|

Listen to this story

|

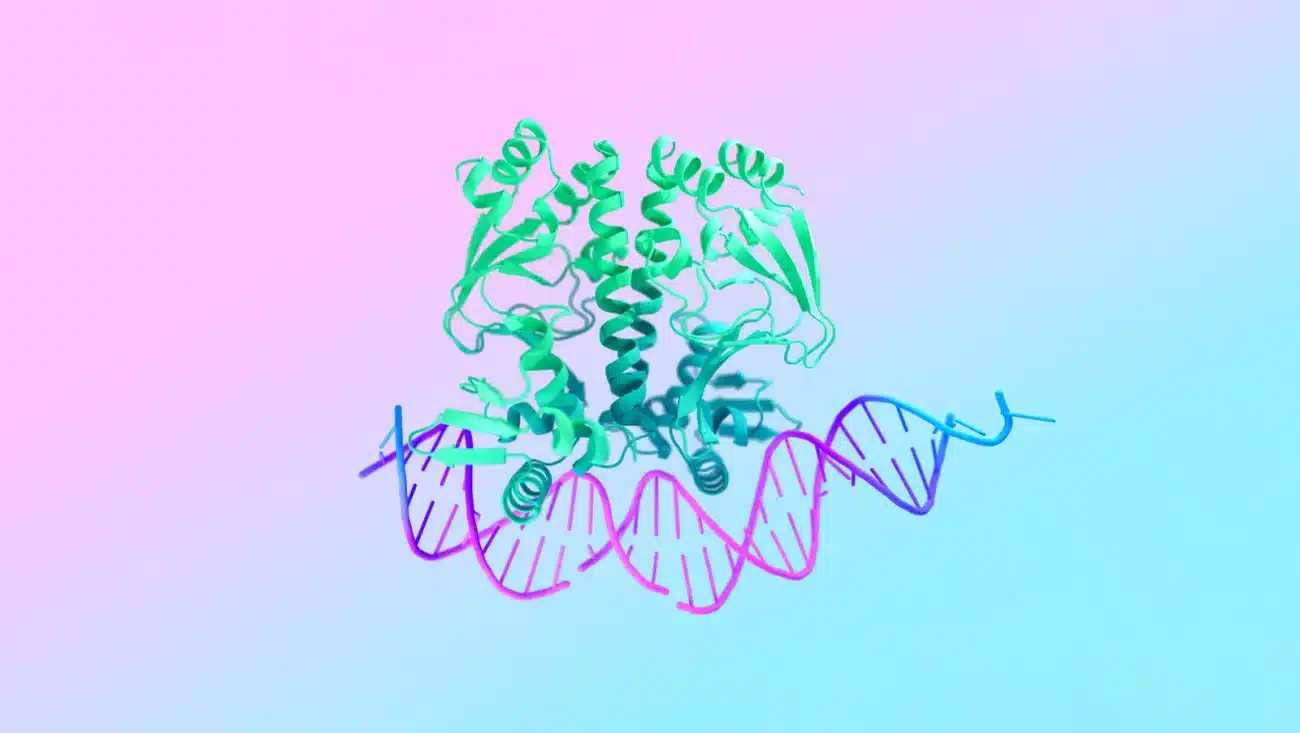

Mukesh Ambani-owned Reliance Technologies is going big on AI. Last week, it announced a major partnership with NVIDIA to develop India’s foundational large language model trained on the nation’s diverse languages. NVIDIA will provide access to Reliance with GH200 Grace Hopper Superchip and NVIDIA DGX Cloud for exceptional performance.

The partnership points towards Reliance’s big ambition to emerge as a key player in the AI space and later in the semiconductor industry. The Indian conglomerate is also heading in the same direction. Last year, it was reported that Reliance, along with HCL Technologies, was planning to acquire stakes in the International Semiconductor Consortium (ISMC), a collaborative effort between UAE’s Next Orbit Ventures and Israel’s Tower Semiconductor.

The fate of the ISMC consortium was dependent on Intel’s acquisition of Tower Technologies, however, since Intel’s attempt to acquire Tower did not materialise within the expected timeframe, it is highly probable that the ISMC consortium has been dissolved or is no longer viable. Now, Reliance Industries is possibly in talks with a foreign chipmaker to set up a semiconductor fab in the country, Reuters reported.

So far, the name of the foreign chipmaker that Reliance is in talks with, has not been revealed. But given that Reliance was already in discussions to acquire stakes in the ISMC consortium, it would be logical for them to pursue the acquisition of Tower Technologies, especially considering the Intel deal did not materialise.

Reliance should look at Tower

Mampazhy told AIM that Intel’s inability to acquire Tower Semiconductor presents an opportunity for Indian businesses like Reliance that are looking to expand into the semiconductor space. The primary reason Reliance should look at acquiring Tower Semiconductor is solely because it is available for grabs.

Intel’s deal to acquire Tower was valued at USD 5.4 billion. At this price point, the acquisition will give Reliance Industries an established semiconductor manufacturing company, allowing it to enter the semiconductor industry with an existing infrastructure, expertise, and customer base.

Mampazhy believes that given Reliance’s financial might, it can opt for buying out Tower Semiconductor and open a branch fab in India. “Another viable option is for Reliance to acquire stakes in Tower and accompanied by an agreement from the company to make substantial investments in the Indian semiconductor industry,” he said.

Last year, Tower Semiconductor, as part of the ISMC consortium, entered into a Memorandum of Understanding (MoU) with the Karnataka government to establish a 65nm technology node analog fabrication facility. But the plan was shelved after the fall of the Intel-Tower deal. Considering Tower Semiconductor’s prior interest and the dissolution of the ISMC consortium, Reliance Industries might rekindle Tower’s initial enthusiasm for establishing a presence in India.

Tower to benefit as well

Not only Reliance but also Tower Semiconductor stands to gain substantially from a prospective arrangement with Reliance or any other Indian enterprise, for that matter. If Tower is unwilling to sell, an alternative path for Tower could be to become a technology partner.

For Tower, to become a technology partner, it won’t require a significant investment, given that 50% of the cost will be borne by the central government and state governments would chip in with another 20-25%. If we assume, the cost of setting up a fab, in partnership with Reliance, is USD 4 billion, it would mean Tower will be making an investment of a few hundred million.

Moreover, another less likely option is for Tower to become a technology provider, instead of a technology partner. “The concept of technology providers involves a technology transfer agreement where ongoing support is provided until the new fabrication facility integrates the technology successfully. A licensing fee is levied for this service. After the facility becomes operational and the technology functions effectively Tower Semiconductor disengages. However, the Indian government seems less inclined towards this approach,” Mampazhy said.

Reliance could also take SCL

Interestingly, in the past, Tower Semiconductor has helped with the upgrade of the Semiconductor Laboratory (SCL) to 180 nm technology. SCL, which is currently under the Ministry of Electronics and IT (MeitY), is renowned for developing chips used in different ISRO missions such as Chandrayaan and Mangalyaan. “SCL in India stands as one of the rare semiconductor manufacturers that can proudly claim their chips have journeyed to the Moon and Mars,” Anshuman Tripathi, member of the National Security Advisory Board (NSAB), previously told AIM.

Last year, the Union Cabinet approved a modernisation plan for SCL and is currently searching for a suitable candidate to manage India’s sole existing fab. Reliance Industries could potentially be a strong contender for taking over SCL, especially considering Mukesh Ambani’s affiliations with the BJP government, which could work to Reliance’s advantage in this scenario. Mamphazy too believes Reliance could potentially be a good candidate to take over the SCL. “Tower did the technology transfer to SCL 10-15 years back and so the same Process Design Kit (PDK) applies for both fabs and so SCL can act as a ‘second source’ for Tower’s 180 nm orders,” Mamphazy said.

Moreover, the 180 nm semiconductor fabrication line at SCL offers the capability to manufacture a range of products, including microcontrollers, sensors, and communication chips. These components have diverse applications, potentially benefiting Reliance Industries, particularly in sectors such as telecom, energy and electronics.

The Reuter report also stated that one of the major reasons Reliance is foraying into semiconductors is to address its supply chain needs. “More than anything else, SCL will be a perfect opportunity for Reliance to ‘get its hands dirty’ on how to run a fab in India,” Mamphazy said.