|

Listen to this story

|

US visa delays have been much talked about lately for impacting the lives of thousands of people in India across all walks of life. Be it youngsters going abroad for further studies or people travelling for leisure, getting a US visa has always been daunting. But for the Indian IT industry, it’s a different ball game altogether amidst a plausible global recession, inflation, rising attrition, and dip in margins, etc.

A visit to a US visa tracker will show you a bizarre picture, where the appointment wait time for Indians lasts close to a year.

Why is this a big deal? At present, nearly 40-78 per cent of the revenue of Indian IT companies comes from the US. TCS, Wipro, Infosys, Tech Mahindra, and HCL Technologies have over 50 per cent exposure. Pure-play analytics firm LatentView Analytics said that 95 per cent of its revenue comes from the US.

Many experts believe that the delays in processing US visas are causing Indian IT service providers to hire more subcontractors, adding to costs. But that is not entirely true. “The US visa problem has been going on for ages, and continuing; it is not a new problem for Indian IT companies,” said Pareekh Jain, CEO of EIIRTrend, in an interview with Analytics India Magazine. However, he said that many IT companies have figured out a way of hiring freshers locally, particularly in the US and Europe, alongside campus hiring in India.

For instance, in the first half of FY23, Infosys, Wipro, TCS and HCL Technologies added over one lakh freshers and are expected to hire 1.57 lakh freshers by the end of FY23. Out of these, some of them have been hired locally as well as from Indian campuses. However, the freshers’ hiring has reduced by 30 per cent compared to last year.

Another observation from the latest quarterly results is that the subcontractor cost for most Indian IT companies has been down. Experts believe that that higher subcontractor costs over the last couple of years might be one of the reasons for the decrease in the margins. Last year, IT majors added over 2.3 lakh freshers, most of whom are likely to have completed the training period and are working on projects. Ideally, the training and assessment of a candidate would last for six to twelve months before they are deployed on the projects.

Jain said that when freshers come into the system, this cost will reduce, both in India and the US. “The worst of subcon costs has passed. We are hoping that it will stabilise in the next three to four quarters,” he added.

“We have probably hired half a dozen people, but we are thinking of tripling or quadrupling the number so that we can get them deployed on engagement as we grow,” shared LatentView Analytics’ chief Rajan Sethuraman, touching upon the 1K people milestone, and building the right capabilities, skills, and talent going forward. “Visa will play an important role as we will eventually deploy people for critical onsite roles.”

“I’ve experienced that during the pandemic period with several slots and delays. But it’s getting back on track. I think the latest round of visa processing is also underway, and we expect that we will get some of those visas to come through,” said Ranjan, adding that they should be in a much better position compared to three-six months ago.

In addition, Jain also said that previously, many employees used to leave IT jobs for startups. But now, because of the inflation and funding squeeze, many people are reconsidering their choices and sticking with IT because of the safety net it offers. This is also an early indicator of attrition coming down in the coming months, alongside a decline in subcon costs.

“Bigger firms have an advantage here, as they have been actively hiring local talent for the last four-five years, building the pyramid,” said Jain. The IT industry survives on freshers. “The cost has not changed in the past 10-15 years.”

From a visa perspective, industry experts said that the H1 and L1 visas have resumed to the previous levels, but the IT industry expects to see an increase in the coming months. However, when it comes to B1 and B2 visas, there is a bit of a challenge, mainly from a deal-signing perspective, showcasing demos, attending events, project escalations, etc.

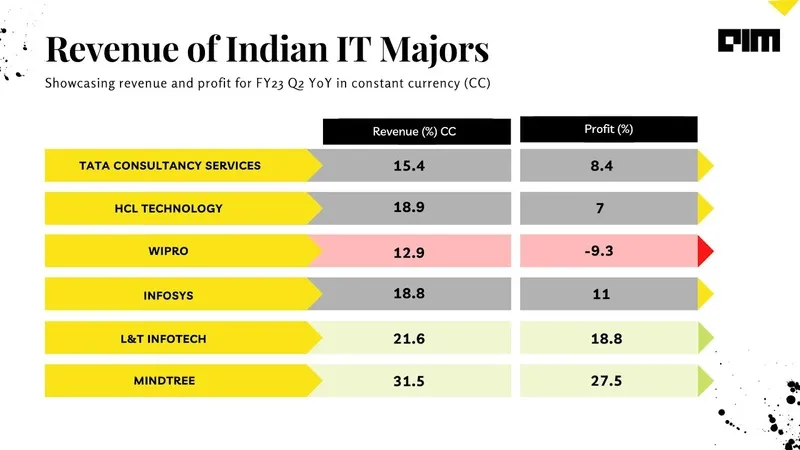

Check out the Indian IT quarterly report card here.

A decline in subcon cost

At the latest earnings call, TCS chief Rajesh Gopinthan said that with borders opening up and visa availability in most countries becoming increasingly easier, the company expects the subcontractor costs to start trending down. The company reported a 40-basis-point sequential dip in subcontracting costs. As per Kotak Institutional Equities analysis, in FY23 Q2, the share of revenue and subcontracting costs were down to 9.6 per cent, compared to last quarter, which stood at 10 per cent.

The subcontractors’ cost is directly influenced by visa delays and skills. The current share of subcontracting among the top Indian IT companies ranges between 6-8 per cent, while it is 3 per cent overall in the Indian tech industry, as per IT staffing firm TeamLease.

Prabakaran Murugaiah, chief executive of IT staffing firm techfetch.com, told ET that the visa delays and the lack of skilled talent in the US are also impacting subcontracting firms. He said that the visa delays impact everyone, including subcontracting firms, as they rely on visas to bring talent to the US. He said if this issue isn’t resolved, it will result in more projects going offshore as there is not enough talent available in the US to staff those projects.

“Increasing offering benefits both clients and IT companies,” said Jain, adding that offshoring has a higher margin, pointing at how people were working post-pandemic, more remotely and virtually. He believes that with time, offshoring has increased.

“Previously, the onshore offshore work ratio was 25-75 per cent; right now, it is 15-85 per cent,” said Jain. He added that now with visa delay as well, certain clients and service providers prefer more offshoring work, resulting in higher margin for service providers as it reduces cost. “Having said that, you still need some people onsite, even 10-15 per cent,” he added, indicating that subcon costs will come down in the next three-four quarters.

Contextually, there are two types of subcontractors: One who hire people from India to provide the same services to IT and tech companies. This includes staffing service providers like TeamLease, Randstad, The Adecco Group, ManpowerGroup, Kelly Services, etc. The other type includes people of Indian origin, who are also citizens in the US, acting as independent contractors.

With the demand for new-age technology and digital skills such as AI and analytics, cybersecurity, metaverse, etc., there will always be a demand for subcontractors in these areas. “So, if a client demands such requirements, you will need heavy expertise. Until you build those capabilities internally, it is always better to rely on subcontractors,” said Jain.

Read: Indian IT loves a good recession

Preparing for global recession

Most Indian IT firms at the earnings call assured they are not seeing any direct impact of the recession on the businesses yet, but are worried about it nonetheless. At the same time, most Indian IT companies are also preparing for recession scenarios by not hiring more people. “So, if a recession comes, they can take necessary steps. And if the recession doesn’t happen, they will be able to ramp up,” opined Jain, saying that hiring is a good leading indicator.

“Hiring has significantly reduced, despite high attrition rates,” said Jain. He added that Indian IT companies are preparing for a recession. So if it strikes, they are not caught up and are likely to let go of a few employees, similar to what happened during the Covid-19 pandemic.