|

Listen to this story

|

Earlier this week, Union finance minister Nirmala Sitharaman addressed the Parliament, fending off a debate on rising prices. Giving speculation a breather on the lurking US economic slowdown, the minister declared that there was ‘no question’ of India entering recession or stagflation. In a Rajya Sabha session that ran up to two hours, Sitharaman described the country’s macroeconomic fundamentals as ‘perfect’. Admitting that there was inflationary pressure, Sitharaman said that efforts were being made to contain retail inflation under 7%.

Sitharaman based her conclusion on a survey by economists at Bloomberg. The report emphasised that most Asian economies would remain sheltered from the impending recession, with the exception of Sri Lanka which is smack in the middle of political turmoil. It raised the expectations of a potential recession for countries like Taiwan, Australia, New Zealand, Australia and the Philippines. For the Indian economy though, the forecast stood at zero.

Declining margins, Higher costs

The IT sector as a whole has pushed against the fears of a recession here. Often considered as the bellwether for Indian IT, Infosys gave a strong forecast of 14-16% annual revenue growth in their first quarter. This forecast was even higher than the 13-15% projected previously. Chief Salil Parekh piggybacked the higher forecast on a solid pipeline of deals for the second-half of the year.

However, there have been small, but definitive signs of a slowdown. The link between Indian IT and the US economy is too deep for one to remain unaffected by the other. Biggest Indian IT firms like TCS, Infosys, Wipro, HCL Technologies and Tech Mahindra have a 50% exposure to the US economy with the Indian IT industry generating 40-78% of their revenues in dollars.

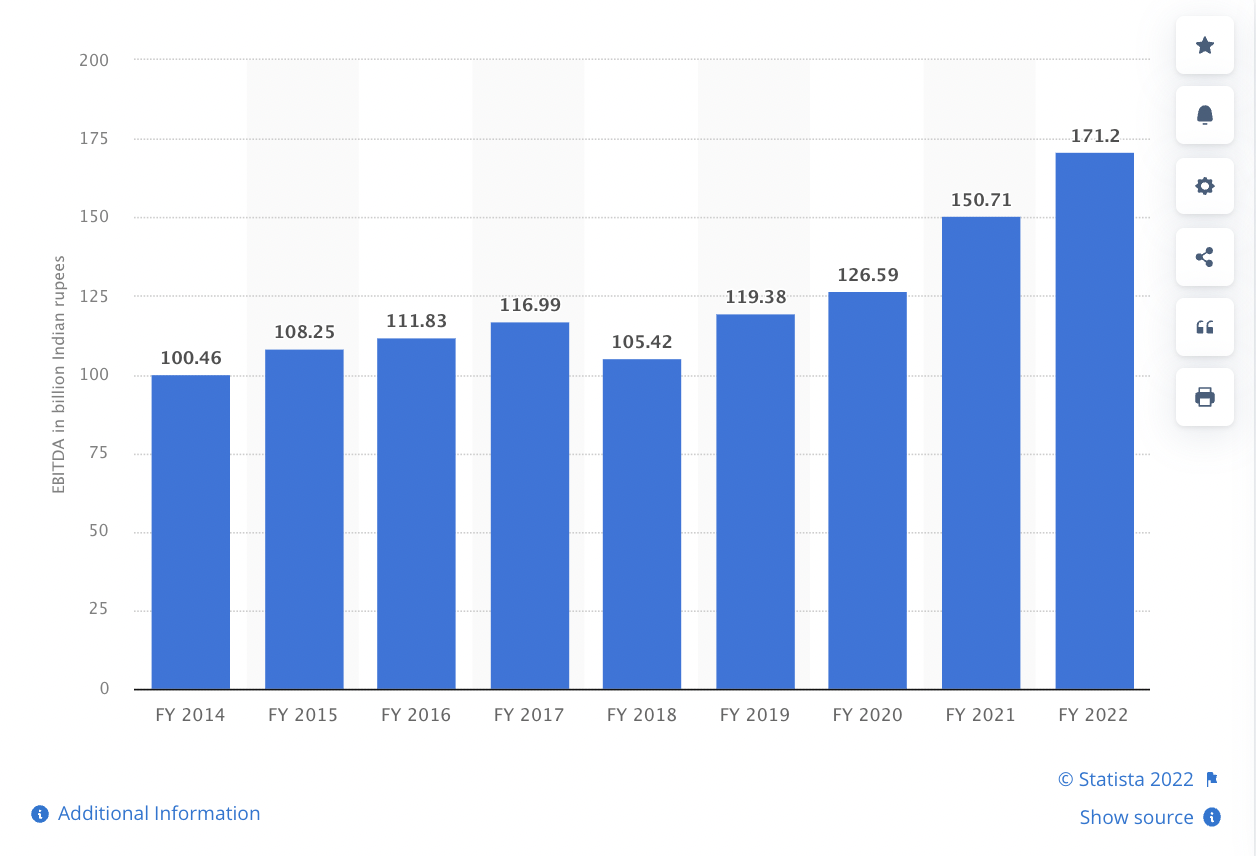

Wipro saw its earnings before interest and taxes (EBIT) margins fall the hardest since 2018. This was mostly because it spent more on trying to hire and retain employees. Until the June-ended quarter, Wipro had hired over 15,000 new employees, of which, 10,000 were freshers.

HCL Technologies, which put the brakes on hiring by cutting net hiring by 2,000, saw their lowest EBIT margins in the recent past. Even TCS, which had the highest operating margins of 23.1 percent, dipped 2% from last year’s quarters. Research analyst Nomura declared this “flattish in terms of year-over-year growth”.

Infosys, too, posted a lower operating margin like its rivals, TCS and Wipro. For the current quarter, it stood at 20 percent which was 3.7 percent less than the previous year and 1.5 percent less than the last quarter. The total value of the deals made by the company in this quarter was USD 1.7 billion, considerably lower than the USD 2.3 billion made in the previous quarter.

A spillover effect

The US job market has become sombre with multiple reports of job cuts starting to pour in. In many instances, a spillover into the Indian market is inevitable. A couple of days ago, The Information reported that Oracle had started firing employees to reduce costs by USD 1 billion. The report also mentioned that layoffs in India, Europe and Canada are to be expected in a few months.

Pareekh Jain of research firm EIIRTrend said, “Yes, there is a chance that the Indian IT industry might see the impact of the downturn. Enterprises are facing a double whammy. On one hand their costs have risen due to a rise in commodity and energy prices, and on the other hand their demand is declining because of inflation. It might mean a slowdown in discretionary IT spending by some clients. This may also lead to slow decision-making in signing new deals. It will impact new orders.”

However, Jain added that the empirical effect of this can only be measured in the orders in the second-half of FY 2023 and the decline in revenue by FY 2024.

When asked if traditional IT companies have a higher chance of being cushioned from the recession, Jain explained, “It will depend upon the impact of recession on companies’ clients. Every IT company is likely to get impacted depending upon their exposure to sectors which will be impacted in a high-inflation environment such as non-essential retail, travel, and manufacturing, among others.”

Jain clarified that in hindsight, the impact of a recession will possibly be seen for a short period, followed by a boom in Indian IT as the value proposition of India for IT talent at scale is intact.

Slow global funding

Another obvious consequence of a global recession is lesser money being pumped into startups. A report by Tracxn Technologies stated that startup funding in the Indian market had plummeted by a massive 33 percent in the second quarter to USD 6.9 billion from USD 10.3 billion in the first quarter. The steady stream of money coming in from global investors like Sequoia Capital is drying up due to the turbulence in financial markets. Consequently, a decline was seen in the number of startups attaining unicorn status with just four unicorns emerging in the second quarter.

Lower forecast in hiring

Leading recruiters across the country have rang the warning bells of a slowdown in tech hiring for the upcoming quarters. In a report by The Hindu, Vidya Sagar Gannamani, chairman of recruitment firm Adecco India, stated, “Owing to global macroeconomic factors like geopolitical uncertainty and expected economic slowdown in many markets, we are expecting a slowdown in tech hiring in India in the coming quarters.”

Maybe the storm isn’t as big as the 2008 financial crisis, and neither are India and the US on the same boat this time, but it is likely that the waves would be felt here too.