|

Listen to this story

|

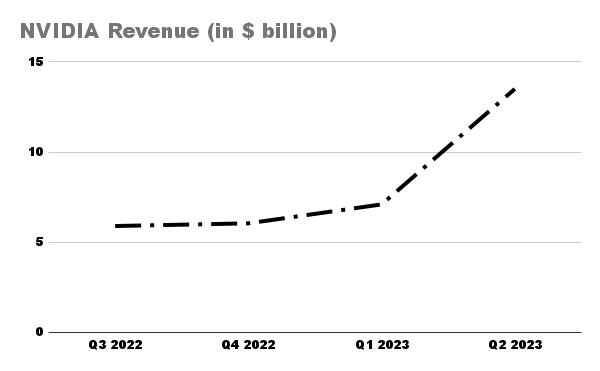

NVIDIA is poised to ascend first in the semiconductor world in 2023, as per findings from SC-IQ. The report indicates that NVIDIA is on track to achieve a remarkable revenue of nearly $53 billion in the fiscal year 2023.

NVIDIA, builds products like GPUs using semiconductors that are manufactured by original equipment manufacturer (OEM), TSMC.

The report underscores NVIDIA’s extraordinary growth, with its projected revenue for the current year nearly doubling the figures from 2022, which stood at $26.3 billion. This surge is primarily driven by the soaring demand for NVIDIA’s processors, which are instrumental in fueling the ongoing AI revolution

Revenue Estimates for Third Quarter

NVIDIA posted a revenue of $7.1 billion in Q1 2023 and an all time high of $13.5 billion in revenue in Q2 2023. Analysts estimate that Q3 will generate around $16 billion. The revenue growth from the last four quarters is 31.6% and if this trend continues, the Q4 2023 revenue would be around $18 billion. This would be a combined revenue of $54 billion for NVIDIA in 2023 if the trend continues. This number supports the prediction of the SC-IQ report.

When it comes to generating income, the company has no doubt that “it has visibility into very strong orders into 2024,” according to Colette Kress, chief financial officer. The stellar performance in Q2 2023 was driven by its data centre business, which contributed almost 70%, as Meta, Amazon and Google gobbled up its next-gen processors.

The fire is hot for NVIDIA as the AI boom will require companies to buy next-gen chips. The orders for 2024 are already booked, where Chinese companies like Tencent, Baidu and Alibaba have already placed orders worth $5 billion. This indicates that the race won’t slow down and the aim of passing the $50 billion revenue mark isn’t that difficult.

“There is no meaningful competition for NVIDIA’s high-performance GPUs until AMD starts shipping its new AI accelerators in high volumes in early 2024,” said Raj Joshi, senior vice president for Moody’s Investors Service, in a statement.

It is worthy to note that the revenue of the chipmaker has beat every major analysts’ estimates for the past 4 consecutive earnings.

NVIDIA’s $1 trillion Market Cap

The AI-boom has not only contributed to NVIDIA’s books, but also recently helped the company reach a market capitalization of $1 trillion, allowing the stock to chill with the elite trillion’s dollar club of Apple, Microsoft and Amazon.

Shares of the chipmaker have surged almost 190% from the beginning of year, fueled by big tech companies spending millions of dollars on AI. Investors are excited about the potential that NVIDIA has, to generate profits. There are currently 44 analysts recommending to buy the stock, as they are bullish on the company.

Furthermore, NVIDIA’s foresight and strategic partnerships have already secured orders for 2024, including substantial commitments from Chinese tech giants like Tencent, Baidu, and Alibaba. This underscores the sustained momentum in the AI sector and positions NVIDIA favourably to achieve the coveted $50 billion revenue milestone.

Market Grows with New Partnerships

NVIDIA has forged over 200 global partnerships, spanning both industry giants and innovative startups, a move aimed at ensuring the supply of its chips and fostering pioneering technological advancements. This approach serves as a buffer against trade restrictions such as the recent ‘U.S. import ban,’ which imposes limitations on companies like NVIDIA and AMD from selling chips to the Middle East due to concerns over Chinese involvement.

Despite the potential revenue implications of such import bans, NVIDIA remains strong in its statement that the impact will not be “immediately material” on earnings.

It partnered with Infosys last week to help the IT giant develop generative AI solutions and train 50,000 employees in this space. In another groundbreaking partnership, Reliance and NVIDIA in the first week of September, have joined hands to build an AI infrastructure, faster than this fastest supercomputer today. They will also develop an LLM trained on India’s diverse languages.

NVIDIA’s alliance with Tata in the first week of September, is set to propel the growth of India’s AI landscape by focusing on the development of supercomputers, fortified by the potent GH200 Grace Hopper superchips.

Notably, NVIDIA’s collaboration with Google in the last week of August, aims to accelerate data science workloads through the construction and deployment of substantial generative AI models, exclusively catering to the needs of Google Cloud customers. These strategic alliances underscore NVIDIA’s unwavering commitment to advancing technology and securing its pivotal role in the AI revolution.

Mukesh Ambani-led, Reliance Industries Limited is in the pre-planning stage to start its own semiconductor company in India to address India’s supply chain needs and the growing demand for semiconductors, according to a report from Reuters. It to initially invest $300 million and will to partner with an OEM for a 30% stake, Reuters said.