For a data analyst, financial analytics is one of the most useful skill sets to inculcate given the rapid growth of roles in this booming sector. A specialisation in this field will be a value-add given the rapid rise of fintech in India’s digital ecosystem.

Financial analytics helps companies uncover deeper insights into the company’s finances and can help in finding pain points and new streams of revenue. Financial Analysts work in investment firms, banks, insurance sector and digital payments companies.

The job role involves modeling and forecasting to make accurate recommendations for investments or mergers. In addition to this, Financial analysts also assess current business practices, monitor investment programmes and interpret data related to investment risks.

Some of the core competencies and skills required for this role include a background in mathematics, economics as well as statistical packages.

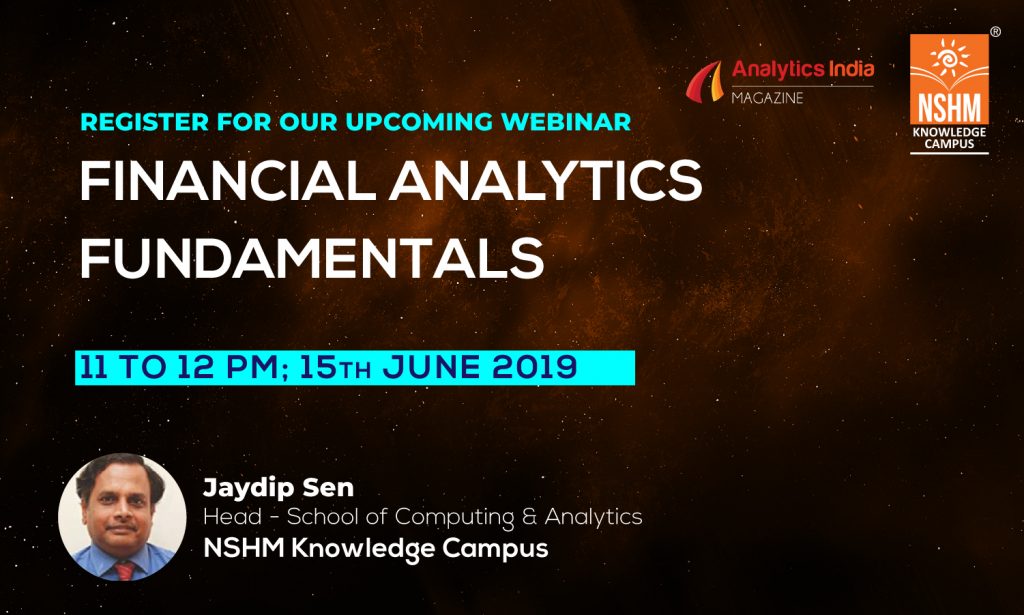

To give you a comprehensive understanding about financial analytics, Analytics India Magazine has partnered with NSHM Knowledge Campus to present a webinar titled Financial Analytics Fundamentals. The webinar will feature an industry leader offering advice and key insights about this buzzing field and how to make a career in it.

Topic: Financial Analytics Fundamentals

Date and Time: 15th June 2019, 11 AM – 12 Noon

Register here

Speaker:

Professor Jaydip Sen.

Head – School of Computing & Analytics; NSHM Knowledge Campus.

Jaydip Sen obtained his Bachelor of Engineering (B.E) in Mechanical Engineering with honors from Jadavpur University, Kolkata, India in 1989, and Master of Technology (M.Tech) in Computer Science with honors from Indian Statistical Institute, Kolkata in 2001.

He has worked in reputed organizations like Oil and Natural Gas Corporation Ltd., India, Oracle India Pvt. Ltd., and Akamai Technology Pvt. Ltd, Tata Consultancy Services Ltd and National Institute of Science and Technology, India and Calcutta Business School, and Praxis Business School.

Register here.

Key Topics To Be Covered:

- The webinar will discuss how financial data is analyzed starting from step 1 – data acquisition, the construction of time series, analysis of the behaviour of the time series data using the decomposition approach.

- It will then present methods of forecasting using various techniques like Holt’s method, Holt-Winters method, Auto Regressive method, Moving Average method and ARIMA (Auto Regressive Integrated Moving Average) method.

- The webinar will also discuss the applicability of various forecasting methods under various situations and for different types of data. Finally, it will also discuss the concept of multivariate financial time series data and illustrate how the concept of Vector AutoRegression (VAR) can be applied in forecasting in multivariate time series data.

Register here.

The session will conclude with a brief discussion and a small illustration of the “Causality Theory” and its application in the analytics of financial data.

The session will take place on 15th June 2019 from 11 AM to 12 noon.

Register here.

Who Should Attend The Webinar (Register here)

The topic is highly relevant in today’s’ era of analytics. BFSI is the domain which is witnessing the highest adoption of analytics, the topic should be of interest to both students aspiring to enter in this field, and also to the professionals working in this field.

Register here.

Moreover, forecasting being a task that even the marketing and sales professionals also have to do regularly, the topic is surely relevant to this set of audience as well. So the target audience should be anybody who is interested in the field of analytics or working in the field of analytics (especially in the field of finance, banking, insurance, marketing, sales and supply chain).

What You Will Learn At The Webinar (Register here.)

- Properties and Characteristics of financial data,

- Financial time series data and its decomposition

- Forecasting using various techniques like Holt’s method, Holt-Winters method, AR method, MA method and ARIMA method

- Concept of multivariate financial time series and forecasting of multivariate data using VAR technique

- Causality Theory and its applications in finance and other fields

- All the concepts will be demonstrated using R software

Register here.