Artificial Intelligence or AI is a field of Data Science that trains machines to learn from inputs, adjust to inputted fields and criteria, and perform tasks of computational logic that match certain human cognitive levels. Over the last few years, AI has emerged as a primary data science function – by utilising advanced algorithms and ever-increasing computing power. AI is transforming business domains and organisations as AI algorithms are now designed to make real-time decisions and interpret various types of data and media.

Analytics India Magazine (AIM), in association with TAPMI, has developed this study on the Artificial Intelligence market to understand the developments of the AI market in India, covering the market in terms of Industry and Company Type. Moreover, the study delves into the market size of the different categories of AI and Analytics start-ups/boutique firms.

To know more about our research services, visit AIMResearch.

Read “State of AI” reports from previous years at the links below:

Section 1: Overview of the Artificial Intelligence Market in India

The Artificial Intelligence technology function is no longer an emerging technology segment – AI as a function has pervaded almost all industries and functions – from eCommerce to BFSI and from Manufacturing to Agriculture – Data Science and Deep Learning are increasingly utilised to solve complex business challenges. AI is increasingly utilised across several B2B, B2C, and, even, C2C (Consumer-to-Consumer) channels.

- AI is increasingly adopted across Contact Center Customer Services (RPA-driven Chat Bots), Media Delivery (ML and AI-driven Social Media, Streaming content, and eCommerce recommendations), and Intelligent Networks / Telecom Services, to name a few.

- AI adoption is no longer restricted to financial enterprises or large technology implementations or organizations. AI adoption in increasingly becoming democratized with personnel from non-technological backgrounds adopting AI processes in their functional roles.

- Machine Learning and AI technologies are central to the functioning of Smartphones, Smart TVs, Household Appliances, and Automobiles.

As revealed in the AI and Analytics start-up investment study for 2020 – 2021, the Data Science space in India, specifically the AI function, is evolving into an innovative enterprise segment. MNC Technology, Domestic, Advanced Engineering, Healthcare, and Semiconductor firms, to name a few, are now developing advanced Artificial Intelligence capabilities in India and providing top-notch AI services to firms across various industries and geographies – they are being rewarded with substantial investments by foreign and domestic funds.

Key Highlights

- The Indian Artificial Intelligence market is valued at $7.8 Bn as of July – August 2021. This represents a 22% increase in size of market over 2020.

- After the adoption of AI services in 2020 to ensure contactless payments and virtual banking services, the BFSI sector’s contribution to the AI industry has remained more or less constant.

- The market size covers revenues from all AI operations originating from India regardless of stakeholder or client type, type of firm providing AI services, and geography of client.

- The AI market share and size in relation to the Types of Companies is the highest across the broad MNC IT / Technology / Electronic category, which includes High-end Software and Hardware technology, IT Services, Semi-conductor, and Electronics firms. The combined market share is 32%, down from a market size of 36.2% in 2020.

- The market size by Industries or Sectors is the highest across the IT Services sector, followed by the Technology sector (including Software and Hardware firms), with a market share of 35% and 23.3% respectively.

- Apart from the IT and Technology sectors, the BFSI sector has a market share of AI services at 9.6%.

- There are close to 109000 Artificial Intelligence personnel working in India across enterprises and sectors – this represents a 20% jump in personnel from last year (91000 Artificial Intelligence personnel) – the median salary of the AI personnel is INR 14.3 Lakhs.

- The highest median salaries are drawn by AI professionals in Mumbai, at INR 17.3 Lakhs.

- Close to 14500 open positions related to AI are currently available to be filled in India, as of July – August 2021. Bengaluru, just as it does for other Data Science and IT services roles, tops the location for the highest proportion of open jobs.

- The 2nd wave of the devastating pandemic has affected the AI sector overall – while contactless services are driving the need for AI services in sectors such as eCommerce and Healthcare, the effect of the pandemic continues to pull down the AI services in the Travel & Hospitality.

Section 2: Artificial Intelligence Market Size by Company Type

The Artificial Intelligence market size in India covers the companies providing Artificial Intelligence services from the India geography, regardless of the geographical market and type of industry the services are provided to. The Artificial Intelligence market in India is valued at $7.8 Bn.

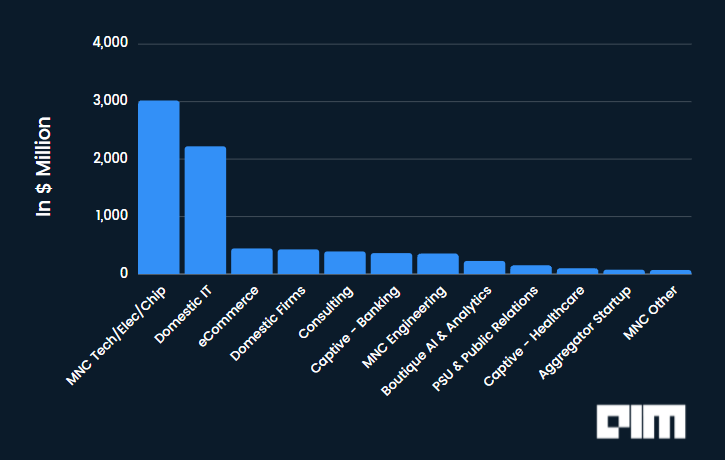

MNC IT | Technology | Semi-conductor | Electronics

In terms of Company Type, the broad-based MNC IT, Technology, and Electronics category has the highest share of the AI market at 38.8% in percentage share and $3012.4 Mn in terms of Market Value. The large share of this category is obvious given the size and scale of the IT and Technology firms that fall under this category, all of which have significant AI operations in India. Accenture, as it had last year, has the largest AI operations base in India across the broad MNC IT and Tech category.

The enterprises that fall under this category include:

- MNC IT Services firms, such as Accenture, IBM, and Capgemini, among others, which provide AI services, as part of the larger Digital and Data Science service offerings, to their international and domestic clients.

- Software Technology firms, such as Microsoft, Google, SAP, Oracle and AWS, among others – Microsoft as it had last year, has the largest AI operations in India across this sub-category.

- MNC Hardware Technology, Networking Equipment, and MNC Telecom firms, including Dell, Cisco, Juniper, Nokia, Verizon, and AT&T, among others.

- Electronics and High-end Semi-conductor firms, such as Samsung, Intel, Nvidia, Qualcomm, and AMD among others, which develop AI technologies for Smart Phones, Processing Units, Chips, Memory Devices, Servers, Data Centres, and other sensor-driven technologies.

Section 3: Artificial Intelligence Market Size by Sector/Industry

Analytics India Magazine has analysed the AI market for 2021 by sector or industry.

The sector-wise distribution of AI services covers:

- Firms that provide services within a sector or industry and utilize AI to deliver those services – such as Amazon within eCommerce and JP Morgan within BFSI.

- Firms within another segment, such as Boutique AI and Analytics, but provide exclusive services to a particular function within an industry – such as Mad Street Den providing Computer Vision and Artificial Intelligence services to the Retail sector or Spyne providing services to the broadbased Digital and Media industry.

Section 4: Boutique Artificial Intelligence Firms Market Break-up

The Boutique Start-up company type/category has a combined market value of $555 Mn, a very large jump from last year when the contribution of this combined segment was about $215 Mn. Most of the jump is attributed to generic Analytics and Data Science firms and specialised AI firms.

AIMResearch has segmented this market on the basis of the Data Science services these firms offer:

- Analytics Products & Services

- Artificial Intelligence / Computer Vision

- Robotics

- IoT / Logistics AI

- Natural Language Processing

The contribution of the Start-up covers:

- Market Value (in $ Mn) across Start-up categories

- Market Share across Start-up Categories

Start-up Market Break-up

The Analytics Products and Services firms have the largest market contribution at $356.1 Mn, at a share of 64.1% across the Domestic Boutique Start-up space. These firms include firms that provide end-to-end analytics services, including AI-as-a-Service – and the development of exclusive AI technologies and platforms.

The specialised Artificial Intelligence firms have a combined market value for AI services at $169.6 Mn (up from $55.4 Mn) and a share of 30% (up from 25% last year) within the Boutique start-up space – this jump in share highlights the revenues generated by such firms especially in the growing Cloud AI and AI-as-a-Service segment.

The contribution of the next segments of start-ups is significantly lower – as it was last year – the Robotics firms have a market contribution of $15.7 Mn (up from $6.0 Mn last year) at a 2.8% share (2.8% last year). These are followed by IoT / Logistics start-up firms that have a market contribution of $ 9.0 Mn (up from $4.8 Mn) and a share of 1.6% (down from 2.3%) and the Natural Language Processing firms that have a market contribution of $4.9 Mn ($3.2 Mn) and a share of 0.9% (down from 1.5%) within the Boutique Start-up space.

Section 5: Salaries of Artificial Intelligence Personnel

AIMResearch has researched the salaries drawn by AI personnel and has provided the findings on the basis of

- Salary-wise distribution of personnel

- City-wise Median Salary Levels

The median salary of Artificial Intelligence professionals is INR 14.3 Lakhs (marginally down from 14.7 Lakhs in 2020).

The median salary is lower than last year as there is a smaller representation of professionals in the higher salary brackets. This is because of greater hiring across the entry-level and lower experienced level professionals in the last year.

Personnel Distribution by Salary

The largest proportion of personnel is in the 3-6 Lakhs salary level at 23.5%. This is followed by the 6-10 Lakhs level that has 17.5% of the professionals. The mid-senior salary category of 15-25 Lakhs has a proportion of salaries at 15.6%. This illuminates the scale of development of the AI domain in India, as the proportion of people across this level is greater than the salaries of the middle category of 10-15 Lakhs, which is at 13.7%.

This is followed by the entry-level 0-3 Lakhs category that has a proportion of 14.5% of the AI professionals drawing salaries within this bracket.

The senior-level salary bracket of 25-50 Lakhs has a proportion of personnel at 11.6%. Finally, the leadership brackets with salaries greater than 50 Lakhs have a combined proportion of 3.6% (against 4.5% last year) of the personnel, with a break-up of 2.3% in the 50-75 Lakhs bracket, 0.9% in 75-100 Lakhs bracket, and 0.4% in the 1 Crore + bracket.

Almost 31% of the personnel across the AI domain have a salary greater than 15 Lakhs. This exemplifies the maturing nature and the demand for experienced and qualified personnel across the AI domain.

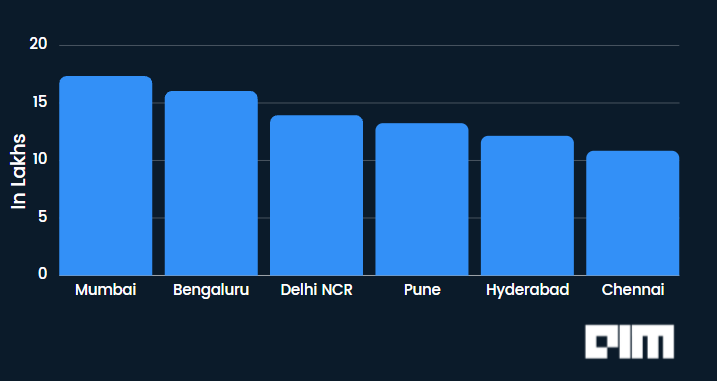

Median Salary By City

The City-wise Median salary levels reveal that Mumbai has the highest median salary for AI professionals at INR 17.3 Lakhs (up from INR 16.7 Lakhs).

Mumbai is followed by Bengaluru and Delhi (NCR), which have closely similar salaries of INR 16 Lakhs (up from INR 15 Lakhs) and INR 13.9 Lakhs (down from 14.9 Lakhs), respectively. This is followed by Pune and Hyderabad at salaries of INR 13.2 Lakhs (up from 12.3 Lakhs) and 12.6 (up from 11.6 Lakhs), respectively. Chennai completes the list of large cities, with a median salary of INR 10.8 (down from 11 Lakhs).

The higher median salary of Mumbai is due to the concentration of many International and Domestic banks, financial institutions, and mutual funds across Mumbai. Moreover, many Domestic firms have their headquarters, which include the Data Science functions, based out of Mumbai. The relatively higher median salary of Data Scientists across Investment Banks automatically drives up the median salary of the city.

Moreover, the relatively higher cost of living in Mumbai results in a proportionately higher disbursal of salaries for professionals working in the city.

Section 6: Experience-wise Classification of Artificial Intelligence Personnel

AIMResearch has researched the experience levels of Artificial Intelligence personnel and has provided the findings on the basis of:

- Experience-wise distribution of personnel

- City-wise Median Experience Levels

The median experience level of Artificial Intelligence professionals is 7.9 years as against 7.1 years last year.

The higher median experience over the previous year median level highlights the maturing nature of the AI domain in India (as was the case last year).

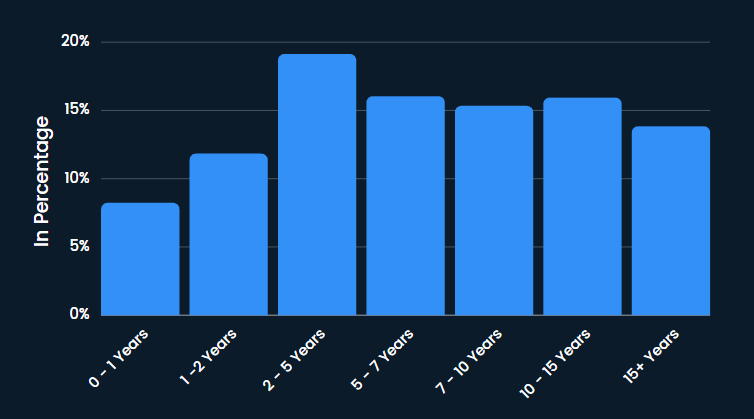

Personnel Distribution By Experience

The experience-wise distribution plot reveals a flatter distribution than usual – the highest distribution of personnel is in the mid-junior experience level of 2-5 years, as was the case last year with a proportion of 19.1% (down from 28.6%). The distribution of personnel is the 2nd highest in the experience level of 5-7 years at 16% v/s 13.7% last year; in the mid-senior level of 7-10 years at 15.3% v/s 11.9% last year, and the leadership level (15+ years) at 13.8 (up from 11.4%). The lowest concentration of professionals is across the entry, 0-1 years, and junior level, 1-2 years, of experience at 8.2% (up from 8.8%) and 11.8% (up from 11.2%) respectively.

The combined distribution across mid-senior, senior, and leadership levels of experience is (greater than seven years) – 45% as against 37.7% last year. This concentration of professionals across the senior experience level highlights the strengthening state of the AI function in India – programme managers and leaders of many years of experience are leading cross-geography teams of AI professionals. The Indian AI market is driving key Research & Development initiatives of AI platforms and technologies across several sectors and enterprises.

Median Experience By City

The city-wise median experience level reveals that Mumbai has the highest median experience level at 8.8 years (as against eight years last year when it was the highest median experience level last year). This is consistent with the type of roles and companies in Mumbai. Most of the Investment banks, domestic financial institutions, and international banks have their Analytics and AI operations based out of Mumbai – most of the domestic firms, headquartered in Mumbai, have their AI operations also based out of the city – including Reliance, Godrej, Aditya Birla, among others – this drives the median experience level of the city to the highest level.

Bengaluru is in 2nd position with a median experience level of 7.8 years (as against 7.1 years last year). Bengaluru is the hub of data science and AI R&D, having the highest concentration of data science professionals across the country – covering Technology, Software, Engineering, and Semiconductor firms. Moreover, the city is the hub of start-ups not just in data science but also other technology functions – the start-ups typically have a relatively lower median experience level.

Delhi (NCR) is in the 3rd position, down from the 2nd position last year – with a median experience of 7.7 years (as against 7.4 years).

The median experience of Chennai is also 7.6 years (as against 7.1 years) – many Technology firms and Semiconductor firms have set up AI R&D centres in Chennai and have hired experienced professionals to lead and manage these centres.

Chennai is followed by Pune, with a median experience level of 7.5 years (against 6.8 years).

Pune is followed by the cities of Hyderabad and Kolkata that have median experience levels of professionals at 7.1 years (against 6.5 years) and 7.0 years (against 6.4 years), respectively.

Section 7: Artificial Intelligence Jobs

AIMResearch has researched the open jobs across the Artificial Intelligence segment and has provided the findings on the basis of the following:

- Salary-wise Distribution of Open Jobs

- Experience-wise Distribution of Open Jobs

- City-wise Distribution of Open Jobs

Jobs Distribution By Salary

The salary-wise distribution of open jobs reveals that the 6-10 Lakhs salary bracket, offered for jobs, has the maximum proportion of open jobs at 26.2% (v/s 27.9% last year). This is followed by the salary level of 10-15 Lakhs offered for jobs at 24.6% (v/s 21.2% last year). This salary bracket is followed by the mid-senior salary level at 20.7% (v/s 17.2% last year); mid-junior salary – 3-6 Lakhs at 16% (v/s 20.6% last year).

The salary-wise distribution of open jobs reveals a flatter curve distribution as compared to last year. Moreover, the second-highest and third-highest distribution of jobs in the 10-15 and 15-25 Lakhs categories reveals the developed nature of job openings or the roles advertised by companies.

Jobs Distribution By Experience

The experience-wise distribution of open jobs reveals that the greatest proportion of jobs has been advertised for the experience level of 5 to 7 years at 21.2% (v/s 21% last year). This is followed by the proportion of the mid-senior level of jobs for the experience level of 7-10 years at 20.8% (v/s 21.8% last year). This is followed by the mid-junior level at 18.7% (v/s 22.3% last year). The higher level of experience of jobs for 10–15 years has a significant proportion of 14.7% (v/s 16.2% last year).

The entry experience levels of 0-1 years and 1-2 years have a distribution of 7.5% (v/s 5.7%) and 9.2% (v/s 7%) respectively. The senior-most experience level has a proportion of 8% (v/s 6.1% last year), underscores a steady move to leadership roles across the AI across companies in India, instead of roles focused on delivery or development. This is accentuated by the combined proportion of jobs at 22.7% for senior and leadership positions greater than ten years.

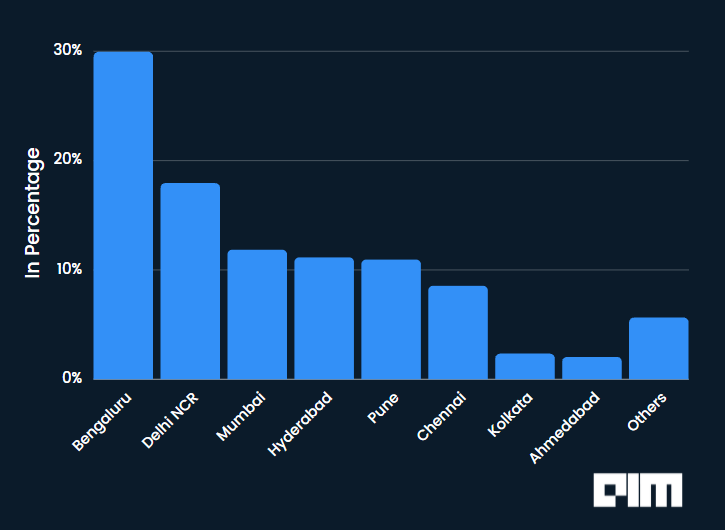

Open Jobs Advertised By City

The city-wise distribution of open jobs indicates Bengaluru has the highest proportion at 29.9% (against 28.6% last year). IT firms, Technology firms, and Start-ups firms, to name a few, all have extensive operations across Bengaluru, and hence the city has the highest proportion of advertised jobs.

Similarly, Delhi (NCR), the hub of ITES firms, has the 2nd highest proportion of open jobs advertised at 17.9% (against 21.9%).

Delhi is followed by the hub of Captive Banking, Domestic BFSI, and Domestic firms of Mumbai, which has a proportion of 11.8% (against 11.5% last year) of the open jobs.

Mumbai is followed by Hyderabad and Pune that have respective proportions of jobs at 11.1% and 10.9%. Chennai has a proportion of open jobs at 8.5%. The cities of Kolkata and Ahmedabad have an open jobs distribution of 2.3% and 2.0%, respectively. Other Tier 2 and Tier 3 cities have a combined proportion of open jobs of 5.6%.

Distribution Of Jobs By Sector

The year-on-year flatter and more equitable distribution of prospective hiring from the mid-junior to the mid-senior experience levels indicate that companies across industries are seeking to develop AI capabilities across numerous levels of expertise. This is indicative of the growth of the AI domain in recent years, covering such capabilities as Recommendation Engines, AI in the Cloud, AI in Digital, Computer Vision, Robotics, and Natural Language Processing.

Moreover, the entry-level open job categories afford opportunities to freshers and junior-level professionals.

In terms of industry, while the highest proportion of AI jobs advertised are in the IT and ITES sector – the overall proportion has drop from 71% last year to 62.9% this year – the jobs advertised across other industries and sectors indicates the opportunity that job seekers have to develop skills in these sectors and apply for suitable opportunities. Moreover, the opportunities across the remaining breadth of sectors covering BFSI, Pharma, eCommerce, and even the Government sector indicates the potential that AI offers in terms of industry-specific jobs across other sectors.

Section 8: Artificial Intelligence Market Forecast

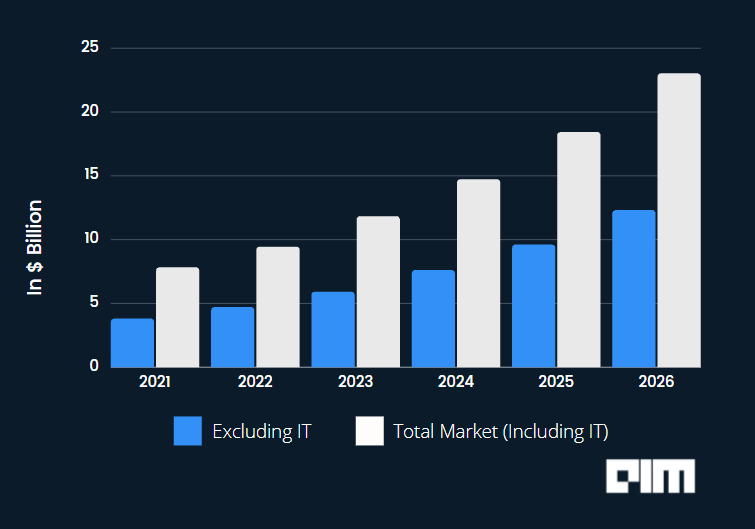

The Artificial Intelligence market is currently valued at $7.8 Bn.

The market has been represented in 2 formats – the first format excludes the contribution of IT services to the AI domain, and the second includes the contribution of IT services to the AI domain.

Hence, the current valuation of the AI market, excluding the contribution of IT services across AI, is $3.8 Bn, and including the contribution of IT services across AI is $7.8 Bn.

This demarcation has been done as the AI industry is maturing at varying rates across industries and segments. Nonetheless, the pace of growth is higher than the growth in 2019-2021. The growth for 2020-2021 was higher than the growth predicted last year – this was despite the recessionary effects caused by the unfortunate pandemic.

The pace of growth is the highest across the IT segments, Boutique AI, and eCommerce firms – while the growth across BFSI will continue to be negligible.

The projections of the market are as follows:

- In 2022, the entire AI market would value at 9.4 Bn. The market excluding IT services will value 4.7 Bn

- From 2022 to 2026, the CAGR for the entire AI market is expected at 27.5%, taking the valuation of the entire AI market to $23 Bn by 2026. Similarly, the market for the AI domain excluding IT services is expected be 22.5% valuing the AI market (excluding IT) in 2025 at $12.3 Bn.

- These growth rates are significantly higher than the growth rates of 9% predicted last year.

Conclusion

The substantial growth in the AI market across various sectors and segments signifies the reliance of broad-based processes and services on Artificial Intelligence.

Domestic firms, Indian start-ups, Retail firms, Financial firms, and even International Technology start-ups across various sectors continue to make significant investments in terms of operations, personnel, and scale, in the Indian AI market.

Additionally, IT services and Boutique AI & Analytics firms are now providing end-to-end AI, Machine Learning, and Automation offerings in India for their clients over the cloud – AI-as-a-Service or AIaaS is fast emerging as the next level of service delivery in AI services. This is evinced by the significant growth in the contribution from these two segments:

- IT services industry or sector has the highest share of the AI market at 51.8%, which is up from 41.4% last year, and $4025.3 Mn – up from $2625 Mn in market value.

- The Boutique Analytics and AI firms saw Revenue contribution jump to $555 Mn, 2.5 times from jump last year in revenues when the revenues of this combined segment were about $215 Mn

The Artificial Intelligence market in India will continue to be the primary growth driver of the Data Science domain and the broader IT industry over the next few years.