|

Listen to this story

|

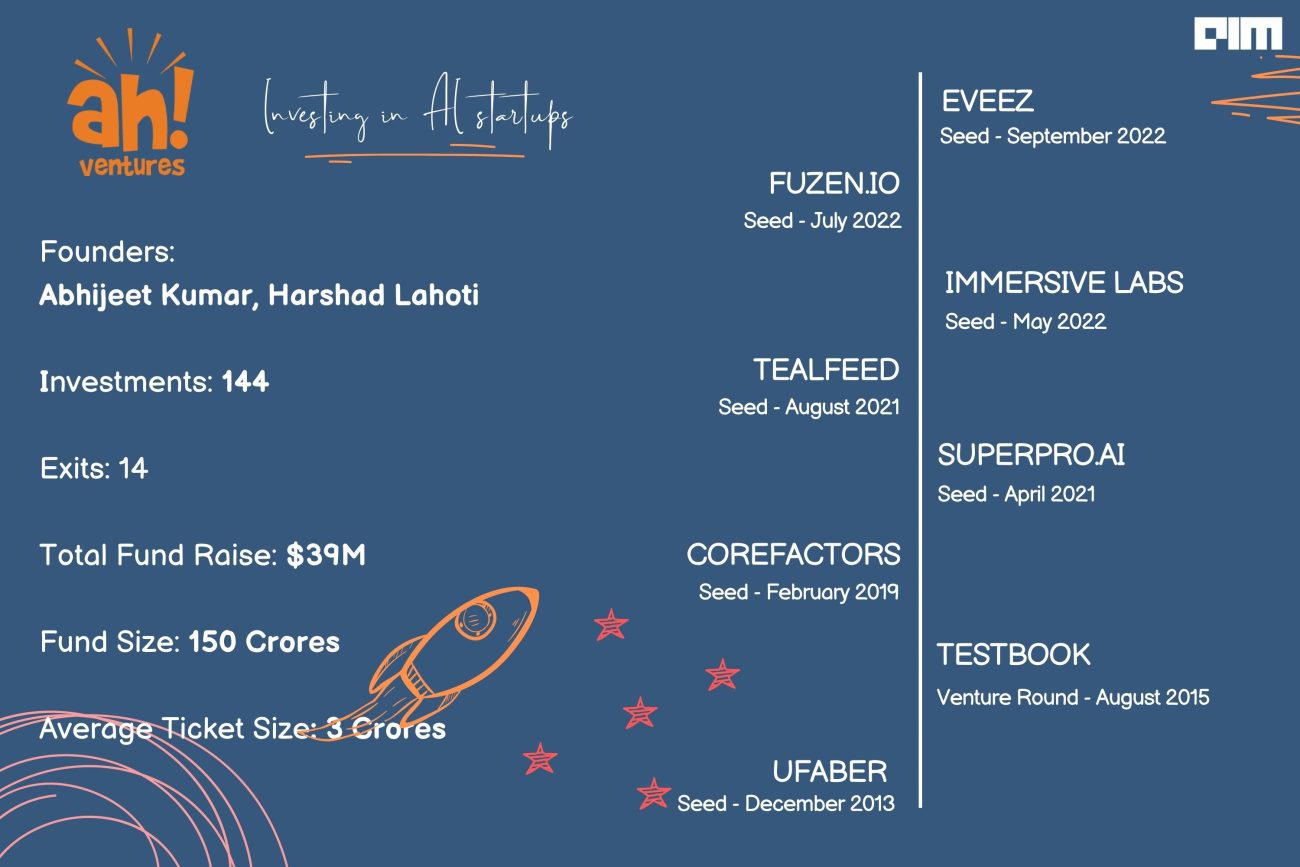

In 2009, Abhijeet Kumar and Harshad Lahoti founded ah! Ventures, a Mumbai-based, sector agnostic investment firm. Since then, the duo along with their team has invested in more than 140 startups spanning all the sectors and are now also focusing on taking steps towards investing in startups related to artificial intelligence and machine learning.

Speaking with Analytics India Magazine, Amit Kumar, who joined as a partner at ah! Ventures in 2019, shared the story about the firm, their investment philosophy, how the team is structured to analyse startups, and tips for companies and founders pitching ideas and starting in the field.

“We have more than 50 venture partners, that are essentially our extended legs, arms, and brains,” said Amit, “We have partners in India, UAE, UK, and in the US.” The firm is also expanding in Singapore, Australia, and Canada. The team is also spread across different cities in India like Pune, Nashik, Delhi and these experts from all regions source out startups from tier-2 and tier-3 cities—thus expanding the reach.

With 63 lead investments, their most recent investment, EVeez, was in September—an electric vehicle subscription ecosystem founded in 2019 by Gaurav Rathore and Abhishek Dwivedi with a total funding of $467k and a valuation of $3.21 million. Razorclub, Klassroom Eductech, Fuzen.io, Immersive Labs, We360.io, Superpro.ai, Playo, Testbook, are some of the investments made by ah! Ventures.

People, Product, and Potential

“People are the most important part of a company,” said Amit. “The bigger the team is, the more we are interested in investing in them, given that all of them have different skill sets and contribute. The more, the merrier.”

Elaborating on the philosophy, Amit explains how 50% of the weightage, when investing in a startup, is given to the founders and their team. “Proof of the pudding is in the execution,” added Amit. Then the product attracts 30% of the focus of the investors. “It doesn’t really matter whether the product or a service is tangible if it does not produce results,” he remarked. The last 20% goes to the potential and scalability of the product. “What if the product stops expanding after two or three years because the market is not right for it?”

Going by gut

“Sometimes, more than the aptitude, the attitude of the founders makes a big difference,” explained Amit about taking risks and betting on the potentiality of a startup. “You have to go by the gut sometimes. That does not mean putting blind faith in someone or something, but evaluating them informally, outside the investment and pitching ecosystem.”

Founders are essentially going to be working with teams and managing them. “We always make a point to meet the founders informally as well to analyse how they are as human beings,” said Amit. “We are investing in an environment. If we meet founders in a structured business environment, we would not be able to judge the person. Meeting them in an informal setting and assessing their behaviour towards others enables us to validate whether they are capable of running a people-oriented business or not.”

Amit also said that the firm is not using any AI/ML algorithms in their operations at the moment. “The process of evaluating a startup cannot be entirely automated using machines, it has to have a human angle to it,” said Amit.

“How much objectivity you want to build into an algorithm, depends on the subjectivity of analysing people and their business plan, and that makes a larger difference.”

Expectations and offerings

“The investors are never in love with you or your company, they are only in love with money,” said Amit, while talking about expectations from startups. The only expectation from the companies is to make a big business for their investors and the shareholders. The founders should keep ethics, professionalism, and governance intact and give full precedence and focus to the business and the community they are building.

What makes ah! Ventures stand apart from other investors is their four-layered curation process, as described by Amit. It begins with the deal sourcing team that screens and gathers around 400 business plans per month, which are then passed onto the partners and the extended partners for evaluating the deal.

“I think the numbers speak for themselves,” said Amit, while discussing the firm’s success over time. Out of a total of 140 plus investments, the firm has successfully exited from 14 companies while only 11 have been unsuccessful over a period of six to seven years.

“Companies often over valuate”

“If you ask any founder about how much money they want to raise, they only want to dilute maybe 10% of it. It’s like a fixed formula that they have,” said Amit about how founders overvalue their companies even without a working product or business.

“Companies run after valuation rather than value creation, even in early stages.”

Companies should factor in a lot of things before fixing a value to their business like, “Is the product scalable over time? Or will the company still continue to function without getting funding? and then backtrack their valuation and maybe increase dilution to 15~20%,” advised Amit.

“Founders become very passionate about their products without even thinking whether the market needs it or not,” Amit pointed out, citing this as a common mistake on several founders’ parts. A product can be fantastic but there might be no market for it since it does not solve any issue or problem. “The customer is the king, and he needs to validate your product.”

“When building an AI/ML product, founders should be focused on the test data, and not just the training data,” explains Amit. He adds that founders should not overfeed data into their models and allow machines to learn on their own, which is essentially a part of machine learning.

Prediction about AI/ML

Every sector is now implementing AI/ML in their business—whether it be fintech, edtech, or even content creation. “We want to see more innovation in the field of healthcare,” added Amit. “Though there is already a lot of AI/ML in the healthcare industry as well, the diagnostics aspect of it is still lacking machine learning in it, maybe because it can be risky to implement it without perfection.”

Another field that ah! Ventures predicts or hopes for more innovation using AI/ML is infratech. “Traffic management using AI/ML is on its way already, but building infrastructure using this technology is something that is still unexplored.”

“Peon to President”

“You should be ready to handle the losses along with the success,” said Amit, addressing investors and businesses alike. He further adds that all startups should be ready for failure and take advice from several experts and mentors before coming in for pitches and asking for investments.

“There is a clear cut P to P principle—Once you are an entrepreneur, whether you are 20, 30, or 50 years old, you have to let go of the perks, and work from being a peon to a president. You will have to do anything and everything from the beginning. And then, when you have a large team, they will be ready to do anything because tough times don’t last but tough people do.”

To pitch your ideas to ah! Ventures, click here.