|

Listen to this story

|

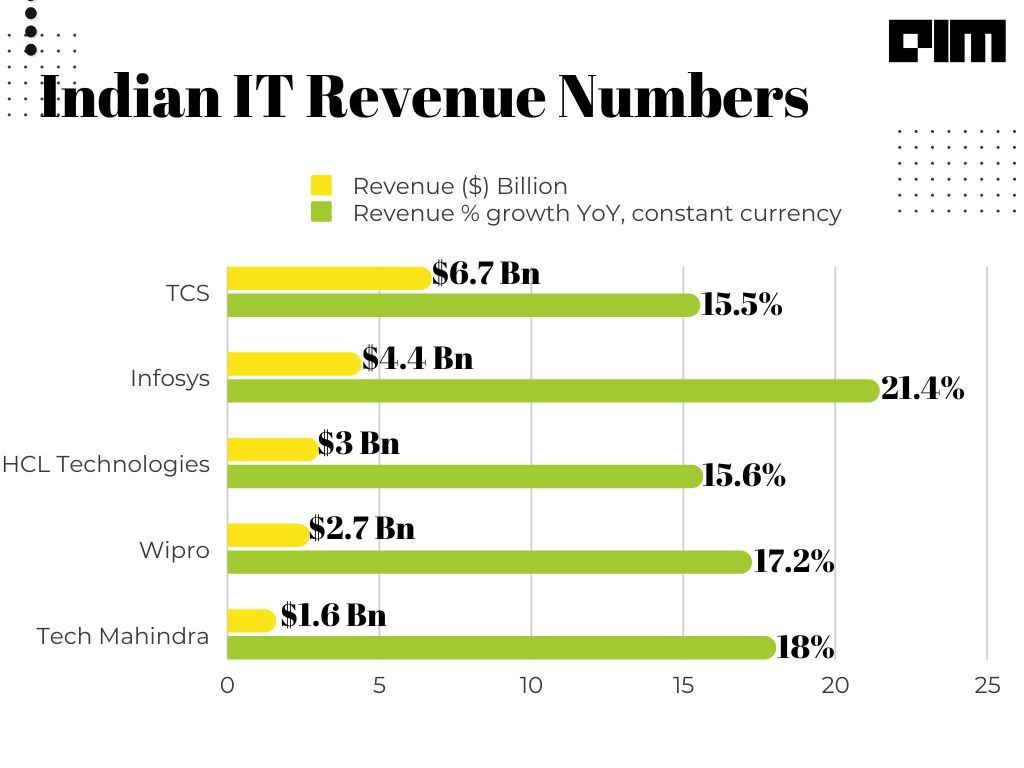

The revenue numbers of top Indian IT companies for FY-23 Q1 paint a vivid picture; in the latest quarter, Infosys is ahead of most of its peers, showcasing 21.4 per cent year-on-year growth, followed by Tech Mahindra and Wipro with 18 per cent and 17.2 per cent revenue growth respectively.

Profit dips

Infosys witnessed double-digit growth across all its business segments in constant currency terms, with several growing at 25 per cent or higher. The company’s digital business alone accounted for 67 per cent of overall revenues, growing at 37.5 per cent year-on-year in constant currency.

Based on the robust Q1 results for the current financial year and visibility on orders, Infosys has raised its revenue guidance to 14~16 per cent, from 13~15 per cent. However, it saw a dip in net profit, below expectations at INR 5,360 crore, up by 3.2 per cent year-on-year, but was down by 5.7 per cent sequentially. That was because of higher talent costs, noted the company.

With a strong order pipeline, Infosys is aggressively looking to capture a larger market share, driven by its Cobalt cloud capabilities and service offerings. At the recent earnings call, Infosys chief Salil Parekh said that the company is focusing on the growth areas in digital and cloud, alongside cost areas through automation and AI.

Further, Parekh said the strong growth they witnessed in the current quarter would lay a robust foundation for the year ahead. He said that the growth continues to remain broad-based across segments, service lines, and geographies. The company currently has a strong presence in the US and Europe markets, with 18.4 per cent and 33.2 per cent growth, respectively.

In FY-23 Q1, Infosys signed about 19 deals with a large total contract value (TVC) of $1.69 billion. This consists of 50 per cent net new work. Additionally, the company saw an increase in customers this quarter compared to the previous year. For instance, the number of $50 million customers increased by ten to 69, the number of $100 million customers increased by four to 38, and the number of $200 million customers grew by six in the last year.

Tech Mahindra ended its first quarter in this fiscal year with a revenue of $1.6 billion, up 3.5 per cent sequentially and 18 per cent year-on-year. The company’s profit margin for the quarter was 11 per cent, which saw a dip of 220 basis points due to higher salaries, sub correlated costs, high deal transition costs and others.

Wipro also noticed good revenue numbers, at 2.1 per cent revenue growth sequentially and 17.2 per cent year-on-year. “We grew 15 per cent plus YoY across all markets,” said Thierry Delaporte, CEO at Wipro, at the earnings call. The company has raised its revenue guidance to 3~5 per cent in Q2, which would translate to growth, to be precise, 11.6 per cent to 13.8 per cent year-on-year in constant currency terms. “With this guidance for Q2, we will comfortably grow in double digits for the fiscal year 2023,” added Delaporte.

The outliers

TCS and HCL Technologies, on the other hand, saw year-on-year revenue growth of 15.5 and 15.6, clocking revenue of $6.7 billion and $3 billion, respectively.

However, TCS remains top of its game in terms of revenue. The company recorded continuous growth momentum in BFSI with 13.9 per cent year-on-year growth, clocking in at $2.18 billion of quarterly revenue. On the other hand, retail and CPG saw 25 per cent YoY growth, reaching $1.08 billion in revenue.

HCL Technologies’ revenue grew 2.7 per cent sequentially and 15.6 per cent year-on-year in constant currency. The company said that its services business continues to have robust growth momentum—growing at 2.3 per cent QoQ and 19 per cent YoY in constant currency. In its financial guidance, HCL said that revenue is expected to grow between 12~14 per cent in constant currency.