Over the last few years, financial institutions have achieved exponential growth, driving innovation in the sector by building enterprise-wide analytics capability, that is now woven into the key business processes throughout the organisation. Much of the growth in analytics jobs is also credited to the fintech boom in India – led by top digital payments firms Paytm and PhonePe that leverage data analytics to not only digitize cash payments but also scale the reach of their customers.

The emerging fintech ecosystem in India has created a slew of opportunities in data analytics and AI space. On the other end of the spectrum is tremendous innovations happening in the Financial Services (FS) organisations space with banks and financial institutions applying advanced analytics and machine learning across the entire business model. Today, banking and financial services industry has adopted analytics across three broad functional areas – customer satisfaction, risk management and operations analytics.

Our annual study done by Jigsaw Academy and AIM captures the data-heavy financial ecosystem in India and dives into the talent market — unpacking key trends across jobs, salaries, hiring trends, top financial companies in India hiring financial analytics talent and the AI talent divide across companies. The research also reveals what’s hampering the growth and innovation story is the big talent challenge facing financial institutions.

Key Trends

- The size of the analytics industry in the financial sector is currently estimated to be $1.2 billion (annual) in revenue

- Currently, there are approximately 60,000 data science and financial analytics professionals in India, working in the finance sector

- According to our research, 7,000 freshers were added to the financial analytics workforce in India in 2018

- Mumbai continues to be the financial hub with 33% analytics professionals working in the financial capital

- The median financial salary is India is INR 13.4 lakh across all experience level and skillset

- On average, the entry-level salary for financial analytics professionals is less than INR 6 lakh while 3% of financial analytics workforce takes home more than INR 50 lakh

- Women participation is skewed with only 27% of women making up the financial analytics workforce in India

- Top skills FIs look for are Data Analytics, Marketing Analytics, Predictive Modeling, Business Analytics, SAS, Campaign Management & Business Intelligence

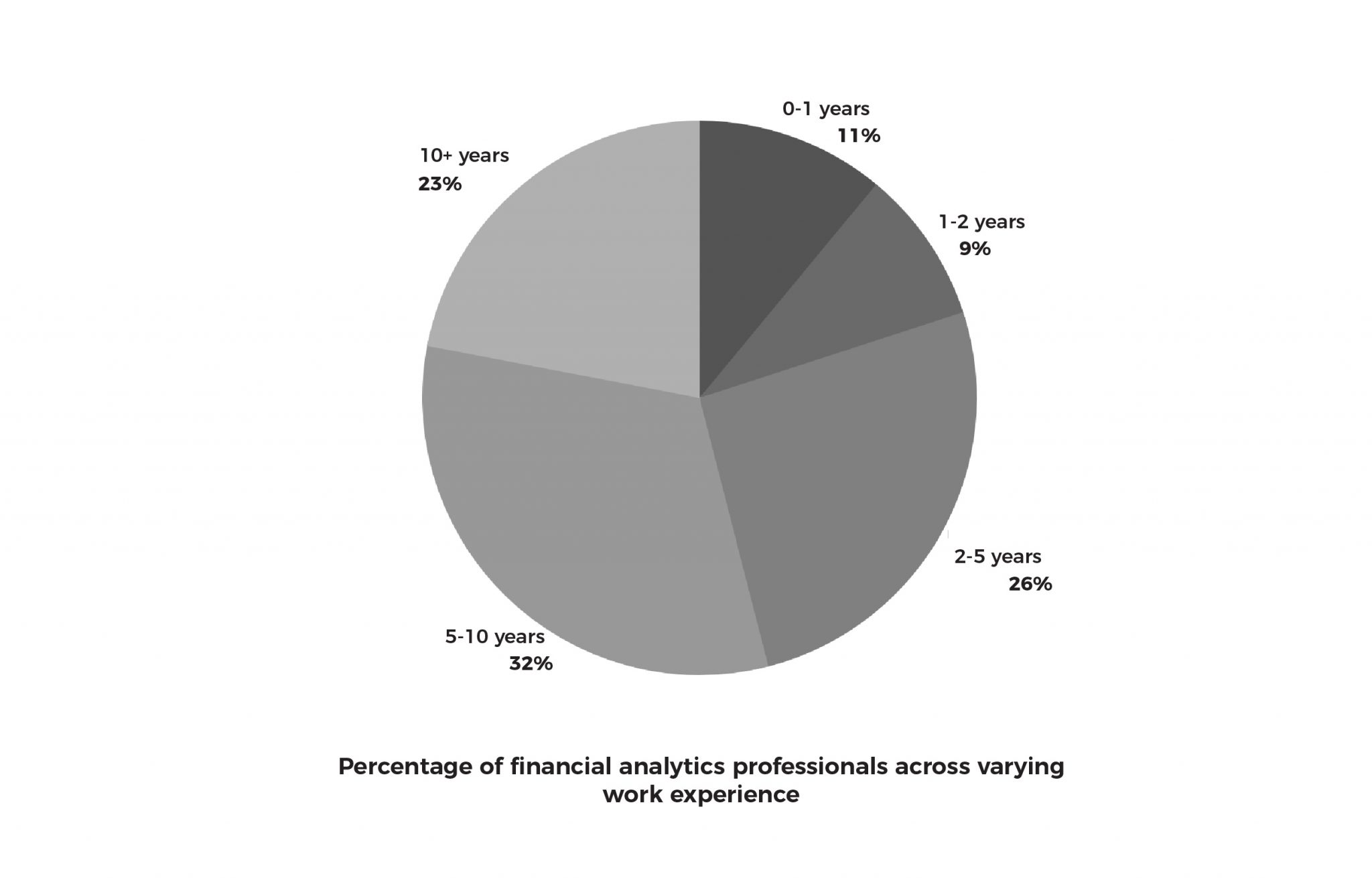

Work Experience Of Financial Analytics Professionals in India

- The average work experience of Data Scientists in financial industry in India is 7.2 years, marginally lower than the overall average number of 7.9 years

- Around 7,000 freshers were added to the financial analytics workforce in India this year

- Almost 45% financial analytics professionals in India have a work experience of fewer than 5 years, same as last year

- 23% of financial analytics professionals have more than 10 years of work experience

- Women participation in financial analytics workforce remains low – only 27% of financial analytics professionals constitute the workforce

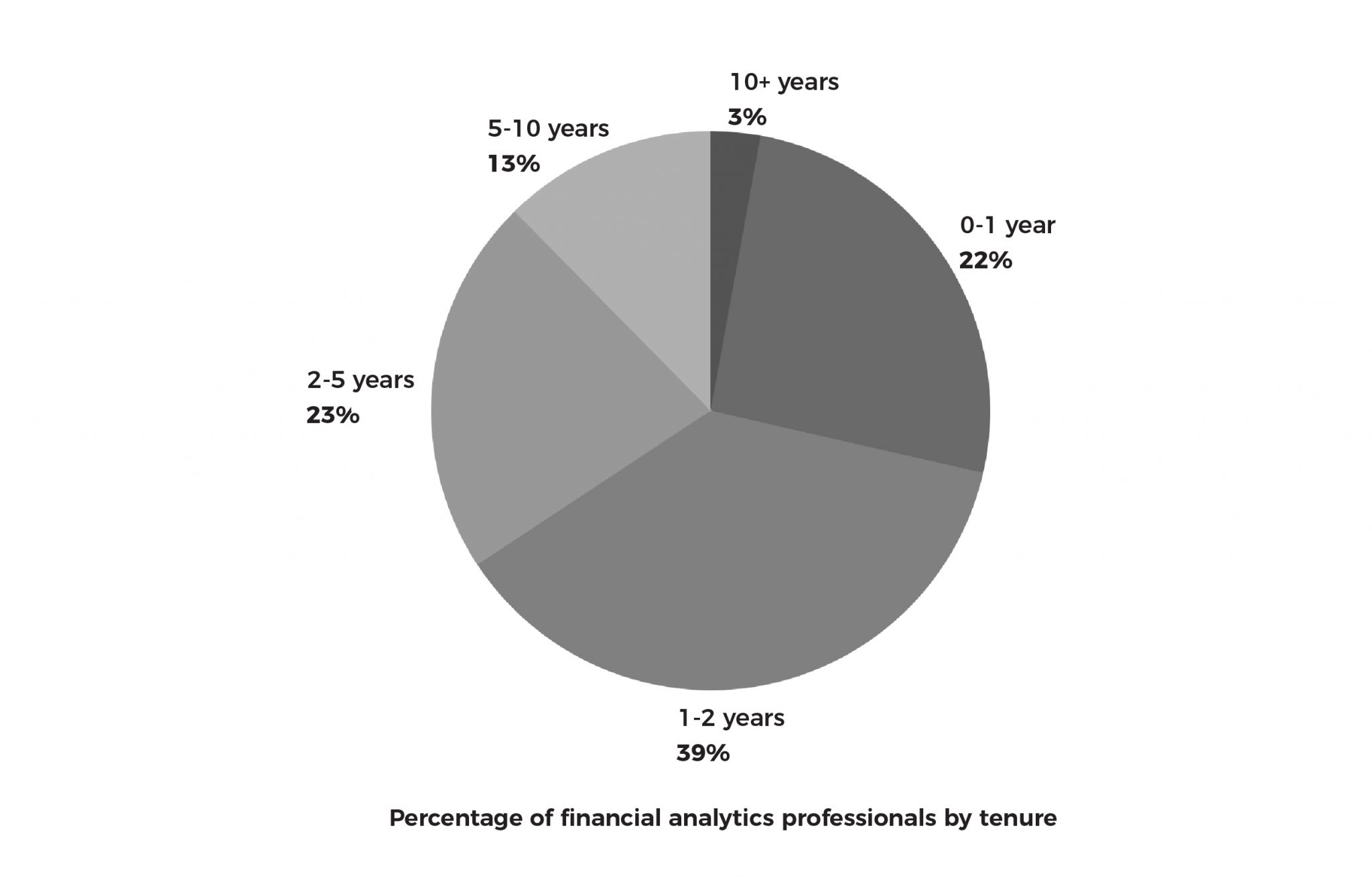

Tenure Of Analytics Professionals

- On average, financial analytics professionals in India have joined/transitioned to their current role in the last 3.1 years

- 61% financial analytics professionals in India transitioned to their current role in the last 2 years

- Just 16% stay in the same role for more than 5 years

Leading Cities Hiring Financial Analytics Professionals

- Mumbai leads the cities in terms of the size of ecosystem. 33% of financial analytics professionals in India are working in Mumbai

- This is closely followed by Bangalore at 24%

Top Financial Analytics Companies in India

- The 10 companies that employ the maximum number of financial analytics professionals in India are HSBC, American Express, ICICI Bank, Moody’s Analytics Knowledge Services, Citi, JPMorgan Chase & Co., HDFC Bank, Axis Bank, EY & Barclays

- Close to 250 companies in India work on financial analytics in some form. This includes a small number of companies into products and a larger chunk offering either offshore, recruitment or training services

- Moreover, the number of vertical financial analytics companies in India is less as compared to North America and Asia Pacific. India accounts for just 7% of global Analytics companies

Company Size

- On average, Indian financial analytics companies have 340 employees on their payroll

- Almost 88% of financial analytics companies in India have less than 200 employees.

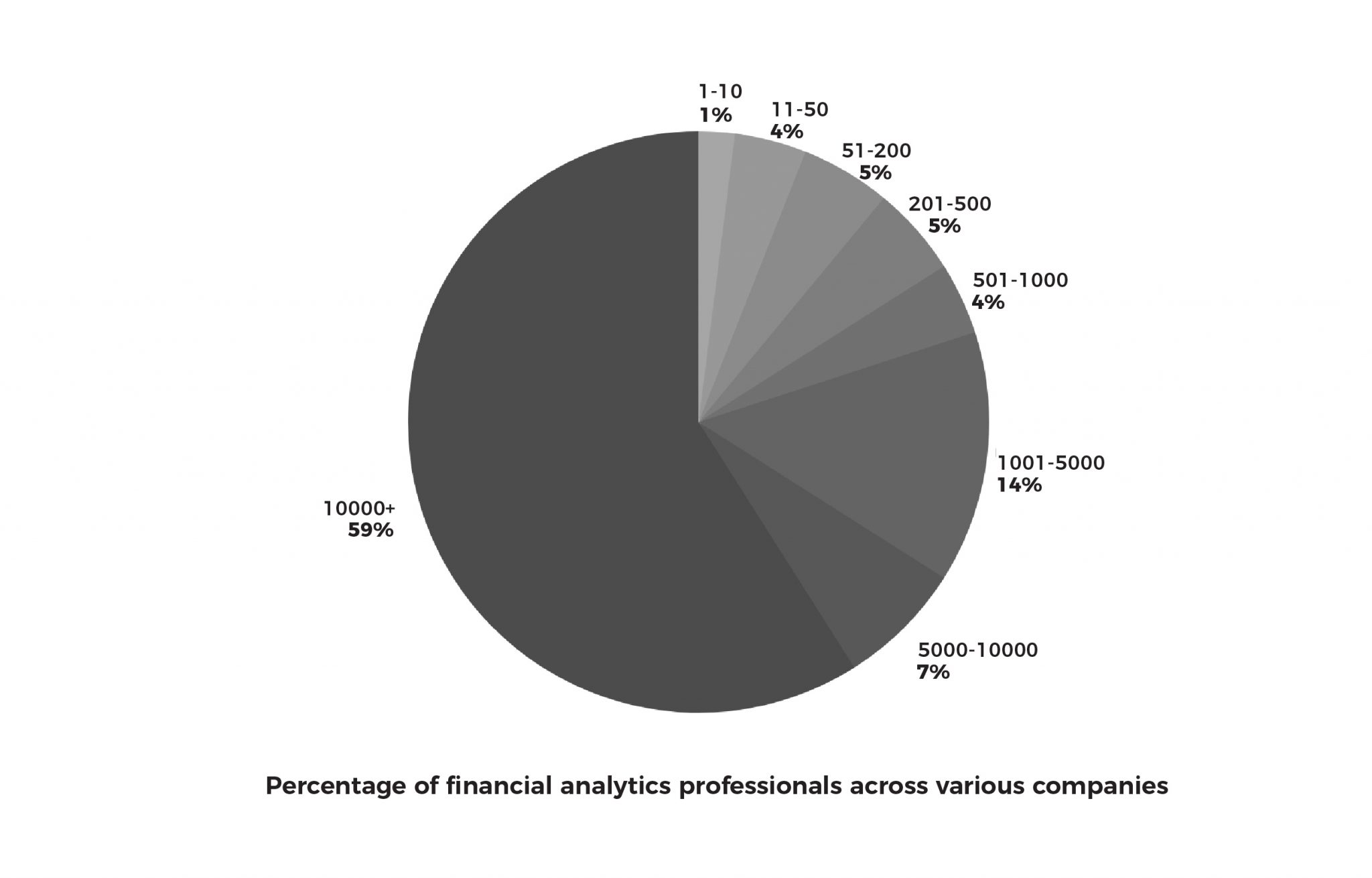

Analytics Talent Divide Across Companies

- Almost 59% of financial analytics professionals in India are employed with large-sized companies(with a total employee base of 10k+)

- Mid-size organizations (total employee base in the range of 200-10K) employ 30% of all financial analytics professionals in India

- Startups (less than 200 employee base) employees form 11% of financial analytics professionals in India

- A large percentage of financial analytics professionals are absorbed by large service providers or MNC captive units

- This is also a clear indication of the financial analytics talent divide between enterprises and startups in India, which will only continue to widen further

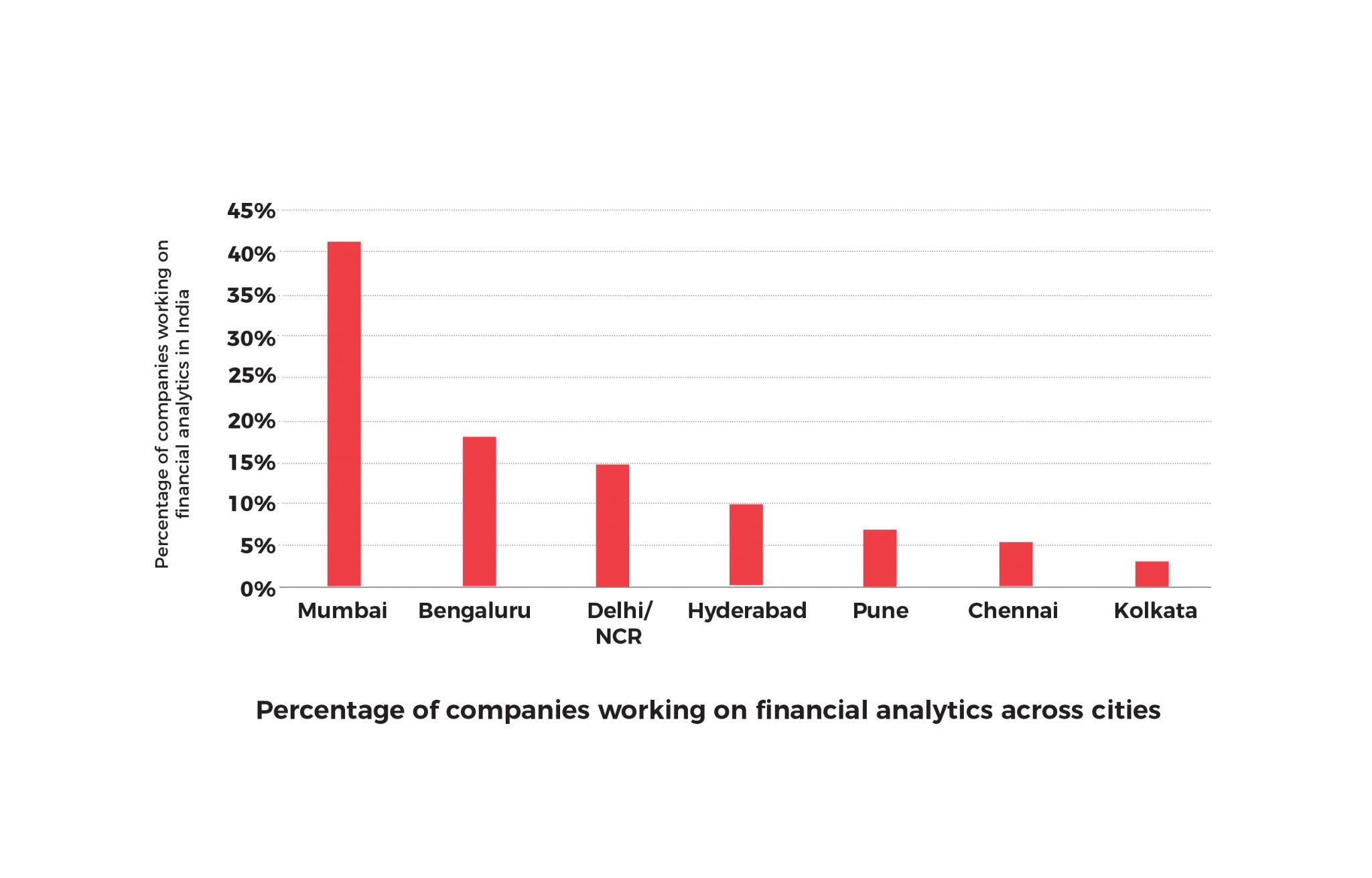

Financial Hubs in India

- 41% of all companies that work on financial analytics in India are based out of Mumbai, the financial capital of India

- This is followed by Bengaluru at 18%

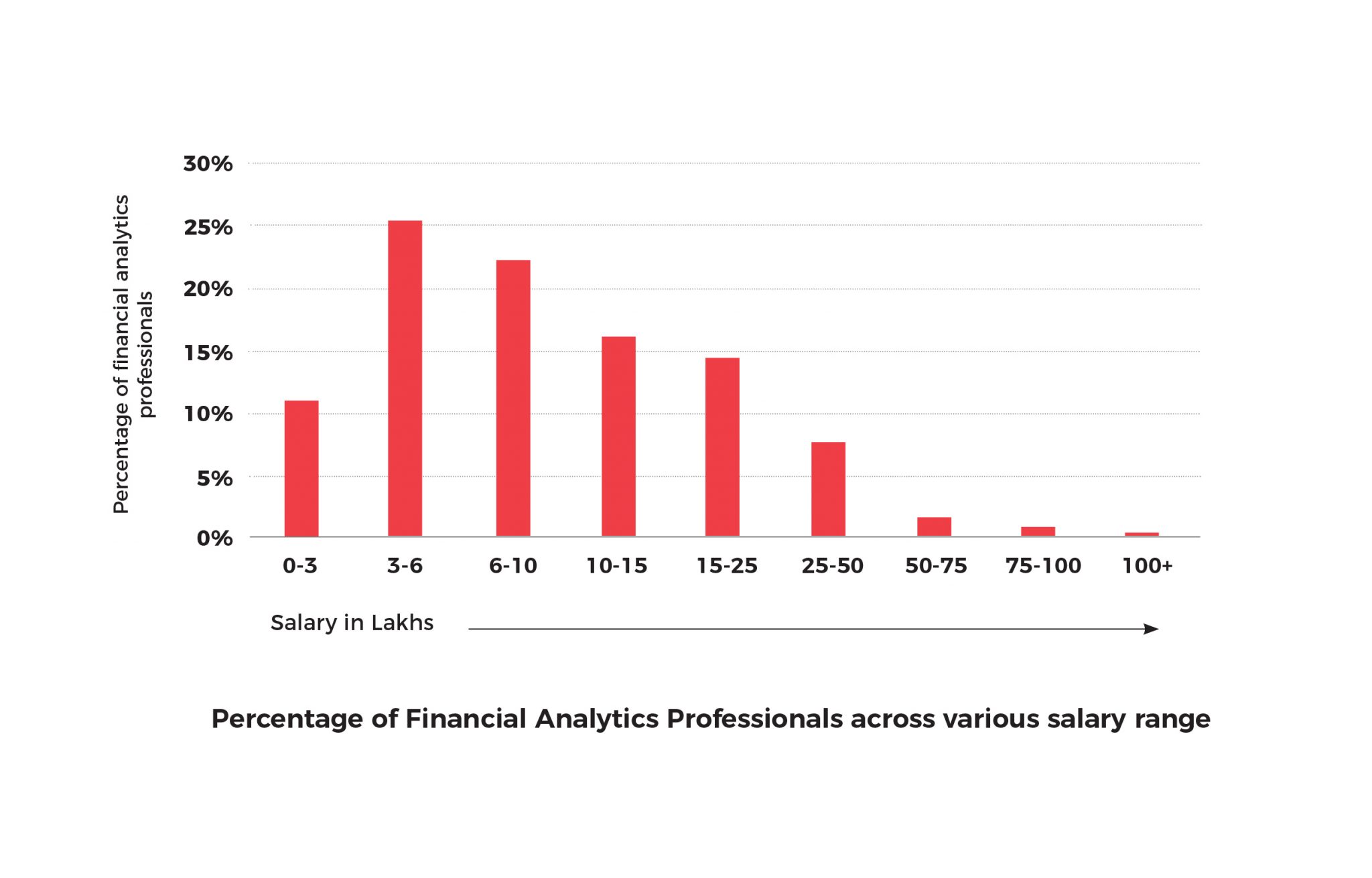

Financial Analytics Jobs & Salaries in India

- The median financial analytics salary in India is INR 13.4 Lakhs across all experience level and skill sets.

- Around 36% of financial analytics professionals in India have an entry-level salary of less than 6 Lakh

- Almost 3% of financial analytics professionals in India command a salary higher than 50 lakh

- While it is difficult to ascertain the exact number of open financial analytics job openings, according to our estimates, close to 36,000 positions related to financial analytics are currently available to be filled in India

- 10 leading organizations with the highest number of financial analytics openings this year are – Fidelity Business, eClerx Services, Bajaj Allianz, Morgan Stanley, RBS India Development, HDFC Bank, Ernst & Young, Invesco, PwC & ICICI

- The top skill sets that financial analytics employers are looking for are Data Analytics, Marketing Analytics, Predictive Modeling, Business Analytics, SAS, Campaign Management & Business Intelligence

Financial Analytics Jobs By Cities

- In terms of cities, Mumbai accounts for around 28% of financial analytics jobs in India.

- Delhi/NCR comes very close second contributing 28% jobs in India.

- Approximately 21% of financial analytics jobs are from Bengaluru

Key Takeaways

Innovation Drivers in the Financial Ecosystem

- As banks and financial institutions transform to become data-driven enterprises, digital technology will soon become the backbone of FIs

- In order to build a sophisticated analytics capability, banks and FIs are now investing along several important dimensions – technology infrastructure, strengthening processes and people

- Another key area emerging is banks and major FIs are setting up dedicated analytics and AI CoEs in strategic partnerships with fintech and knowledge mentors to drive the innovation story forward

- Increasingly, the financial industry has started leveraging in-built analytics, machine learning and AI capabilities for specific use cases to drive profitability and growth

Rethinking Talent Strategies

- The key traits financial institutions look for when hiring talent are: quantitative and technical skills as well business acumen to generate insights. The core capabilities required are ability to use statistics, quantitative analysis and information-modelling techniques to make business decisions

- There’s also a fundamental rethink in terms of people strategy with most FS organisations in India fostering a culture of innovative thinking and embracing hacks for hire to bolster their human capital.

- In order to meet the growing talent demand, financial organisations are investing in developing robust learning modules and skill development programmes to reskill staff

- Most leading financial organisations are now taking an active step and partnering with third-party institutions to train and source talent. This is in a way, is paving the way for talent exchanges

Corporate Training As A Key Indicator of Changing Trends in the Financial Sector

Way Forward

Judging the impact of artificial intelligence and automation on job roles and skill-set, and how it will redesign jobs frameworks, (for eg. AI’s robo-advisors have replaced financial advisors), FS organsiations are now doubling down on closing the talent gap by collaborating with leading institutes and stakeholders to even out the supply and demand gap. In an automated world, financial organisations have recognized the changing skills demand and in order to keep pace with the market, organisations are teaming up with stakeholders to develop tailored solutions for talent management and develop work-ready workforce.

Here’s the complete Report