Analytics adoption among Indian firms dwarfs in front of global peers. We, quite often, get asked the question on how has been the analytics adoption by Indian companies. This was, therefore an interesting investigation to understand the amount of analytics adoption amongst the domestic firms in India. Surely, we have seen it gaining momentum across all industry segments over the last few years; nevertheless, Indian companies are still slow when it comes to adopting analytics. However, most of the B2C companies in India have some kind of analytics function in them.

To carry out this independent research, we studied 20 large Indian firms that utilize relatively high analytics in their internal processes and score them with regards to their analytics penetration and maturity.

Read our last Domestic Indian Analytics Market Study

Broadly speaking, Indian analytics market can be thought of as having three sets of players- Service providers, Captive centres and Domestic market.

Almost 75% of Indian analytics market is dominated by service providers, these are those companies that provide analytics services to the end consumer of analytics – either domestic or out of India. On the other hand, those companies which have back offices in India are called Captives. A lot of analytics worldwide is being outsourced to India via these captives. They account for almost 20% of Indian analytics market.

Surprisingly, the domestic market consists of less than 5% of Indian analytics market. These are those Indian companies that utilize analytics for internal processes either through their own internal analytics teams or by outsourcing analytics to service providers. The focus of this study is to assess the domestic companies with internal analytics teams.

Since, the domestic analytics market is still in a very nascent stage, Companies in this segment are typically large private B2C companies in various sectors such as Banking, Telecom, Automobile, E-commerce as well as Conglomerates.

While the Indian Banking sector is primarily dominated by private banks such as ICICI, HDFC, Axis, Yes Bank and Kotak Mahindra when it comes to analytics; the public banks such as SBI are not far behind.

Taking the Indian telecom industry into consideration, Bharti Airtel and Idea Cellular have internal analytics.

Moreover, TATA Motors and Mahindra & Mahindra are one of the first to adopt analytics in the Indian automobile sector, while conglomerates such as Reliance Industries, L&T, Aditya Birla and ITC are the latest to turn to analytics.

Lastly, the Ecommerce industry in India is booming with Flipkart, Snapdeal, Myntra, Ola, Paytm, Quikr, being renowned brands to adopt analytics in their processes.

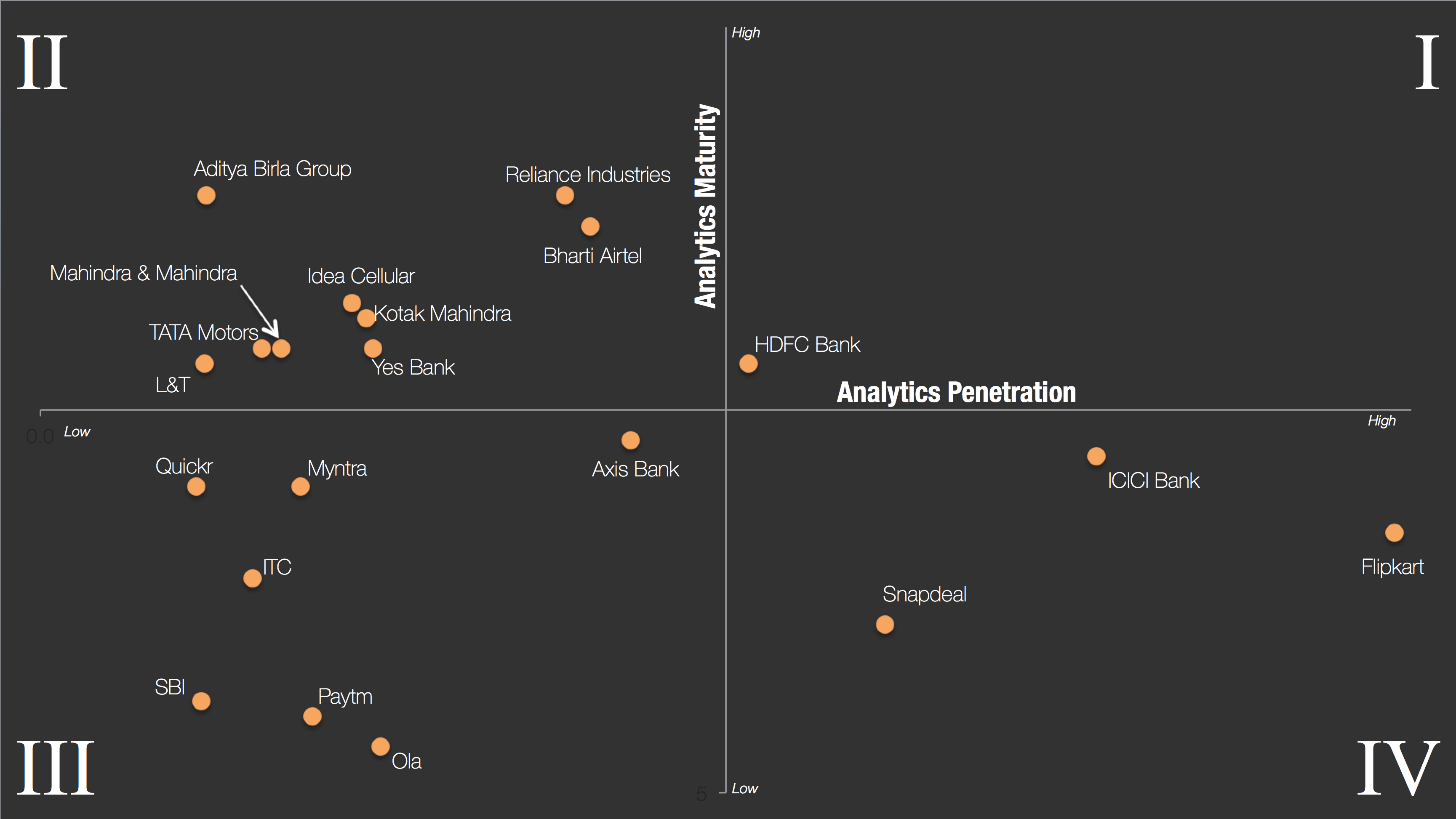

In the graph below, we have plotted these organizations on the basis of their analytics penetration vs. analytics maturity.

While analytics penetration is the metric that plots ‘how well infused the analytics function is’ within an organization; on the other hand, maturity metrics look at the quality and depth of analytics being done internally with the organization.

However, please note that these are relative metrics, i.e. these organizations are plotted on their relative strength on these metrics vis-a-vis each other. These cannot be compared to any other organization outside this study. Moreover, a high on this study might be low on global standards.

Following conclusions can be made from the graph:

- There is a slight negative correlation between maturity & penetration.

- HDFC Bank is the only company to be in the first quadrant. Given, HDFC was among the first Indian banks to adopt analytics; they have gradually ramped up the practice both in terms of size and quality of work.

- The highest number of companies seem to lie in quadrant II. This could be attributed to the expansion in analytics function. However, it seems to come at cost of depth of work being done with the function. Given that the industry is still at nascent stage, think of analytics functions to work more like startups and economies of scale are almost non-prevalent.

- On the other hand, SBI hovers at the bottom of quadrant III. The public sector bank has just recently adopted analytics.

- Flipkart has the highest analytics penetration of all domestic firms in India. The ecommerce giant has rapidly built up a large analytics and big data team internally over the past years. Snapdeal also exists in quadrant IV along with Flipkart.

- Quadrant III also has a large number of new age e-commerce firms – Quickr, Myntra, Ola, Paytm. The focus on analytics as a key differentiator is low or just building up for these companies. We would have expected these new age firms to adopt analytics much quicker than their older peers that are mostly bundled in quadrant II.

- Compared to two years back, Snapdeal has the biggest change in penetration, pushing it from quadrant III to IV.

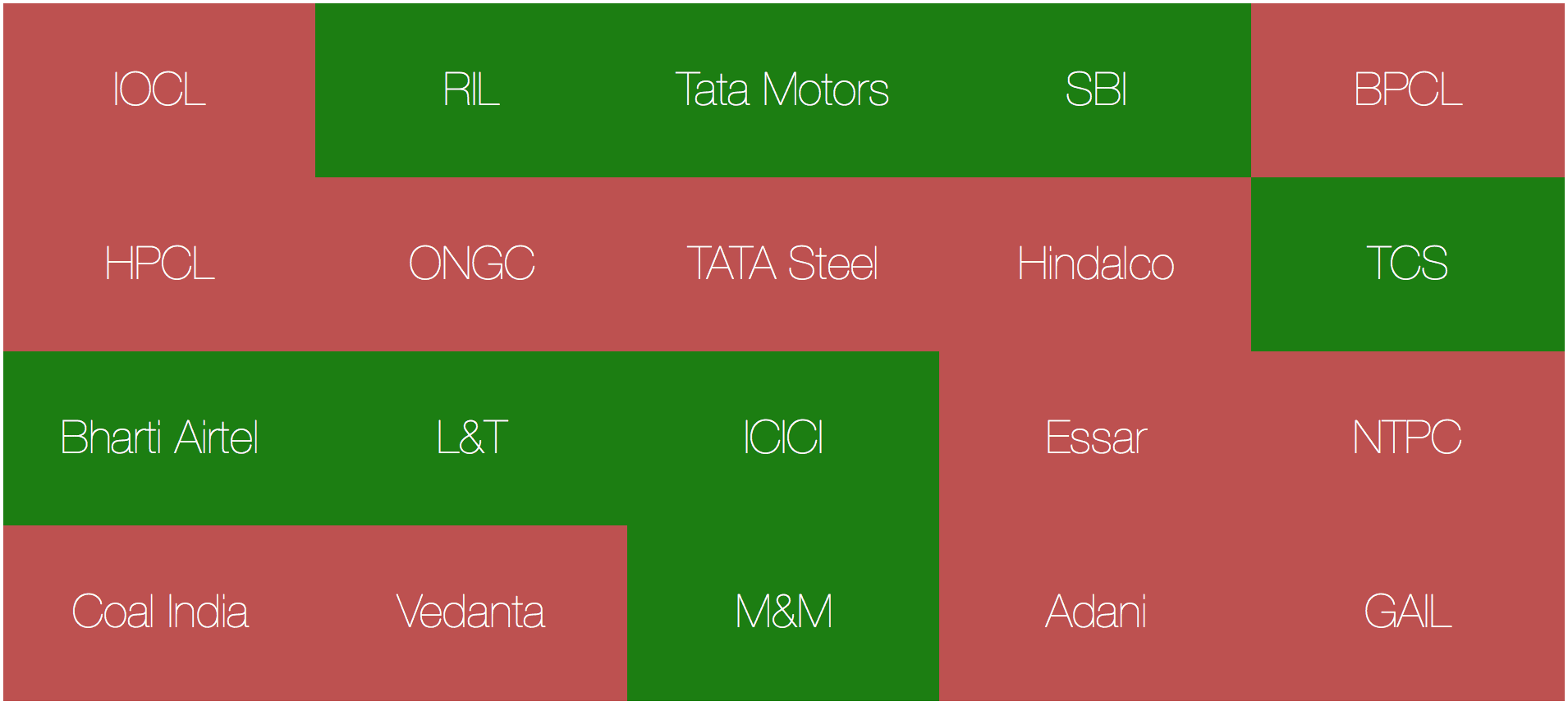

We also looked at the top 20 Indian companies by revenues and discovered that just 8 out of these have any significant focus on analytics. The ones in Red do not have significant analytics and the ones in green have adopted analytics as a function.

The reason for low adoption is the fact that most large revenue companies utilizes/B2B/energy organizations which are always slow at adopting analytics.

Moreover, another facet of any industry is billing. During the course of this research, it was found that the billing rates for some of these larger Indian companies are not cheap anymore. Moreover, the sale cycles have decreased and in fact, all issues that the service providers used to complain earlier about are getting eradicated.

Even though the demand for analytics in India may seem to be increasing, yet looking at it from the global lens, the Indian domestic market still seems dwarfed.