|

Listen to this story

|

Oracle Corporation witnessed a significant drop of more than 9% in its shares during extended trading on Monday. The decline follows the release of the software giant’s fiscal second-quarter results, which not only fell short of Wall Street expectations but also prompted a downward revision in quarterly revenue guidance.

The financial figures, when compared to consensus estimates from LSEG (formerly Refinitiv), revealed several key areas of concern. According to the reported results:

- Earnings per Share: Oracle posted adjusted earnings of $1.34 per share, slightly exceeding the expected $1.32 per share.

- Revenue: The company’s revenue amounted to $12.94 billion, falling short of the anticipated $13.05 billion.

Despite a 5% year-over-year growth in revenue for the quarter ending November 30, Oracle reported a substantial 44% increase in net income to $2.5 billion, equivalent to 89 cents per share, compared to $1.74 billion or 63 cents per share in the same period a year ago.

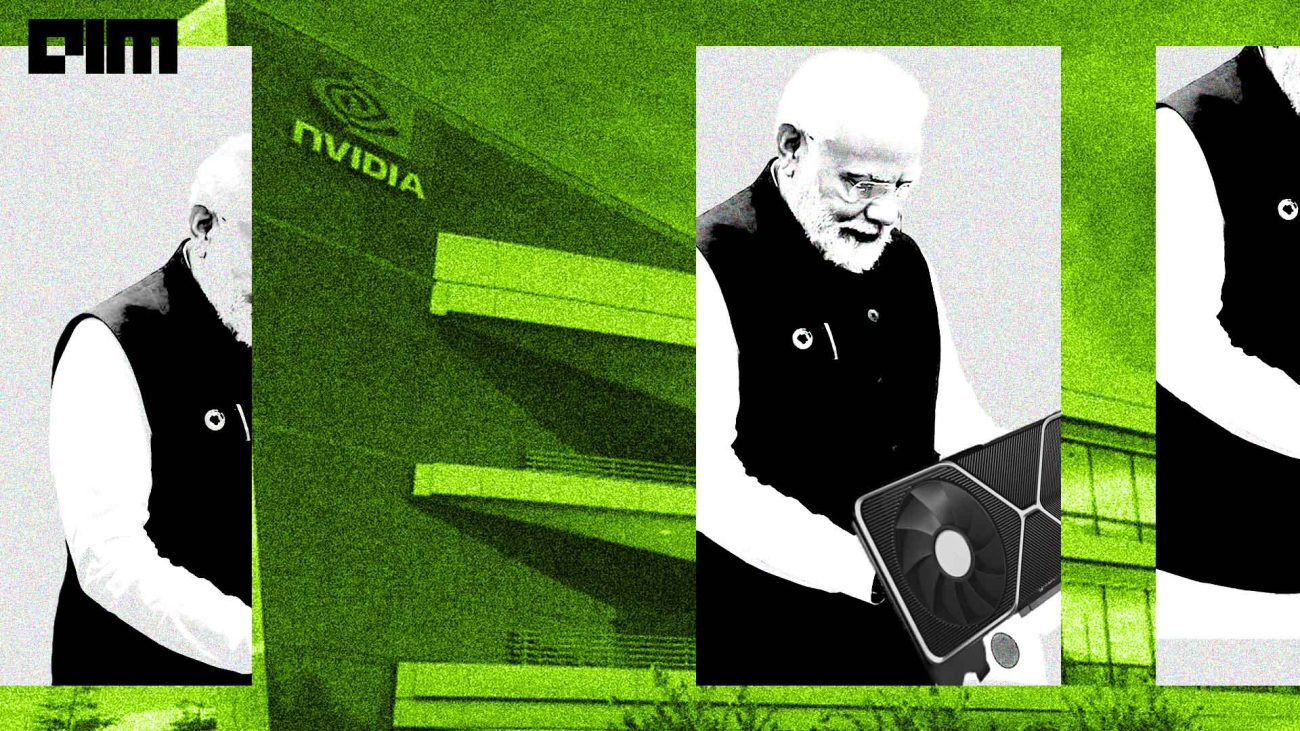

On a positive note, Oracle reported a remarkable 52% increase in cloud infrastructure revenue, reaching $1.6 billion. Notable clients during this period included Elon Musk’s artificial intelligence startup xAI, Halliburton, and Samsung.

However, Oracle faced challenges meeting the demand from Musk’s company, which sought more AI chips than Oracle could supply.

Read: How Oracle is Fuelling Musk’s Ambitions

During the earnings call with analysts, Oracle co-founder Larry Ellison acknowledged the chip shortage, stating that the company had to choose between a smaller buildout to recognise revenue in the quarter or a larger buildout with a wait for capacity availability, leading to the current constraints.

However, the company’s guidance for the fiscal third quarter raised eyebrows, with adjusted net income projected to range between $1.35 and $1.39 per share and a modest 6% to 8% revenue growth. Analysts polled by LSEG had expected $1.37 in adjusted earnings per share and $13.34 billion in revenue, reflecting a 7.6% growth.

Read: Oracle’s Symbiotic Connection with AMD and NVIDIA

Oracle’s performance in key segments further contributed to the market’s reaction. Notably, revenue from cloud services and license support reached $9.64 billion, showing a 12% increase but still falling short of the StreetAccount consensus of $9.71 billion.

Revenue from cloud and on-premises licenses saw an 18% decline to $1.18 billion, slightly below the $1.21 billion consensus. Additionally, services revenue amounted to $1.37 billion, missing the consensus of $1.40 billion.

Oracle’s strategic moves during the quarter included securing cloud business from larger rival Microsoft and announcing the availability of its database software on Microsoft’s Azure public cloud. The company plans to activate 20 data centers connected with Azure in the coming months.

“Oracle is in the process of expanding 66 of our existing cloud data centres—and building 100 new cloud data centres—to meet growing demand,” said Ellison. “We can build our new data centres very rapidly and operate them inexpensively because they are all highly automated with identical high-performance RDMA networks and the same set of autonomous services. In the next few months, we are turning on 20 new Oracle cloud data centres collocated with and connected to Microsoft Azure. Simultaneously we are building dozens of new data centres in countries all over the world. Demand is over the moon.”

Read: Oracle’s Grand Multicloud Gamble

Despite these efforts, Oracle’s shares are now up only about 41% for the year, a significant drop from previous performance, still outperforming the S&P 500 index, which has gained 20% during the same period. Investors are left to assess the impact of these results on Oracle’s future prospects and market standing.