Investors pumped in $213 million across over 20 deals in Indian startups in 2016. Though the investment appears to dwarf the total investments in all startups in India, analytics still forms a significant rising technological domain which is eminent from the big PE names below.

Read Top 10 Investors in Indian Analytics firms – 2015

1. Khazanah Nasional Berhad

Investment: Fractal Analytics

Khazanah Nasional Berhad is the sovereign wealth fund of the Government of Malaysia.

Khazanah Nasional Berhad is the sovereign wealth fund of the Government of Malaysia.

Khazanah holds and manages selected commercial assets of the Government and undertakes strategic investments on behalf of the nation. It is involved in sectors such as power, telecommunications, finance, healthcare, aviation, infrastructure, leisure and tourism, and property, amongst others. The fund is a member of the International Forum of Sovereign Wealth Funds,[1] which maintains and promotes the Santiago Principles on best practices in managing sovereign wealth funds.

Its portfolio includes Axiata, CIMB, Tenaga Nasional, IHH Healthcare, UEM Group, Telekom Malaysia, Malaysia Airlines, and Malaysia Airports.

2. Lightspeed Venture Partners

Investment: Qubole & Innovacer

Lightspeed Venture Partners is a venture capital firm focusing on early and expansion stage investments in the consumer, enterprise technology and cleantech markets.

Lightspeed Venture Partners is a venture capital firm focusing on early and expansion stage investments in the consumer, enterprise technology and cleantech markets.

Lightspeed Venture Partners has backed more than 200 companies, including Brocade (BRCD), DoubleClick (acquired by Google after going public), Nicira (acquired by VMware), Playdom (acquired, DIS), Pliant Technology (acquired, SanDisk), XtremeIO (acquired, EMC), Blue Nile (NILE), Fusion-io (FIO), Phone.com (OPWV), Informatica (INFA), and Solazyme (SZYM). The fund has 24 early stage enterprise investments that have gone public, the most of any fund in the world.

3. Access Asset Managers

Investment: Beroe

Access Asset Managers is a fund manager set up to focus on Private Equity Investments in the Indian SME sector. The Manager is in the process of launching Access India Fund – I invest in high growth small and mid-cap companies in India

The two principals of the Investment Team, Nilesh Mehta and Sangeeta Modi are seasoned investment professionals. They have collectively over forty five years of investment experience in Indian debt and equity of which twenty years are in the private equity industry.

Access believes that the best results can be achieved when the fund manager can partner with the management of the investee company to assist in growth. Typically Access attempts to provide guidance on both operational and strategic issues.

To this extent, Access’ management team also includes prominent entrepreneurs with real and relevant experience of managing businesses in addition to the Investment Team.

4. Edelweiss Private Equity

Investment: Bridgei2i

Edelweiss Private Equity (PE) is the venture capital and private equity arm of Mumbai-based financial services firm Edelweiss Financial Services Ltd. It is focused on future demand areas including wearable technologies, internet of things, data analytics, fintech, health and hygiene. The fund was set up in May 2015.

5. Charles River Ventures

Investment: Qubole

CRV (a.k.a. Charles River Ventures) is a venture capital firm focused on early-stage investments in technology and new media companies. The firm, which is based in Cambridge, Massachusetts and Menlo Park, California, was founded in 1970 to commercialise research that came out of MIT. (Its name comes from the Charles River that divides Boston and Cambridge)

CRV (a.k.a. Charles River Ventures) is a venture capital firm focused on early-stage investments in technology and new media companies. The firm, which is based in Cambridge, Massachusetts and Menlo Park, California, was founded in 1970 to commercialise research that came out of MIT. (Its name comes from the Charles River that divides Boston and Cambridge)

The firm has raised over $2.1 billion since inception across 16 funds. Upon closing of the 16th fund, the firm rebranded to CRV. Prior to that, the firm’s most recent fund, CRV XV, closed in February 2012 with $375 million of investor commitments. CRV’s 14th fund raised $320 million of commitments.

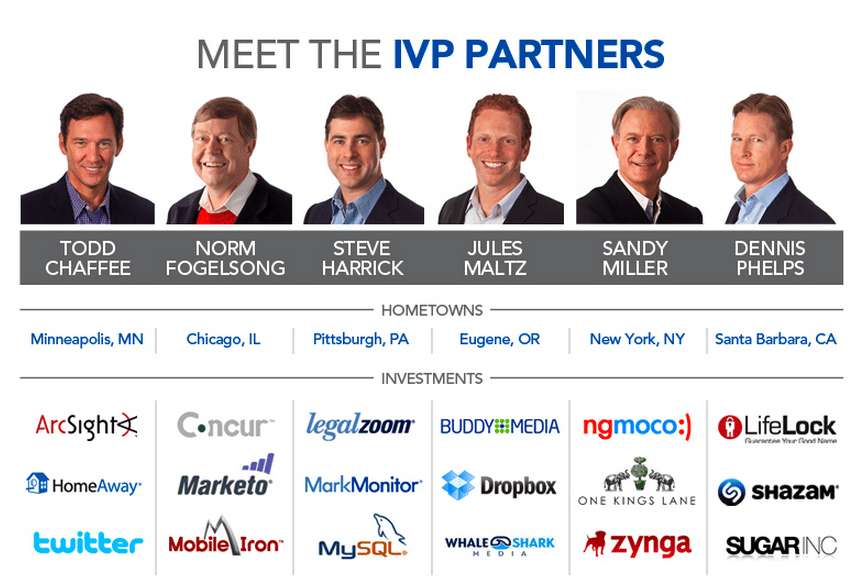

6. Institutional Venture Partners

Investment: Qubole

Institutional Venture Partners (IVP) is a US-based private equity investment firm focusing on later-stage venture capital and growth equity investments. IVP is one of the oldest venture capital firms on Sand Hill Road founded in 1980.

Institutional Venture Partners (IVP) is a US-based private equity investment firm focusing on later-stage venture capital and growth equity investments. IVP is one of the oldest venture capital firms on Sand Hill Road founded in 1980.

7. Norwest Venture Partners

Investment: Qubole

Norwest Venture Partners (Norwest) is a venture and growth equity investment firm with approximately $6B in capital under management.

Norwest Venture Partners (Norwest) is a venture and growth equity investment firm with approximately $6B in capital under management.

The firm targets early- to late-stage venture and growth equity investments across several sectors, including cloud computing and information technology, Internet and consumer, software as a service, business and financial services, and healthcare.

8. Pravega Ventures

Investment: Innovacer

Pravega Ventures, founded in 2016, is an early stage Venture Capital fund focused on providing seed and pre-Series A funding to companies.

9. WestBridge Capital

Investment: Innovacer

WestBridge Capital is a highly experienced investment firm, managing over $2 billion of capital, which focuses on investments in India. WestBridge seeks to partner with some of India’s most promising mid-sized companies run by outstanding entrepreneurs and management teams for the long-term, whether they are public or private. A typical investment ranges from $10 million to $80 million, often resulting in a substantial minority equity ownership, second only to the founder in many cases.

WestBridge Capital is a highly experienced investment firm, managing over $2 billion of capital, which focuses on investments in India. WestBridge seeks to partner with some of India’s most promising mid-sized companies run by outstanding entrepreneurs and management teams for the long-term, whether they are public or private. A typical investment ranges from $10 million to $80 million, often resulting in a substantial minority equity ownership, second only to the founder in many cases.

WestBridge was co-founded by KP Balaraj, Sumir Chadha, SK Jain and Sandeep Singhal. The same team of four also co-founded Sequoia Capital, India. In the last fifteen years, the team has led investments in over 80 companies and oversaw a total investment of over $1.6 billion. The six funds that invested on the advice of the team, have raised over $3.2 billion in capital. The team is one of the most recognized in the industry, and has a combined 50+ years of experience in investing in Indian companies.

10. Sequoia India

Investment: Vymo

Sequoia Capital is an American venture capital firm. The firm is located in Menlo Park, California and mainly focuses on the technology industry. It has backed companies that now control $1.4 trillion of the combined stock market value. Sequoia manages multiple investment funds including funds specific to India, Israel, and China.

Sequoia Capital is an American venture capital firm. The firm is located in Menlo Park, California and mainly focuses on the technology industry. It has backed companies that now control $1.4 trillion of the combined stock market value. Sequoia manages multiple investment funds including funds specific to India, Israel, and China.