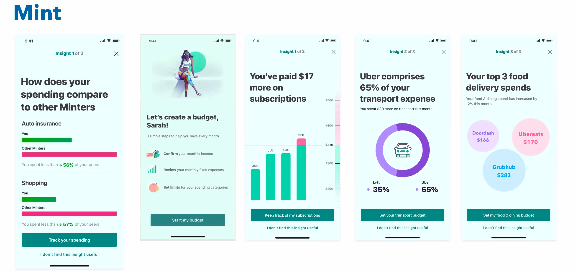

At the fourth edition of Machine Learning Developers Summit (MLDS), Intuit’s Sidharth Kumar discussed in-depth, the features, metrics, challenges, and potential of developing a personal financial management app such as Intuit Mint (formerly known as Mint.com), targeting users in the US and Canada.

As a principal data scientist at Intuit, Kumar is responsible for augmenting Intuit’s personal finance platform, Mint. At Intuit, he has helped launch several successful AI-based offerings, including cash flow forecasting, automated subscription discovery, automated budgeting for savings maximisation, transaction categorisation, anomalous spend detection, and automated customer cohorts.

What is Mint?

With 4 million active users, Mint helps its users manage spending, budgeting, subscriptions, etc. As a personal financial management app, Mint has over a decade of user transaction data of tens of millions of users. The transaction data include bank accounts, money management accounts, retirement or investment accounts, credit card, trading, and other financial services. Besides these, other data also include clickstream, demographic, geolocation, derived features like aggregates and sequences.

Making decisions and predicting outcomes using these data is easier said than done. Kumar explained the strong and growing competition in the space, coupled with challenges like data completeness, dynamic nature of transactions data, user fatigue, and legacy systems.

“We had to deal with a lot of legacy systems, which we migrated over to AWS,” said Kumar. Further, they used EC2 inference nodes for real-time scoring (tens of millions of transactions scored per day), along with EMR or clusters of nodes for better processing (train up to 100s and millions of ML models within a few hours or several x 1000 core clusters), on-device or federated learning (iOS), etc. For data storage, Intuit Mint currently uses Hive, DynamoDB, Redshift, S3. In addition, the company leverages Python, Pyspark, R, SQL, and SWIFT (OS) in terms of programming languages.

Metrics

The essential business metrics include the voice of the customer (VoC), retention, click-through rate (CTR), net promoter score (NPS), profit and loss (PnL), relative rankings, and other capabilities with respect to competition.

The AI metrics include: accuracy (cash flow); completeness (recurrent transaction discovery); precision, recall and AUC like credit default and anomaly detection; cross-entropy (categorisation); custom (MCMC) for optimisation for savings; AIC, KL-divergence (particularly clustering) etc.

AI potential ubiquitous extensions

“Fintech is the next big thing. So, we all know that. The next thing is automating customer profiling and relative spending ranking,” said Kumar.

The potential (along with techniques used) use cases include credit default/late payment prediction (logistic), cash flow forecasting (SVMs), anomaly detection/large transaction alert (GB), transaction categorisation (NN), engagement maximisation via path recommendation (reinforcement), merchant switching (GMM+MAB), spend recommendations (reinforcement), trending patterns and break-down analytics of user or overall (statistical), financial wellness improvement (MAB), CLTV (survival), and marketing optimisation and ad-targeting (NN).

Kumar explained the techniques behind automated customer cohorts and relative spending ranking (autoencoders + GMM), bills or subscription identifications (FFT), can I afford this? (RF), and automated budgeting (ensemble + custom optimiser).

“If we provide our customers with a simple way to ask Mint if they can afford a certain purchase in a certain category or merchant, then Mint will be able to provide advice based on the users’ current spending pattern, which will help them make quick decisions on spending,” he said. Mint uses on-device RF (Swift, CoreML, iOS) for feedback learning and a multivariate statistical model for seeding.