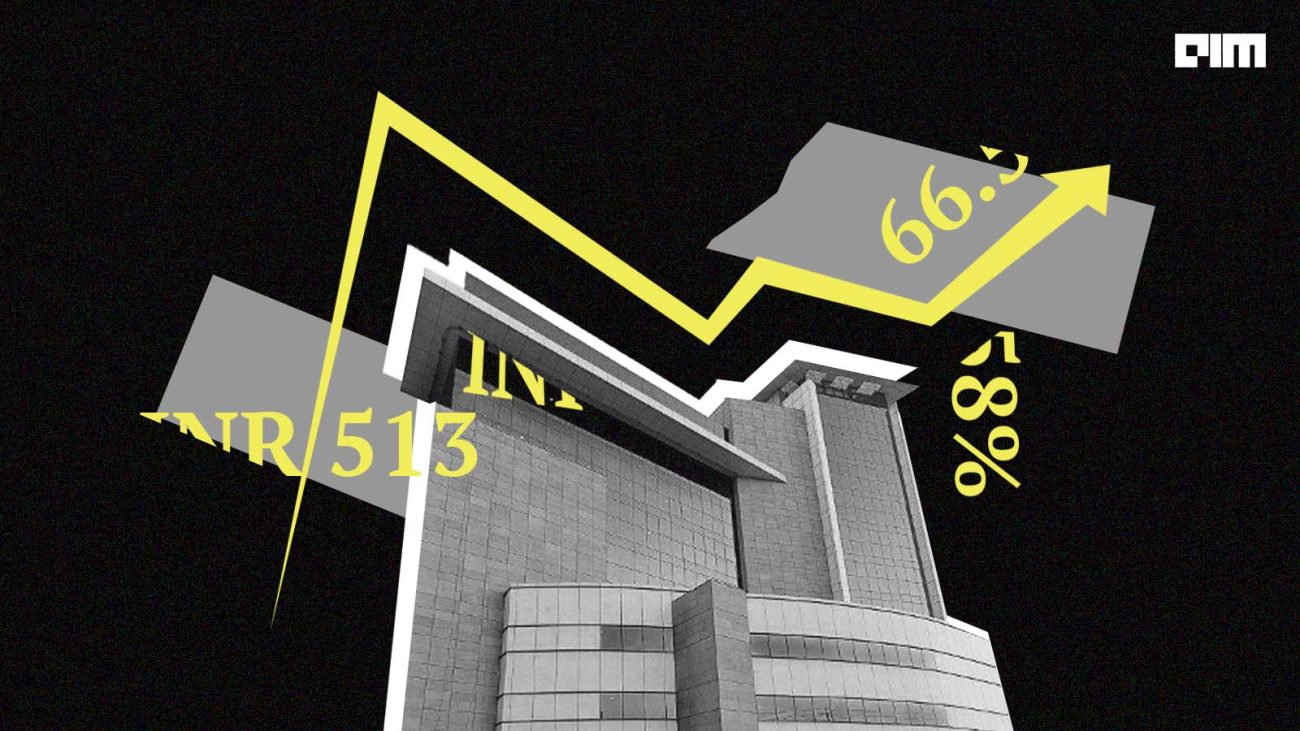

Info Edge – one of India’s leading internet companies – has recorded a significant rise in its net profit, with its recruitment business contributing a major chunk.

To give you a sense of understanding, in FY22 Q4, the company’s billing amount in recruitment clocked INR 513 crores, up by 66.58 per cent compared to last year, which stood at INR 308.1 crores.

Moreover, the company’s recruitment wing witnessed revenue of INR 344 crore, up by 65 per cent, alongside recruitment EBITDA up by 97 per cent to INR 207 crore and recruitment cash EBITDA up by 89 per cent to INR 386 crore. This was followed by its real-estate business, 99acres, which recorded a billing and revenue worth INR 79.3 and INR 61.3 crores, respectively.

Overall, for the financial year 2022, Info Edge recorded recruitment EBITDA of INR 679 crores, up by 55 per cent, and recruitment cash EBITDA of 987 crores, up by 110 per cent, compared to last year.

What are these numbers telling us?

Info Edge CFO Chintan Thakkar said that the outstanding growth in billing, revenues, profitability and cash from operations has placed the company on a solid platform of consistent profitable growth.

Info Edge chief Hitesh Oberoi said they are experiencing strong tailwinds in recruitment and real estate business. He said that the supply and demand for skills have increased globally. “We expect this trend to continue in the mid to long term and will create demand for platforms like Naukri,” said Oberoi.

The numbers indicate that the IT hiring is going through the roof and is providing additional revenues for the platform. Even though it is counterintuitive in this market, the company claims a 66 per cent uptick even in March YoY.

This largely goes against the current trend of ‘there are no jobs,’ where a growing number of Indians are no longer even looking for work.

Experts said there are about 65K startups in India, employing around 13 lakh people. So, even at a 20 per cent contraction in the market, you only lose 2.5 lakh jobs. This is slightly lagging as an indicator, given that people would have brought their subscriptions earlier. Nonetheless, they have one lakh active subscribers, so recruitment doesn’t seem to have died with the dry up in funding or layoffs.

At the same time, IT companies are also on a hiring spree, and nearly 40-50 per cent of people who succumbed to layoffs in well-funded startups are getting absorbed into the IT world.

In its financial report, the company said that the billing from IT/ITES customers almost doubled during the year. Naukri recorded 1 lakh paid customers during the year. It said that it will continue to focus on new product launches such as Talent Pulse, Enterprise resdex, etc.

Competition galore

Today, there are very few monopolies in the Indian stock market. The company owns a monopoly through Naukri.com. It throws out a lot of cash, said market expert Kush Katakia, saying, “Ask any HR officer, and she’ll tell you no HR department can survive without a subscription to Naukri.”

Interestingly, Naukri.com today makes up 80 per cent of the online job segment market share. As per its financials report, the value selling helped average billing per customer grow by 25%+ in the latest financial year. Besides Naukri, the other players in the market include Indeed India, apna, Shine.com, timesjobs.com, Monsterindia.com, etc. But, each of them has its niche in the recruitment market, where some cater to blue-collar jobs, freshers, etc.

Here’s a quick overview of the number of users (monthly visits) on each of these platforms:

Recruitment acquisition play

Info Edge runs multiple businesses, including Naukri, Jeevansathi, 99acres, and Shiksha. Besides these, the company also owns Naukri Gulf and Quadrangle. Previously, it has also made significant strategic investments in startups, including Zomato, PolicyBazaar, Happily Unmarried, etc.

The company saw record growth in billing of newly acquired brands, including Aisle, DoSelect, Zwayam, iimjobs.com, hirist, and Ambition box. In this year’s financial, the billing in recruitment included two companies, namely Zwayam and DoSelect, which stood at INR 529.5 crores.

Acquired in June 2021, Zwayam is a SaaS-based end-to-end recruitment shortlisting and screening solutions provider. This particular acquisition broadened their recruitment offering to HR managers. DoSelect, which was acquired in July 2021, was engaged in providing technical assessment services to its clients for recruitment and learning purposes. The acquisition helped the company to offer a new variety of services under its flagship brand Naukri.com.