Earlier this year, pure-play data analytics and insights company Course5 Intelligence filed preliminary documents with market regulator SEBI to raise INR 600 crore through an initial public offering (IPO). Last year, data analytics company LatentView Analytics went public, becoming India’s most heavily subscribed IPO ever – subscribed by 326 times.

Meanwhile, AI and data analytics unicorn Fractal Analytics is also eyeing an IPO to fuel its growth as the pandemic boosts demand for its products and services. According to Reckitt Benckiser Group Plc and Wells Fargo & Co, Fractal’s revenue will increase 37 per cent to $160 million in the fiscal year, ending March 2022.

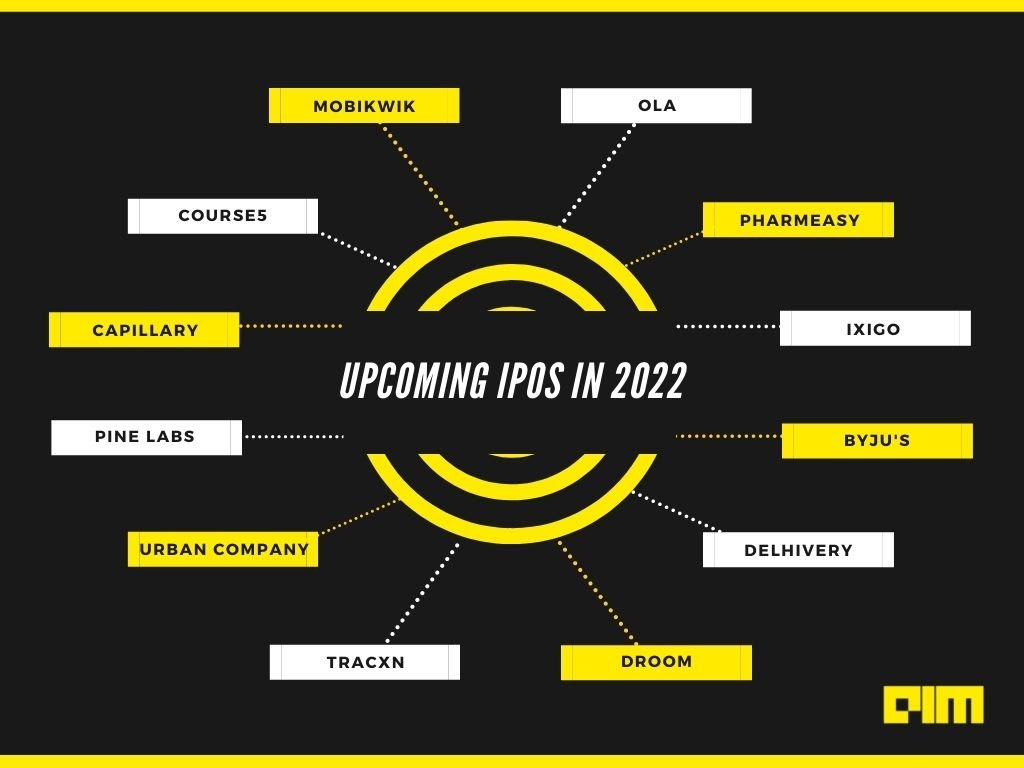

Besides AI and data analytics companies like Fractal Analytics, LatentView Analytics and Course5, other tech-enabled startups foraying the IPO route in 2022 include Capillary Technologies, Tracxn, Delhivery, Droom, Pharmeasy, Urban Company, Pine Labs and others.

Globally, many data analytics and AI companies went public last year. Research shows close to 1000 companies going public, raising $315 billion as of late December – and smashing the previous record of less than $200 billion. Some notable names that went public include Roblox Corp, Coinbase Global, Rivian Automotive, Robinhood Markets, Babylon, UiPath, Darktrace, SentinelOne, etc. Discord, Databricks, Reddit, and others are expected to go public in the coming months.

Last year, the Chinese AI startup SenseTime went public despite being blacklisted by the US government. In China, most IPOs have gone through a bumpy ride due to the concerns around data security and data compliance, alongside the US-China tussle, making investors think twice about betting on tech.

Ever-evolving AI & data analytics space

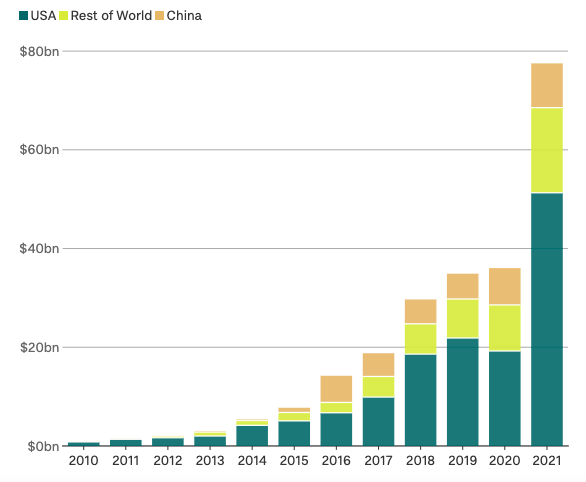

With businesses accelerating digital transformation amid the pandemic, data analytics and AI companies are attracting huge investments from entrepreneurs, venture capitalists, private equity firms, HNIs and angel investors. Global AI Index by Tortoise Intelligence revealed that the total AI investment surged to a record high of $77.5 billion last year, up from $36 billion in 2020.

Michael Chui, a partner at the McKinsey Global Institute, said that the urgent need for digital collaborative and remote working tools amid the pandemic forced business leaders to understand the importance of digitisation. This has been the reason why investment in AI is growing at an exponential rate.

KPMG’s survey stated that the pace of AI adoption is moving too fast, and business leaders are confident AI can help solve some of today’s toughest challenges.

A study by PwC finds 52 per cent of companies accelerated their AI adoption plans due to the Covid-19 crisis. A McKinsey study also showed that 67 per cent of companies that pivoted to digital in the wake of the pandemic had the edge over their competitors. According to Statista, the global spending on digital transformation is expected to touch $1.8 trillion by 2022 and $2.8 trillion in the next three years.

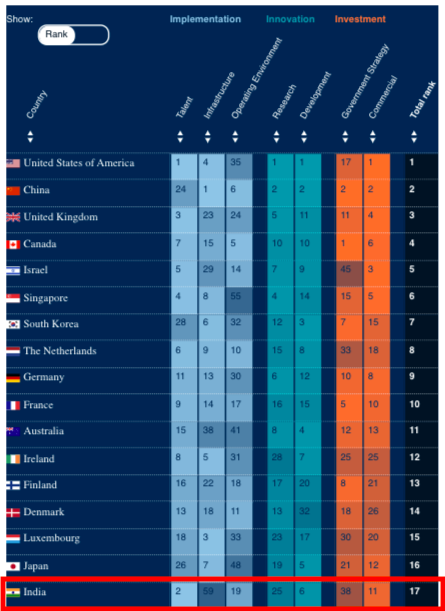

When it comes to investments in AI, India still lags behind other developed countries, ranking at the 17th position. Currently, the USA, China and UK are on top of the leaderboard, as per Tortoise Intelligence.

Investment in AI startups

Recently, California and Bengaluru-based Pixis raised $100 million in Series C funding from SoftBank, alongside General Atlantic and other existing investors. Last year, Sigma Computing raised $300 million in funding led by D1 Capital Partners and hedge fund XN, alongside existing investors like Altimeter Capital, Sutter Hill Ventures, and Snowflake Ventures.

This week, London-based InstaDeep, an AI-decision making tools company, raised $100 million in series B led by Alpha Intelligence Capital, along with CDIB. Last year, San-Francisco-based cloud data platform DataBricks received a $1.6 billion investment in series H led by Counterpoint Global (Morgan Stanley).

AI companies in China also witnessed an increase in funding, where it pulled about $9 billion so far in 2021, up by 20 per cent in 2020. Recently, Chinese tech giant Baidu and auto manufacturer Geely invested nearly $400 million into autonomous electric vehicle startup Jidu in a Series A round. The recent funding comes in little less than a year after the company was launched in March 2021, with $300 million in initial funding from undisclosed investors.

Last year, autonomous flying vehicles startup HT Aero raised over $500 million in series A round, led by IDG Capital, 5Y Capital and XPeng Inc. alongside other investors, including Sequoia China, GGV Capital, GL Ventures, Eastern Bell Capital, and Yunfeng Capital. This is considered to be one of the biggest funding rounds in China.

IPOs galore

As investments in the AI and data analytics space continue to grow exponentially, more and more AI and data analytics startups will eventually look at IPO as an exit strategy for private investors. That is because such sales often result in huge profits, with returns many times bigger than the initial investment.

Many AI and data analytics companies are also looking at IPO to raise capital for research and development, geographical expansion, and acquiring talent.

Data analytics and AI offers a huge potential for startups to explore – not just in fueling the digital transformation but also in developing niche tools and products that help scale the AI and data analytics space to the next level. It also becomes important for companies to maintain growth to reach profitability and scalability. Many industry experts believe that this is just the beginning, and the AI and analytics space is ripe for disruption as we can expect more IPOs and funding in the coming times.