- Published on October 12, 2021

- In AI Startups

How Bengaluru-based KreditBee Leverages AI And ML To Democratise Credit

📣 Want to advertise in AIM? Book here

Telangana has attracted over 75 greenfield GCCs in 2025, compared with 40-plus in Karnataka.

“Only 30% of software engineering happens on the laptop. The real 70% starts after you commit the code,” says Jyoti

With capacity expected to more than double this decade, the industry is investing in training as graduates struggle to meet

Arrcus positions itself as a horizontal software layer that can run across different types of networking hardware.

Defenders must be active at all times, while attackers need only one opportunity.

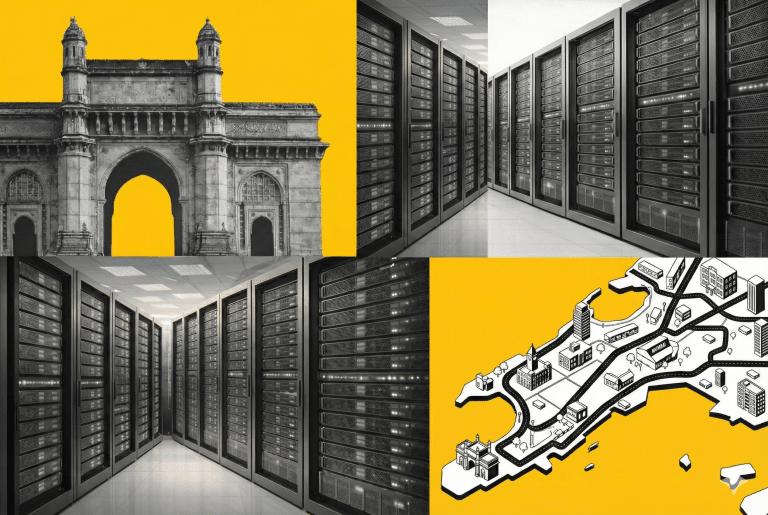

Without compute buildup beyond metros, the next wave of digital adoption will be constrained

Land prices are among the highest in the country, but total build economics remain competitive by global standards.

A decentralised GPU marketplace may scale AI compute faster than traditional clouds, as GPU demand towers over supply