|

Listen to this story

|

Software company Atlassian’s recent acquisition of video messaging firm Loom, for $975 million, which is 36% less than Loom’s valuation of $1.5 billion in 2021, throws the spotlight on the fate of video messaging platforms. What witnessed a boom during pandemic, with app usage even hitting 21 times pre-covid levels, video conferencing platforms are losing their lustre post pandemic. This resulted in big tech companies swooping in to seemingly make profitable deals.

Catch When The Hype Drops

Recalling Zoho chief Sridhar Vembu’s personal philosophy of investing in companies when the ‘hype dies,’ seems to be a guiding principle for the latest M&A that has been happening in the video conferencing space.

Atlassian’s biggest deal of buying Loom when the hype around video calls have declined, may be construed as a favourable deal for the company. However, the deal is advantageous for Loom too considering its plunging market value.

In another case of plunging valuation, Hopin, a video teleconferencing and hosting platform, sold its business for $15 million to RingCentral, a cloud-based company in August. Believed to be worth $7.75 billion in 2021, Hopin lost close to 99% of its value.

Technology and communications company Verizon acquired BlueJeans, a video application designed for businesses, for $400 million in May 2020. However, a few months ago, Verizon announced that they will be shutting down BlueJeans in a phased manner. Interestingly, BlueJeans was launched two years before Zoom was released into the market.

The Growth and Tumble

Owing to a pandemic that forced the world to work out of homes, video conferencing platforms saw a huge surge in user base. However, with companies calling their employees back to the office, the decline was inevitable. Companies faced drops in market capitalisation, valuation, layoffs and sometimes acquisition too.

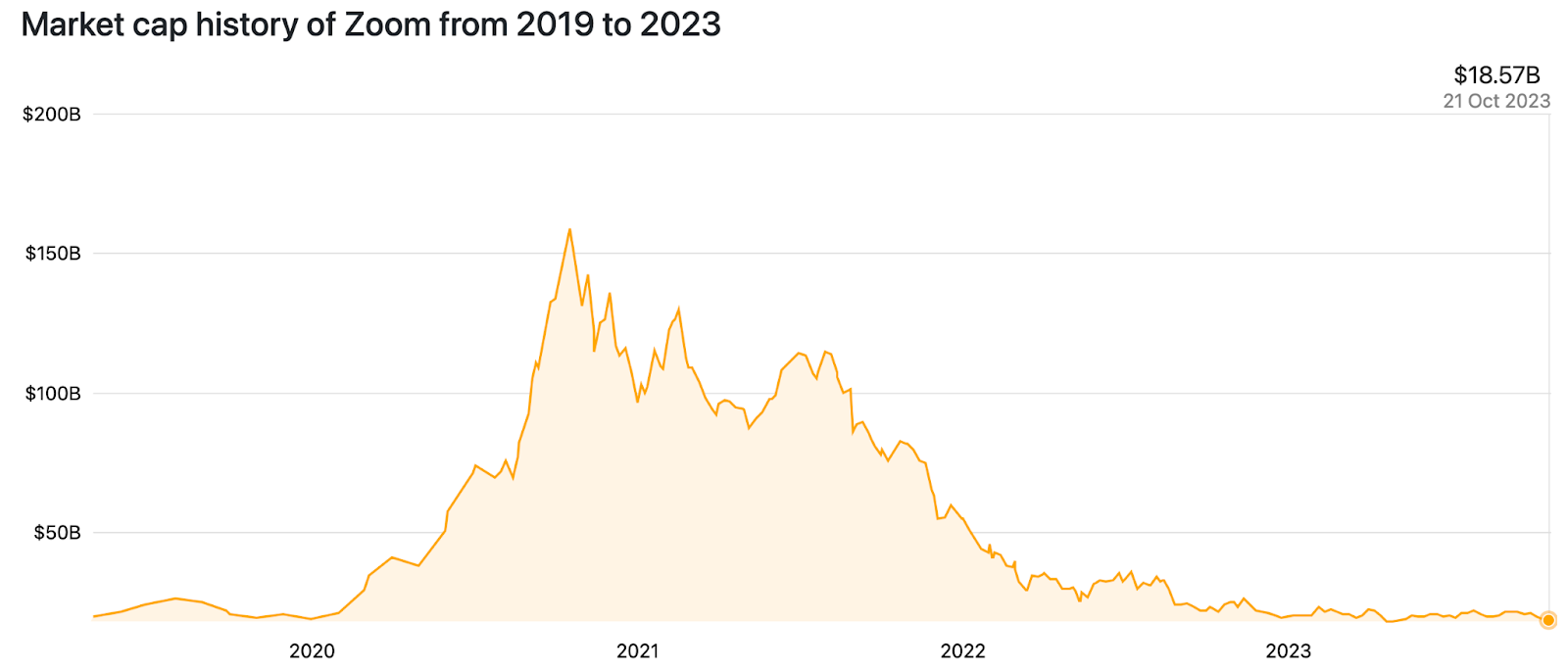

Video conferencing platform Zoom saw a huge spike in market cap during the pandemic, reaching as high as $158.99 billion. Today it stands at $18.57 billion. Not surprising, considering how even Zoom has called their employees to return back to work.

Source: CompaniesMarketCap

The recently acquired work communication tool Loom had been witnessing a steady rise. In 2020, the company hit a valuation of $350 million with 4 million users. The company raised fundings from companies such as Atlassian, Figma, Slack and others. By 2021, the company hit a $1.5 billion valuation. However, the valuation dropped at the time of acquisition by Atlassian.

Hubilo, a virtual and hybrid event platform, also faced the brunt post pandemic. The company that raised $150 million in 2021, laid off 35% of its staff early this year. Similarly, other virtual event platform hubs also faced a similar fate.

During the pandemic, companies also invested in video conferencing applications to boost their existing product. In August 2021, Microsoft acquired Israeli video streaming company Peer5 for an undisclosed amount in a bid to boost Microsoft Teams’ performance.

The Big Tech Players

Big tech companies such as Microsoft and Google that already provide video conferencing products through Teams and Meet respectively, also witnessed a spike in users during the pandemic with companies finding ways to meet the demand. However, by not being an exclusive video platform, the rise and fall in its user base owing to pandemic may not be a complete business damper. It’s the exclusive players that have witnessed a major change in their business.

Webex by tech conglomerate Cisco is also pushing ahead with its web and video conferencing application, ready to take on Zoom as well.

All is Not Dead

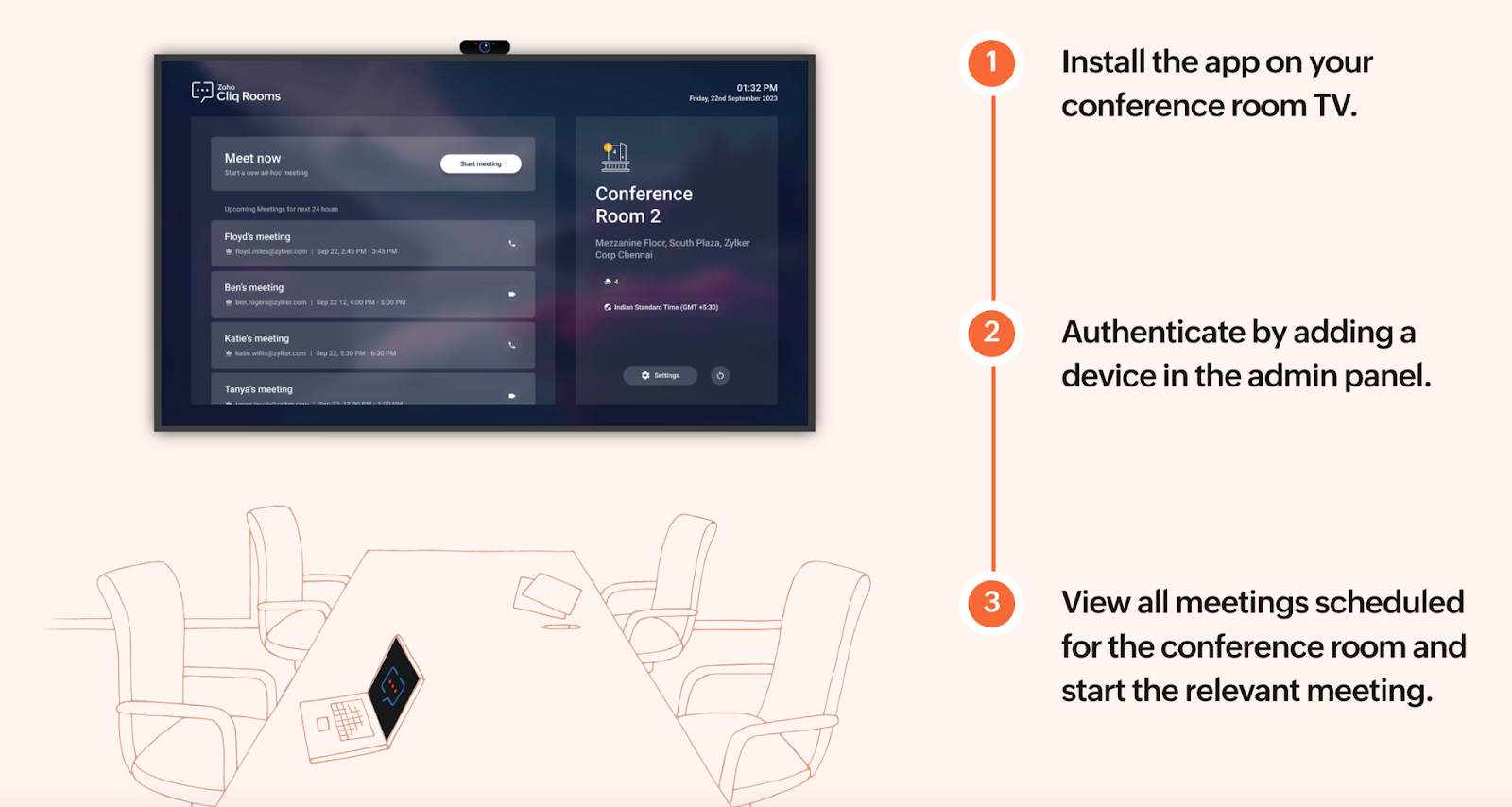

The global market of video conferencing which stood at $10.6 billion in 2022, is expected to hit $19.1 billion in 2027. Established SaaS players are also working on enhancing their existing products by offering video features. For instance, Zoho recently unveiled its smart conference rooms solution on their existing AI-enabled platform Cliq. Here, the company allows customising room devices such as TV screens for supporting video meetings, and pushing for a work from anywhere culture post pandemic as well.

Source: Zoho

While we have witnessed a decline in the number of video conferencing platforms post-pandemic, which enabled software companies to swoop in and make the best of it via acquisitions, it is likely that more consolidation of video SaaS companies will occur in the near future.