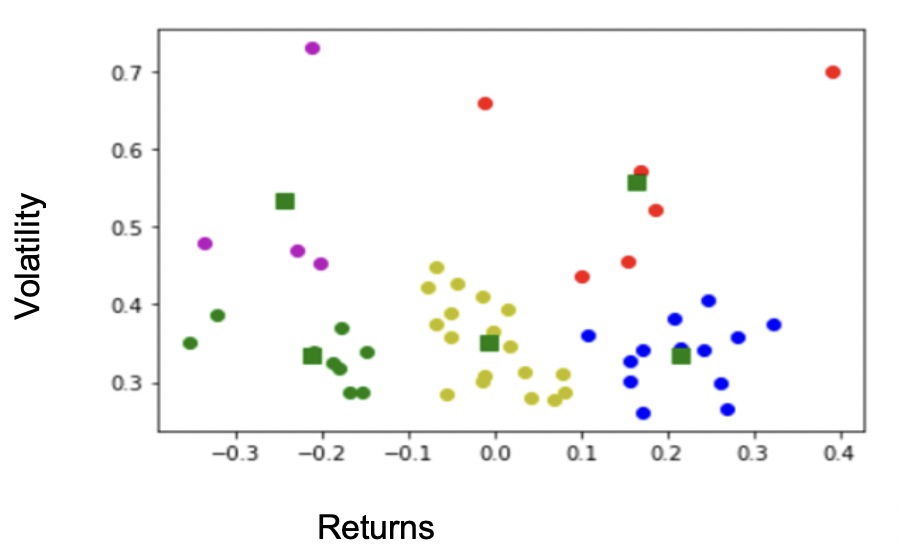

Now that we had reduced Nifty 50 to 5 clusters the next challenge was to figure out which of these would represent a value cluster. Hence we factored in the volatility of these stocks with a simple measure such as Beta. We tried to collate stocks amongst the Nifty 50 that gave higher returns as well as had relatively lower Beta as shown in the figure 1 below.

It is clear that if we plot these as a scatter plot of Volatility versus Returns, the bottom right hand corner is the stocks that should interest a value investor. Almost all these stocks were from one of the five clusters only. Thus we managed to identify the cluster with value stocks from the Nifty 50 stocks. This cluster had 13 stocks in all, across sectors, that a value investor could consider for investments. Thus such a cross-sectorial clustering provides an alternate way of finding value stocks.

Now one might argue if these identified stocks are actually Investible stocks or are they Value stocks. Four of the 13 stocks were such that their intrinsic value was higher than their market value indicating that they would be considered to be value stocks by the classical definition of value stocks. Hence an analytical approach is very likely to come up with a basket of stocks that consist of both value stocks and stocks that are interesting to invest. This way an investor could exploit all the opportunities a market provides and not be restricted by classical definition.