|

Listen to this story

|

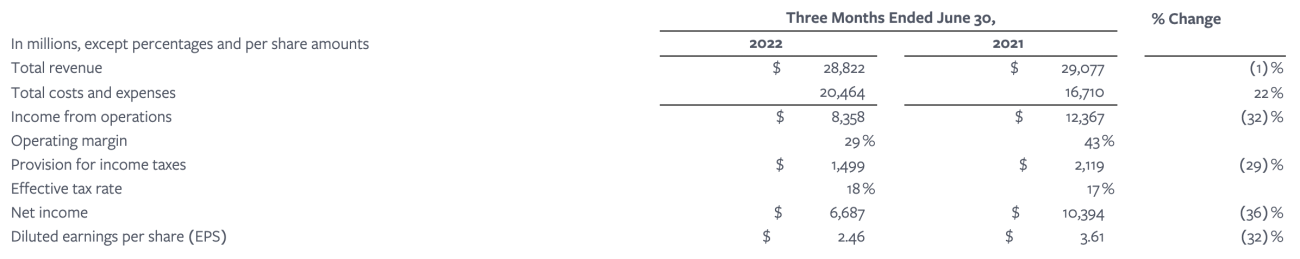

The earnings week has been a bloodbath for Big Tech. A slowdown in digital ad spending caused by rising inflation has dampened the report cards for Google, Snap Inc and Twitter, all of which rely heavily on ad revenue. However, none has fallen harder than Meta.

Facebook’s parent company Meta posted its first-ever revenue decline after a stupendous run for years. The company posted its quarterly revenue numbers of USD 28.8 billion, which is 1 per cent lower than last year’s revenues. The figures also fell short of market expectations which stood at USD 28.9 billion. Moreover, Reality Labs unit, which is behind the company’s metaverse push, generated sales of USD 452 million, down from USD 695 million in the last quarter.

Macro-economic factors aside, it was no secret that Meta was struggling with growing competition from rival TikTok.

Meta’s pivot to catch up

ByteDance Ltd.’s TikTok, unlike Facebook, isn’t based on the social-graph model. TikTok doesn’t need influential people to use it to enhance engagement, nor does a user need to have friends on it already to find it useful. The app runs on an excellent recommendation algorithm that can determine a user’s interest area with great accuracy in no time.

The TikTok model did not require building a giant social network like Meta or Twitter; it simply exists to distract a user. Considering it has random short videos catering to a user’s interests, the platform’s addictiveness can be gauged by the sheer number of its active users. Currently, TikTok has around a billion monthly users with an engagement time of about 10.85 minutes, making TikTok the most engaging app ever. Even more impressive is the fact that the platform reached these figures in a short span of four years.

Facebook’s fears that they weren’t doing enough to compete against TikTok left senior executives desperate. In April, The Verge obtained a memo from Tom Alison, Meta’s executive in charge of Facebook stating that Facebook feed would be built much like TikTok’s, i.e. fewer posts from people that users followed and more recommended posts regardless of where they came from.

Meta had already incorporated their Reels, a short video feature from Instagram onto Facebook. Akin to TikTok, Reels had tools which allowed users to edit their videos, add chosen audio clips and AR effects. With heavy promotion of Reels, Instagram had already transformed its interface to appear as close to TikTok as possible. However, these efforts proved to be insufficient, post which Meta shifted the feature to Facebook with the intention of bringing youngsters back to the app.

This is not the first time that Facebook has rushed to copy the algorithm of another competitive app. Earlier, Facebook had copied the Stories format from Snapchat. During the earnings call with analysts, Zuckerberg revealed that Reels could potentially be monetised faster than Stories, but it wasn’t making them money at the moment. But even with these changes, Meta recognised the long-term dangers with moving away from a connection-centric model.

The Cunningham memo

In mid-July, an internal document called the Cunningham memo re-surfaced in the news. The document signalled that in addition to being anxious about its rivals, Zuckerberg was also worried about subsidiaries WhatsApp and Instagram cannibalising Facebook’s business.

A former data scientist from Facebook, economist Thomas Cunningham, made three noteworthy points in the memo. First, a single messaging or sharing app tends to dominate in a market across all ages, genders and classes. There was only one group that eluded this rule: teens. An app could succeed singularly among teens only. This is what seems to have happened in the case of TikTok. A research done by Ofcom showed that teens were turning their backs on traditional sources of news and consuming their news from TikTok. The number of users on the app consuming news had risen from 800,000 in 2020 to 3.9 million this year. The Ofcom report noted that this growth was mainly powered by users in the ages between 16 and 24.

Second, general messaging apps usually have a bimodal distribution in a market. If an app dominates more than 50% of the market, it will tend to veer towards 90% market coverage. On the other hand, if an app dominates less than 50% of a market, it tends to move towards 1 per cent market coverage eventually.

Third, small declines in the market share of a social networking platform is indicative of big declines to come in the future.

“Once users start using a social app, their use declines slowly,” Cunningham added.

This hypothesis was reiterated when Snap entered the competition and caused a dent in Facebook’s business and now TikTok.

Future model

In the current climate, Facebook is stuck between a rock and a hard place and the stakes are high. Sticking to the current model could mean succumbing to hypercompetitive apps like TikTok. But changing its original model and moving away from being a social network would mean it is in direct competition with apps like TikTok. Apps like TikTok, which have no underlying principle binding it together, might be a flash in the pan once newer competition arrives. New apps that are more interactive and more distracting could dismantle TikTok. But this heated contest might produce one collateral result — the end of the dominance of social media giants like Facebook and an open field for smaller internet companies.