|

Listen to this story

|

“Extra cautious spenders are like a dam that keeps accumulating and end up splurging on emotional life events,” seasoned angel investor and founder of fintech startup CRED, Kunal Shah tweeted in April this year.

Also, the former founder of mobile wallet firm FreeCharge, Shah’s philosophy was clear — spend big on buying something if you really want it. For the past six months, Indian fintech startup CRED has been negotiating an investment in wealth management startup Smallcase. The seven-year-old stock platform is backed by Zerodha, Amazon and Sequoia Capital, among other venture capitalists.

In the early days of the talks, CRED intended to invest in Smallcase, rather than acquiring it. While CRED hasn’t commented on the deal yet, conflicting reports emerged saying the acquisition was either underway or had fallen through the cracks.

Meanwhile, in June, CRED raised USD 140 million in its Series F financing led by Singapore’s sovereign wealth fund, GIC. Other existing investors also participated in the funding, which now values the fintech company at USD 6.4 billion, up from USD 4 billion in October 2021.

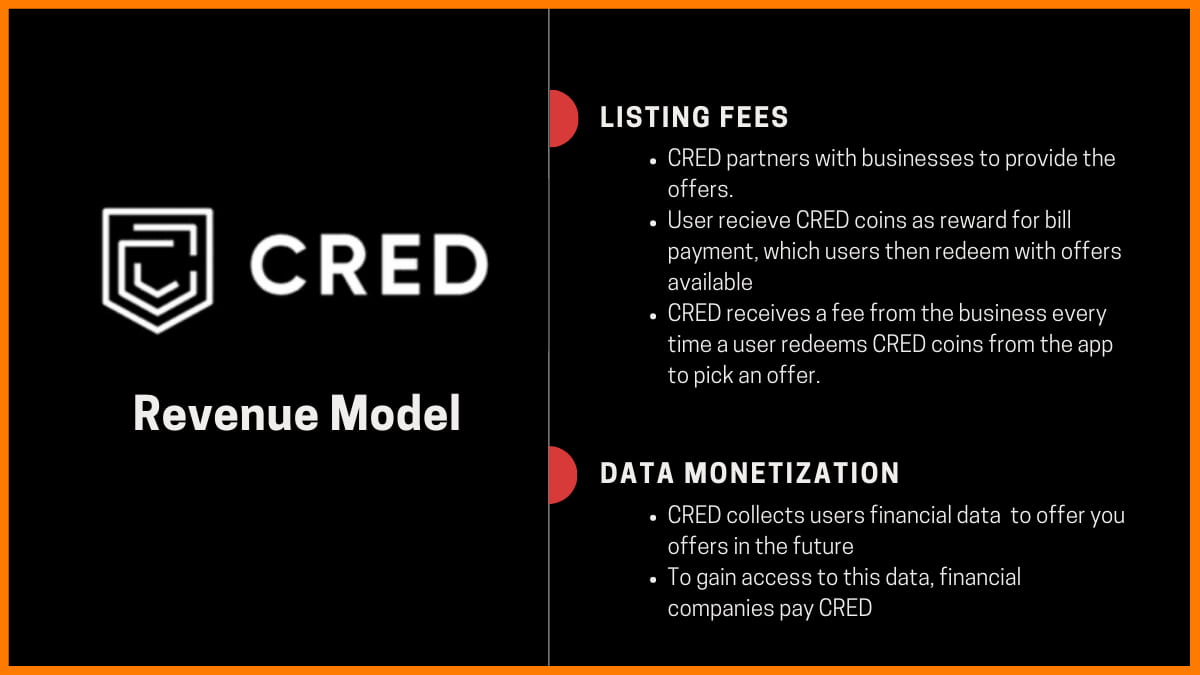

CRED’s revenue model

But what does an app that helps clients with their credit score have to do with wealth management? In the past one and a half years, CRED has expanded in seemingly haphazard directions.

In December last, Shah bought corporate expense management company Happay in an undisclosed deal. Reports pegged Happay’s valuation at USD 180 million. Founded in 2015, Happay manages over a million users globally with companies like TATA Grow, PwC, Maruti, OYO and Byjus as its clients. In a press statement, CRED said, “While Happay will operate as a separate entity, the team will work closely with CRED leadership to leverage its ecosystem, build distribution, expand the product offering and drive scale.”

At the announcement of the Happay deal, Shah said that CRED had grown rapidly in the past three years having resolved the issues with credit card management. He stated that professional expense management was now a natural route for the company. To begin with, CRED’s core service was to help users track their credit card bills and make payments on time. If they made timely payments, they were rewarded with CRED coins which could be redeemed on the platform itself by availing offers from certain brands. CRED made money from the brands which had paid to get listed on the app.

To be objective, this in itself was a preface to their product offerings. But the marketing blitzkrieg that Shah ran, popularised CRED at breakneck speed. The startup had climbed USD 800 million in valuation within two years to enter the unicorn club in 2020. If the platform’s business model looked questionable to outsiders, in hindsight, to Shah it made perfect sense. Think of a hook to bring in customers and ensure that they stay.

By October 2020, the app had 30 lakh users as its customer base. First off, the app interface was nifty and appealing. Second, it held the attention of customers and continued to expand with interesting products. Next, CRED launched an e-commerce store and a rent-paying facility. Users could choose from its curated products and make purchases from the in-app purchasing platform Cred Store. Then, it launched Cred Rent Pay, with which consumers could pay their monthly rent via their credit cards. Users would get CRED coins after paying rent and redeem these as well.

Spending big for expanding lending

Shah continued to make a string of purchases to this end. In November last year, Newtap Technologies Pvt. Ltd., a company that Shah had floated, acquired an NBFC called Parfait Finance & Investment signalling it was interested in being in the lending business. The acquisition of an NBFC would give CRED access to low-cost capital to build its lending operations. Last year, it also launched a peer-to-peer lending service that enabled customers to lend to other CRED users at a rate promised to “beat inflation”.

Shah was on a similar spree of acquisitions in other service areas like restaurants and liquor deliveries. It acquired HipBar, a liquor delivery startup with a prepaid payment instrument licence. Last year, CRED was also in talks to acquire Dineout owned by Times Internet, which is used for discovering restaurants, offering discounts and complimentary dishes. Dineout co-founder and CEO Ankit Mehrotra, however, denied the report.

In it for the long haul

CRED had also been discussing a potential purchase with Wint Wealth, another investment platform. Wint counts a bunch of notable names as its investors, including Zerodha’s Rainmatter Capital Fund, Better Capital, Pravin Jadhav of Raise Financial and Shah himself. Negotiations with Wint, which were reported towards the end of last year also fizzled out after the founder and CEO Ajinkya Kulkarni refuted the reports.

Wint itself has run into fresh regulation concerns. Last month, the Securities and Exchange Board of India issued a paper targeting non-institutional online bond platforms like Wint Wealth, GoldenPi, Harmoney and BondsKart that sold debt securities to investors. The regulation plans have for now thrown in a spanner in Wint Wealth’s plans.

According to Shah, the choice to achieve scale ahead of revenue generation was a deliberate one. Most internet businesses, he said, start with distribution, then upselling and crossing eventually. He cited Facebook as an example, noting how the Zuckerberg-run social networking company hadn’t started making a profit until four to five years later.

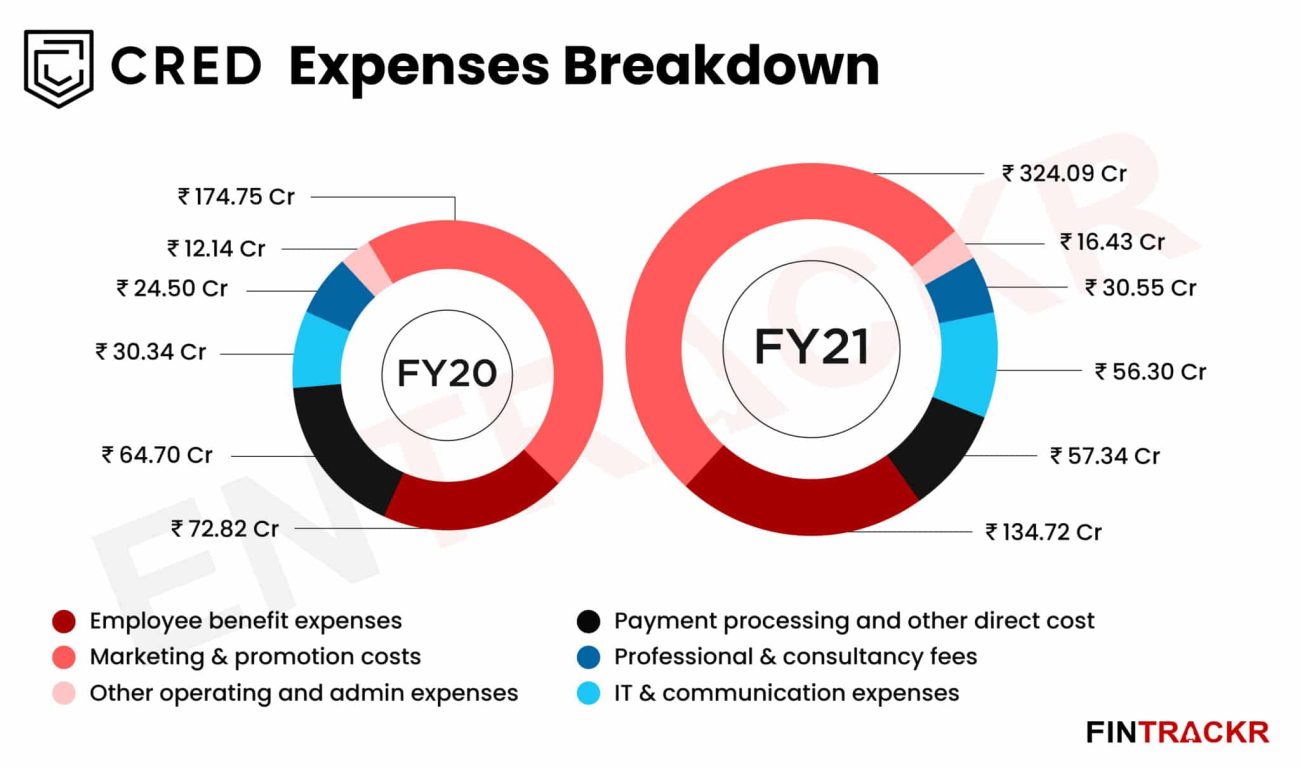

In its earnings released this year, CRED reported a 45% widening in losses for FY 2021 as marketing expenditure increased from Rs. 57 crore in FY 2020 to Rs. 222 crore last year. Shah is undeterred. Having positioned itself bang in the middle of high-income cardholders, CRED is looking at a long game. Lending may not sound as trendy but there is real money to be made in it. For now, Shah’s agenda is: Have money, will spend.