|

Listen to this story

|

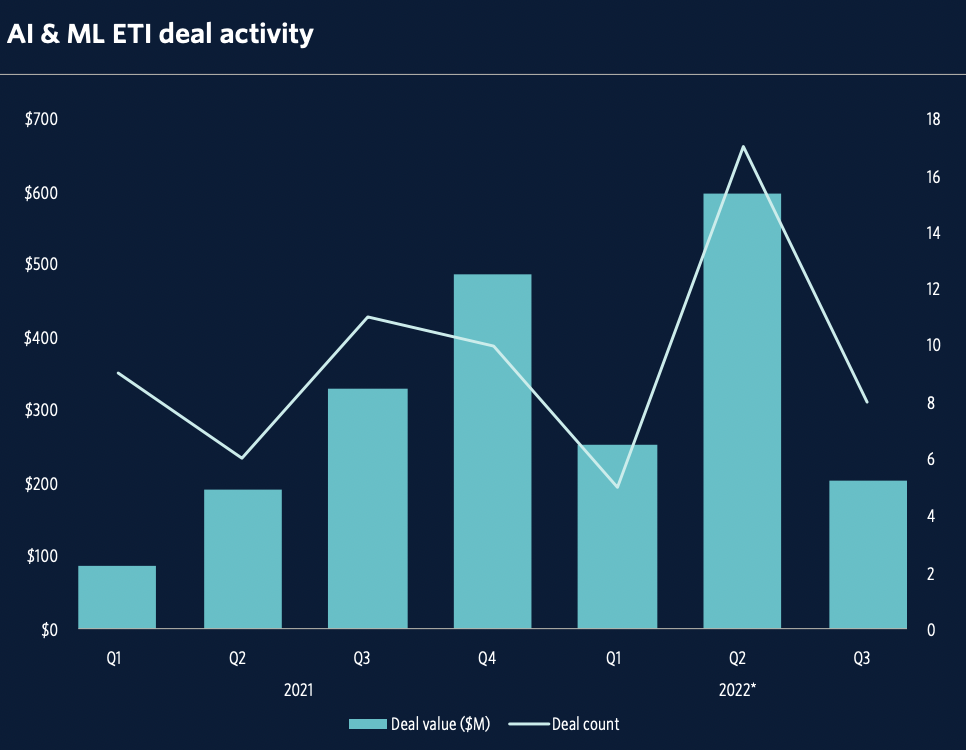

While 2022 was the year that AI made most headlines, startups that operate in the sector did not exactly have the best year. According to a new report by PitchBook, while the global VC deal count has continued to grow from record highs last year, the deal value has dramatically decreased across all stages in 2022, with AI financing bearing the brunt of the loss.

While the high-value deals have declined globally in recent quarters—with only ten deals over $100 million—the AI and ML startups raised $204 million in Q3 across eight deals, representing the fifth largest category of investment. However, when compared with the Q2, in which PitchBook reported a total funding of $600 million, it’s quite a steep drop in fundings.

Three global companies that received a major chunk of the funding were: Flatfile, Inc. ($50 million), which offers client onboarding solutions; Nightfall ($40 million), which provides cloud data detection for security and compliance; and Arthur ($42 million), which is an ML monitoring platform for data scientists.

(Source: PitchBook)

The startups working in the field of Web3/DeFi—while remained on the top of the list by getting highest number of funding with $879 million invested across 24 deals—observed a decline in the funding due to the growing regulatory risk, depressed cryptocurrency prices, and the broader macroeconomic environment in the sector.

(Source: PitchBook)

What’s happening here?

In India, the revenue generated by AI reached a pitch of USD 12.3 billion in 2022. However, despite this overall success in the AI industry, funding for AI startups in the nation has reportedly declined.

It is worth noting that the decline in funding for AI startups in India is occurring at the same time as a decline in funding for AI and Web3 startups in other countries. It is possible that this trend is a result of broader economic or market-related factors than anything specific to the AI industry or to the Indian market.

Though the exact percentage of decline is not available yet, the startups have typically witnessed a decline of 38% in funding. Additionally, with looming winder of funding in AI startups, the unicorns in the sectors are also becoming rarer.

To know more about the ecosystem in India, Analytics India Magazine reached out to Ankur Capital, a VC firm which is known for funding startups like Cropin, Rupify, Krishify and others.

As per Ritu Verma, co-founder of Ankur Capital, said, “At Ankur, we expect rationality in the market—while everyone is talking about a funding winter—we’d like to think about it as the emergence of rationality. So, good companies, ones with fundamentals, will continue to raise capital and grow”.

However, Verma also believes that funding will see a decline in the year of 2023. “While money is not cheap the opportunity remains, so capital will continue to be deployed. Not only is the India market sitting on the capital arsenal, the despondency and closure in other markets also make India an attractive destination for new capital inflows.”

“However we cannot peg last year, which was abnormal,” says Ritu. “Having rationality of course is good for investors where valuations are more realistic. The lack of hype is also beneficial to serious entrepreneurs as it cuts out the noise and focuses investors.”

Still, Anand Lunia, General Partner, India Quotient—which is famous for funding mega-startups like Sugar Cosmetics, Sharechat, PagarBook Lendingkart among others—believes that AI startups are going to get funded for the upcoming decade.

“ChatGPT, for example, has really opened the minds of everyone to the possibilities. We should see more progress on the audio and visual side, and some great projects are coming up. AI is finally replacing parts of human existence right in front of us and entrepreneurs have smelled this opportunity.”

Yet, Lunia believes that “2023 is going to be the same as 2022 in terms of low funding, but more pain as money raised in 2021 gets exhausted”.

“The Indian ecosystem is trying to find a new normal. Investors are just dabbling a bit in seed deals and watching from the sidelines. May take a while to see more action than that,” he concluded.