|

Listen to this story

|

GPU prices are like a wildly swinging metronome. The timing to buy a graphics card for your PC is precarious and can be affected by an eruption in tech development elsewhere.

First, it happened in September, when Web3 platform Ethereum announced the Merge – moving from the proof-of-work protocol to proof-of-stake. Post Merge, the prices of many popular NVIDIA GPUs, such as NVIDIA’s RTX3080 plummeted by nearly 60% over the last 90 days across some parts of the globe. It is happening again, but this time reversing the share price graph.

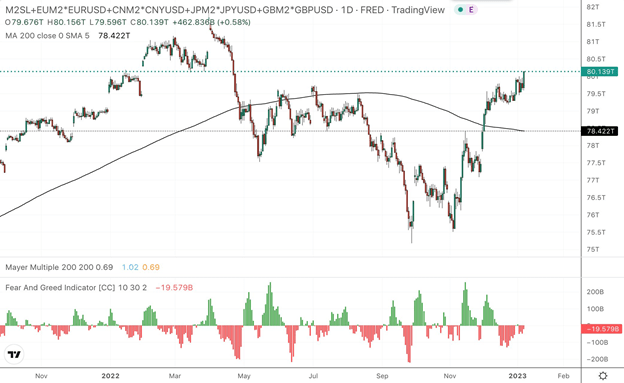

Reports claim that the excitement around OpenAI’s now-famous chatbot ChatGPT has rubbed off its magic on NVIDIA’s GPUs. The GPU-maker’s stock has already shot up by 29% since the beginning of this year with CEO Jensen Huang’s pockets getting heavier by 33% (USD 18.4 billion) this year. Huang, a Taiwanese immigrant, is a rare winner these days, especially when compared to the fortunes of most tech leaders who are taking a harsh beating due to prevailing macroeconomic conditions.

And the logic behind it is plain as day – NVIDIA’s graphics cards have become synonymous with AI tools and ChatGPT, the hottest AI tool right now, is attracting more users by the minute.

OpenAI’s growing need for compute

While OpenAI hasn’t released official figures, sources say that the chatbot has surpassed 10 million daily users in just 40 days, overtaking Instagram’s initial euphoria. The daily traffic is sizeable enough to cause the platform to crash, often preventing people from creating new accounts. Basically, the more popular ChatGPT gets, the better it is for NVIDIA’s GPUs.

In a note to investors on January 16, UBS analyst Timothy Arcuri stated that ChatGPT initially used 10,000 NVIDIA GPUs to train the model. “But the system is now experiencing outages following an explosion in usage and numerous users concurrently inferencing the model, suggesting that this is clearly not enough capacity,” he noted.

Arcuri explained that the compute on training these generative models is as intensive as training an LLM, suggesting that OpenAI will ‘need to scale quite rapidly’. Moreover, with OpenAI planning to release the long-awaited GPT-4, which is expected to be bigger than GPT-3, NVIDIA should brace for more of that sweet GPU money.

Last week, Citigroup released a report estimating that the rapid expansion in ChatGPT users could potentially result in GPU sales of between USD 3 billion and USD 11 billion within the next year. Analyst Atif Malik based his predictions on the number of words generated by ChatGPT and revenue per word for NVIDIA.

Also, ChatGPT is only the tip of the iceberg in generative AI. There are a host of other generative tools in the trend that will also depend on GPUs for inference functions. But there’s no denying that the ChatGPT craze came as a divine intervention for NVIDIA at a time when its market value fell by a sharp 50% last year after peaking at more than USD 800 billion in late 2021 due to lower sales.

Other tech developments affecting GPU prices

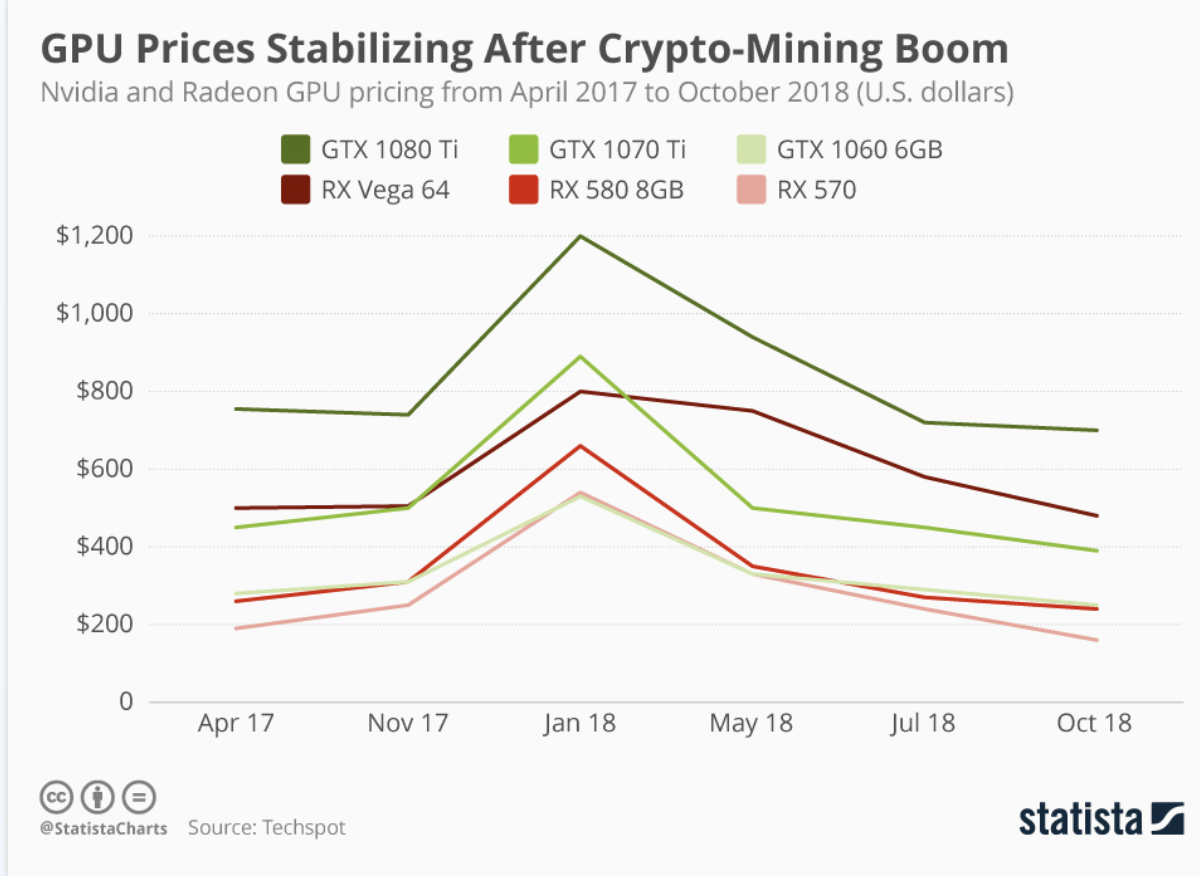

The resulting impact on GPU prices though, isn’t unusual for NVIDIA. In September, Ethereum’s long-awaited transition to the proof-of-stake (PoS) mechanism known as the Merge replaced cryptocurrency miners with network validators effectively killing the need for GPUs.

Since the upgrade, the value of several models of GPUs fell by a lot. Reports showed that the price of the popular NVIDIA RTX 3080 fell from USD 1,118 to around USD 700 within three months in China. While NVIDIA lost the most, other GPU manufacturers like MSI also saw a drop in their prices.

Ironically, just prior to the Merge, the boom in blockchain was responsible for pushing the GPU market further. While mining already was using GPUs, outside of mining too blockchain and GPUs were ideal together.

Mining has distributed networks which use computing power leveraging the total users that create ‘virtual supercomputers’ that rely on the combined power of the network. Besides, there was also an increase in the demand for computing-as-service as indicated by the expansion of the GPU-as-a-service market and cloud computing. While hyperscalers like Google Cloud and AWS did start offering GPU services, they were fully centralised and even inefficient compared to NVIDIA.

Similarly, GPU sales also lost their steam just as the market for Bitcoin and Ethereum lost momentum. GPUs were also consequently affected by other events within the blockchain ecosystem like investment in dedicated mining rigs called ASICs, projected to be faster than GPUs.

On the whole, the demand for GPUs is driven by much more than just crypto mining with its applications ranging between AI to gaming processing. GPUs are vital for development in AI/ML and NVIDIA GPUs are here to stay because of their familiarity among users and variety in usage. The balance in GPU demand may be achieved, again thanks to the latest rage in AI.