|

Listen to this story

|

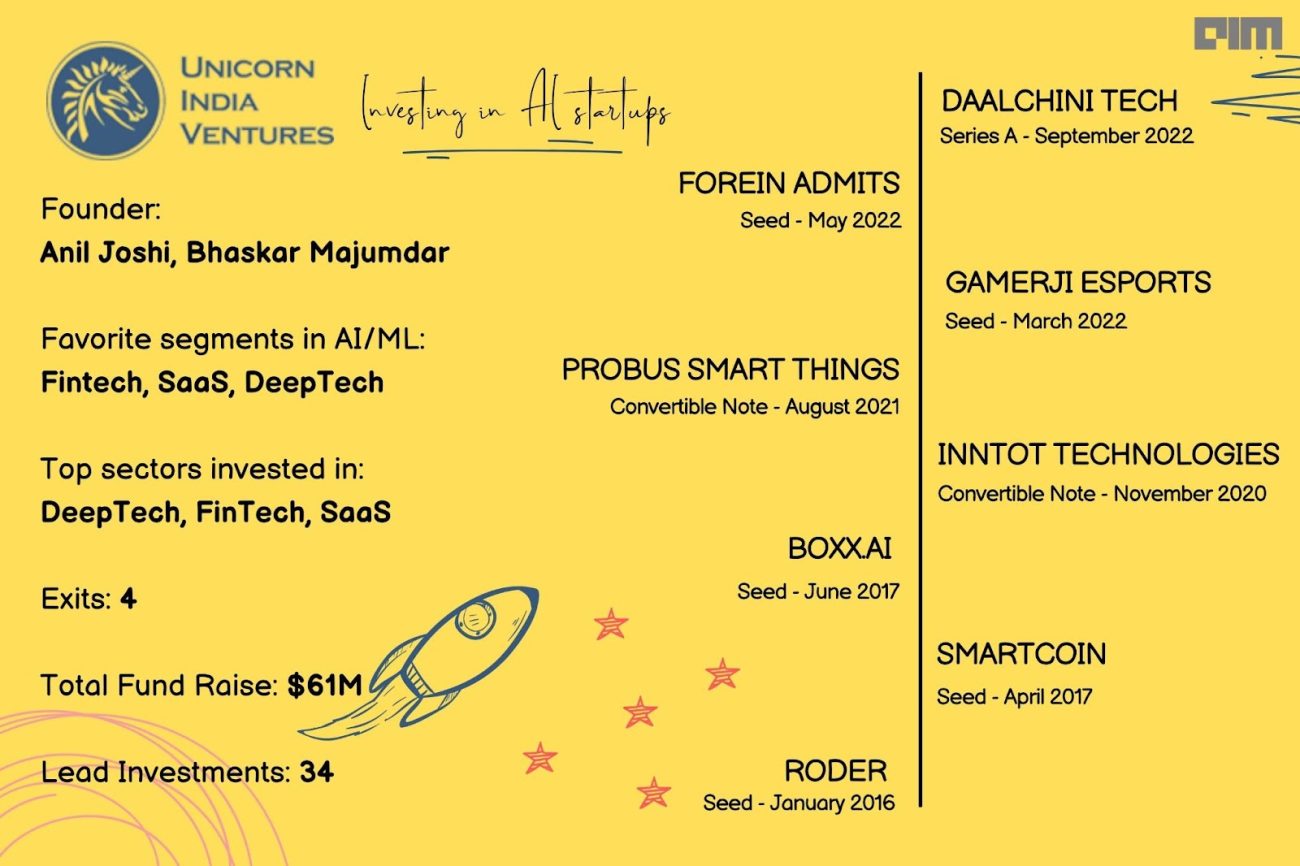

In 2015, Anil Joshi and Bhaskar Majumdar founded Unicorn India Ventures to invest in technology-focused Indian startups. Since then, the Mumbai-based firm has invested in 45 startups with 34 lead investments with a substantial chunk of investments in sectors like fintech, SaaS, Consumer & Internet, Healthcare, Hardware, and Deeptech.

Talking to Analytics India Magazine, Sparsh Kumar, Vice President of the firm, shares insights about the firm’s investment philosophy, metrics before investing in startups, and advice for startups when pitching their ideas.

“We don’t treat AI-startups any differently than others. AI, as we believe it to be, is going to be a core feature of most businesses going forward.”

Anil Joshi, ex-president of Mumbai Angels and Bangalore Angels, is also a committee member of India Venture Capital Associate (IVCA) representing Micro VCs. With an engineering and marketing background, Joshi has expertise in analysing startups on the technology leveraged in their ideas.

Bhaskar Majumdar is a media and technology executive and entrepreneur, besides an early stage investor and advisor, in the UK and India. In the past, he also started two ventures ground up and exited one to a large US Systems Integrator and the other to a large buy-out PE Fund pre-IPO.

Unicorn India Ventures’ first AI-based investment started with SmartCoin in their Seed Round in 2017. Based in Bengaluru, the startup uses AI-based underwriting engine on their mobile-app based lending platform, which combines financial and behavioural insights to assess risk profile of a borrower in real time using machine learning. The company is founded by Rohit Garg, Amit Chandel, Vinay Kumar Singh, and Jayant Upadhyay.

Apart from investing in SmartCoin again in Series A round of funding in 2020, the firm has also invested in boxx.ai, GenRobotic, Inntot Technologies, GamerJi Esports, Probus Smart Things, ForeignAdmits along with Daalchini Technologies—which is their most recent investment that raised $4 million in Series A funding round.

Mentor Capitalist

At Unicorn India Ventures, the team works closely with the entrepreneurs to help them navigate the challenges faced in the journey of building out a successful startup. “Apart from the core investing team, we have a team of domain experts that helps startups in various functional areas of running a startup be it strategy, tech, finances, marketing, public relations,” added Sparsh Kumar.

The firm calls themselves—‘Mentor Capitalist’, as they believe in supporting the companies through thick and thin. “We understand the challenges and the painstaking rigour of building a startup,” said Sparsh Kumar, pointing out that the founders also have entrepreneurial backgrounds. With a large pool of industry experts, the team can validate all aspects of the startups from technology to business models.

The firm deploys multiple ways while exiting a company including secondary buyouts, strategic sales, mergers with larger entities. The firm also plans to implement IPOs as a mainstay exit strategy in the future with their newer funds that will be investing in much later stages, like B–C. Adding to this, Sparsh Kumar said, “Our expectations are that startups use our capital and our assistance to grow, build value and give great exits to us, and by extension to our LPs.”

AI is the internet of this decade

The firm believes that AI is beyond the hype phase when companies could raise money by simply putting a moniker of AI in their pitch decks. Sparsh Kumar said that the majority of the startups continue to claim some AI aspect or angle in their business, rather than pointing out the implementation of AI. “We don’t invest in ‘AI startups’ rather in good businesses that may also use AI to enhance their offerings,” remarked Sparsh Kumar.

“In 2010, VCs wouldn’t have invested in a company just because it used the internet and had a website, as opposed to how it was in the pre 2000s.”

Firstly, when investing in AI startups, the firm focuses on analysing the training data that the startups have. “AI relies on a vast amount of labelled or unlabeled structured data,” added Sparsh Kumar, “there can’t be a good quality AI that can be built without data.”

Secondly, the firm looks at the uniqueness, perishability of data, accessibility, cost, and other factors which can help startups create a defensible moat around their AI-enabled use cases. “If your AI is built on publicly available standardised data sets then that is a point of concern, especially if your entire business revolves around your AI offering being best in class,” said Sparsh Kumar.

Thirdly, largely characterised by the homogeneity, replicability, and quantifiability of the problem that the startup is trying to solve, the firm looks at the applicability of the AI in the use cases. According to the firm’s philosophy, there are many domains where AI is more relevant than others.

“In the short term, AI is getting better and better in the breadth of scope and quality of output and it is becoming an inseparable part of building a new age tech-enabled business,” emphasised Sparsh Kumar. The firm predicts that AI is going to become a part of everyone’s everyday life, the same as how the world cannot imagine their lives without computers, internet, electricity, and automobiles.

How to be a Unicorn

According to the firm’s experience with past pitches, most of the startups are founded by people from technical backgrounds. This results in entrepreneurs getting fixated on pitching technology as the focus point of their business. “Treating AI as the business unless the startup is only about AI, is one of the mistakes noticed during pitches,” mentioned Sparsh Kumar.

“While pitching ideas, many entrepreneurs fall into the trap of using buzzwords like big data, blockchain, AI thinking ‘this is what investors like to see’, and fail to answer any in-depth questions,” said Sparsh Kumar while addressing the mistakes founders make while pitching ideas. “AI can’t be the keystone for a successful business without considering other factors.”

The founders’ advice for entrepreneurs pitching their ideas is to understand the thesis of funds before reaching out to investors with their ideas and structure the pitch in more effective ways. “The first fifteen minutes are the most crucial ones as most of the investors would have made their decision by then. The whole process afterwards is just to check whether the facts stated during the meetings are credible and correct.”

Share your startup ideas with Unicorn India Ventures here.