Japanese financial services giant SBI Holdings has invested $15 million in AntWorks, a three-year-old artificial intelligence company. The purpose of the memorandum of understanding (MoU) is to establish a joint venture company with AntWorks to operate businesses in Asia, said SBI in a statement.

AntWorks has been developing and providing operations processing automation platform called Robotic Process Automation (RPA). This platform delivers services ranging from AI-based data recognition to automating operations.

Yoshitaka Kitao, president at SBI Holdings, told a leading daily, “AntWorks has risen through the ranks of global RPA, automation and artificial intelligence companies with a ferocity that’s unprecedented in the industry. We are excited about the possibilities of ANTstein, and look forward to their growth in the Asian region through our joint venture, as well as globally.”

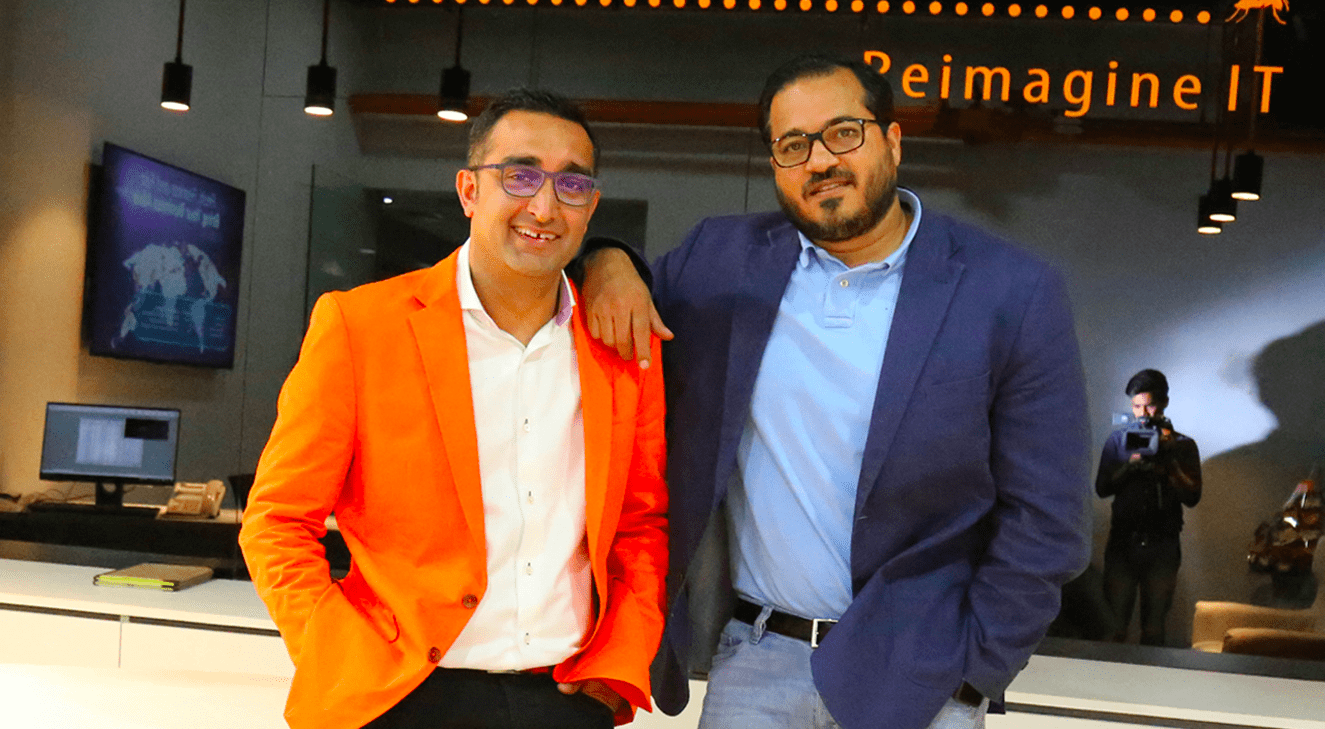

AntWorks is led by CEO Asheesh Mehra; CFO Govind Sandhu and CTO Dr Venkat, who continue to shape the company and set the course for the future. They have offices in Singapore, Chennai, London, among other cities.

AntWork’s platform is excellent for data recognition because it uses a fractal theory-based AI technology to read data in non-unified format documents called non-standard format documents, which account for 90 percent of all in-company documents.

The platform also has Machine Learning and Natural Language Modelling capabilities which makes it one of the most comprehensive end to end automation platforms available.

SBI Holdings and AntWorks will now focus on countries in Asia, such as Japan, China, South Korea, and Indonesia. Going forward, by utilising the SBI Group’s network, including SBI FinTech Incubation SBI Holdings and AntWorks will strive to introduce products and services to domestic and overseas financial institutions through.

SBI A&B Fund of SBI Investment has been actively investing in promising start-up companies inside and outside Japan in sectors such as AI and blockchain, including the FinTech sector, which is being carefully watched globally, as well as the IoT, robotics, and the sharing economy, which have close links to these technologies.