|

Listen to this story

|

Infosys released its first quarterly result for FY23, recording a 5.5 per cent sequential growth and 21.4 per cent YoY growth in constant currency. The company saw double digits across all business segments in constant currency terms, with several growing at 25 per cent or higher. The digital business accounted for 67 per cent of overall revenues, growing at 37.5 per cent in constant currency.

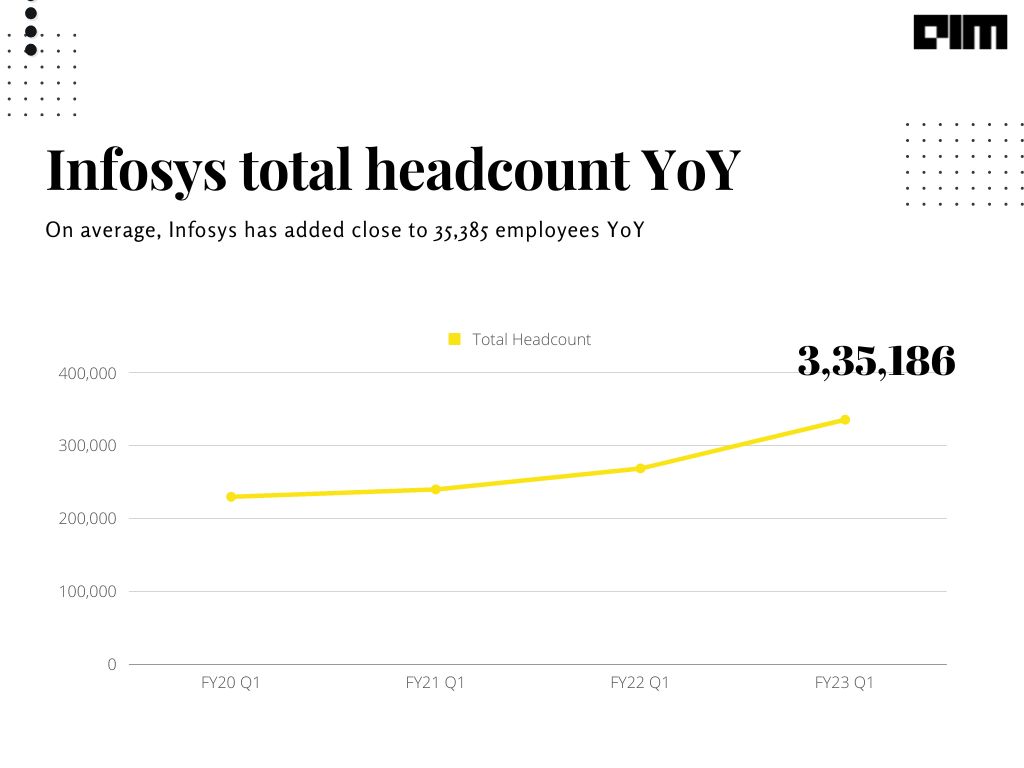

On the people front, Infosys’ net hiring was strong at 21,171 employees. The operating margin for the quarter was 20.1 per cent, with free cash flow conversion at 95.2 per cent of net profit. The current total headcount is 3,35,186. Infosys said that the pressure addition was particularly strong, decreasing utilisation to 84.7 per cent.

Geography-wise, the US grew at 18.4 per cent, and Europe grew at 33.2 per cent. “This indicates a healthy demand environment that reflects how our industry-leading digital capabilities are relevant for our clients,” said Infosys chief Salil Parekh.

He said the company would continue to gain market share and see a significant pipeline driven by its Cobalt cloud capabilities and differentiated digital value proposition. “Overall, the pipeline remained strong. However, we do see pockets of weakness in the area of mortgages in financial services,” said Parekh.

Further, he said that they are keeping a close watch on the evolving macro environment in terms of the changes to the pipeline. He also said that they are focusing on the growth areas in digital and cloud, alongside cost areas through automation and AI. “Our operating margin grew at 20,” said Parekh.

Here’s a list of the key deals made by Infosys this quarter:

- Infosys is implementing a flexible and scalable solution like SAP S/4HANA Public Cloud to help US-based accounting, tax, and business advisory firm EisnerAmper.

- Infosys and Rolls-Royce extended their strategic collaboration by launching a joint ‘Aerospace Engineering and Digital Innovation Centre’ in Bengaluru, India.

- Infosys launched the Infosys Cobalt Financial Services Cloud, an industry cloud platform for enterprises across the financial services industry to accelerate business value in the cloud.

- Backcountry has selected Google Cloud and Infosys to help them deliver seamless and secure digital experiences for outdoor enthusiasts.

- Infosys partnered with TK Elevator to revamp their digital workplace management, network security, and IT infrastructure, powered by Infosys Cobalt.

“There are examples across the spectrum in different sectors driving Infosys Cobalt into the market,” said Parekh. He said that the strong growth that they have seen in the quarter lays a robust foundation for the year ahead, where growth continues to remain broad-based across the segments, service lines, and geographies.

Fresh deals

Infosys has signed 19 deals this quarter with a large TCV (total contract value) of $1.69 billion. “This consists of 50 per cent net new work,” shares Parekh. He said that their on-site mix was at 24.3 per cent. Plus, their utilisation was at healthy levels of 84.7 per cent, as they continue to build capacity for the future.

The 19 deals include five in retail and CPG, four in hitech, three in financial services and energy utility resources and services, and two in manufacturing and communications verticals. “While the order pipeline remains strong across regions, we are seeing some slowness in the mortgage industry and lending business due to increased interest rates,” said Nilanjan Roy, chief financial officer at Infosys.

Infosys saw an increase in clients this quarter compared to the previous year. As per the fiscal report, the number of $50 million clients increased by 10 to 69, the number of $100 million clients increased by four to 38, and the number of $200 million clients grew by six in the last year.

While the deal pipeline is getting bigger for Infosys, is there a correlation between its decision-making getting slower? — asked Sudheer Guntupalli, an analyst at Kotak Mahindra Asset Management, at the earnings call.

Parekh said that the company sees an appetite, and they go by different industries for digital transformation programmes for large cloud programmes, which starts to relate to cost and efficiency. “That is what is the pipeline,” explained Parekh. He said that it is not a timeline function causing an increase.

“It is where we see transactions with more and more client discussions. So we will see how that evolves, but that is our outlook today,” said Parekh.

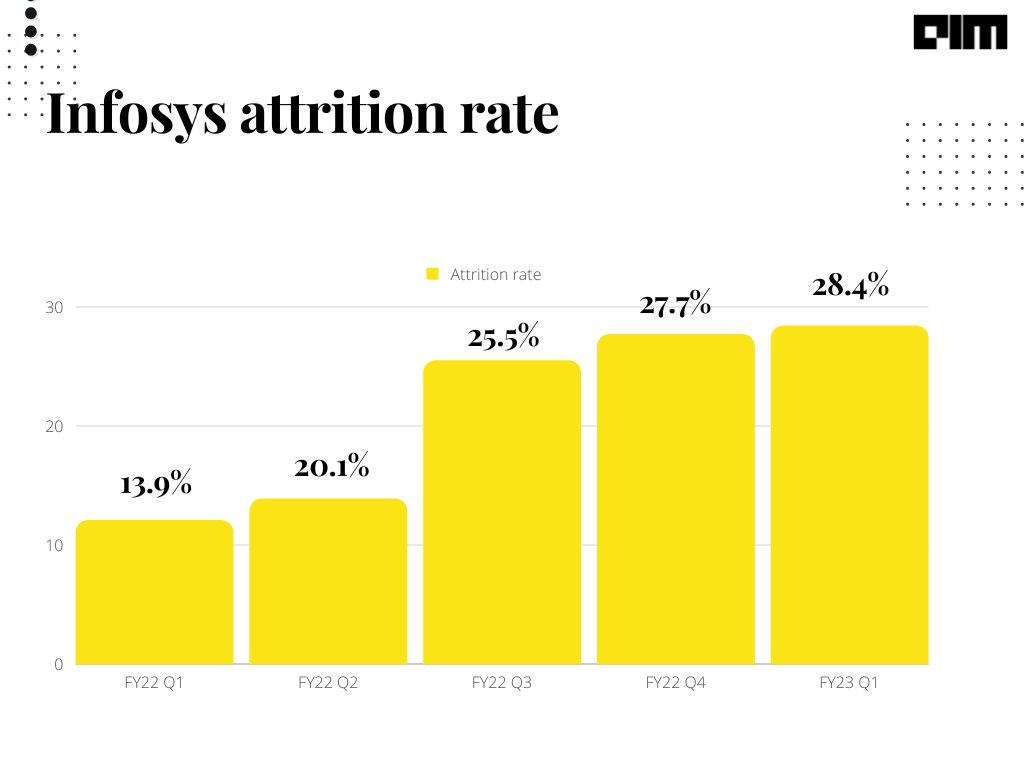

Rise in attrition

Infosys attrition stood at 28.4 per cent this quarter, compared to the previous quarter – i.e. 27.7 per cent, and a year ago, it was around 13.9 per cent. “We’ll be seeing an uptick with the seasonality,” said Nilanjan Roy, chief financial officer at Infosys.

Further, he said they are fueling the strong growth momentum with strategic investments in talent through hiring and compensation revisions. “While this will impact margins in the immediate term, it is expected to reduce attrition levels and position us well for future growth,” he added. In addition, he said they would continue to optimise various cost levers to drive efficiency in operations.

Infosys has been handing out salary hikes to its employees in the past few months to arrest attrition. The company said that the salary increase this year has been higher than historical levels due to the supply tightness and high-prevailing inflation, where the increase varies based on job levels and performance of employees, with top performers getting double-digit hikes, effective from July 1.

Strategic acquisitions

Earlier this month, Infosys acquired BASE life sciences, a Denmark-based technology and consulting firm in the life science industry. This expands Infosys’ domain expertise in medical, clinical, digital marketing, and regulatory areas.

With this, Infosys looks at capturing the European and Scandinavian market, where clients are using the capabilities of BASE as a starting point, which later leads to large technology and digital transformations.

“That helps us overall in terms of scaling up that segment,” avered Parekh. He said that they feel those segments are strong for the future, and want to enhance that with their deep existing capabilities.

A strong quarter

Infosys said with strong growth in Q1 and a current outlook on demand, opportunity, and pipeline, they have increased their revenue growth guidance – from 13-15 per cent to 14-16 per cent for the entire year, with EBITDA margin guidance at 21-23 per cent.

Infosys’ balance sheet continues to be strong and debt-free. The consolidated cash and investments were $4.4 billion at the end of the quarter after returning more than $850 million to the shareholders through dividends, leading to an increase in RoE to 31 per cent. The free cash flow was $656 million, a conversion of 95 per cent of net profit. For this quarter, the yield on the cash balance remains stable at 5.3 per cent.