|

Listen to this story

|

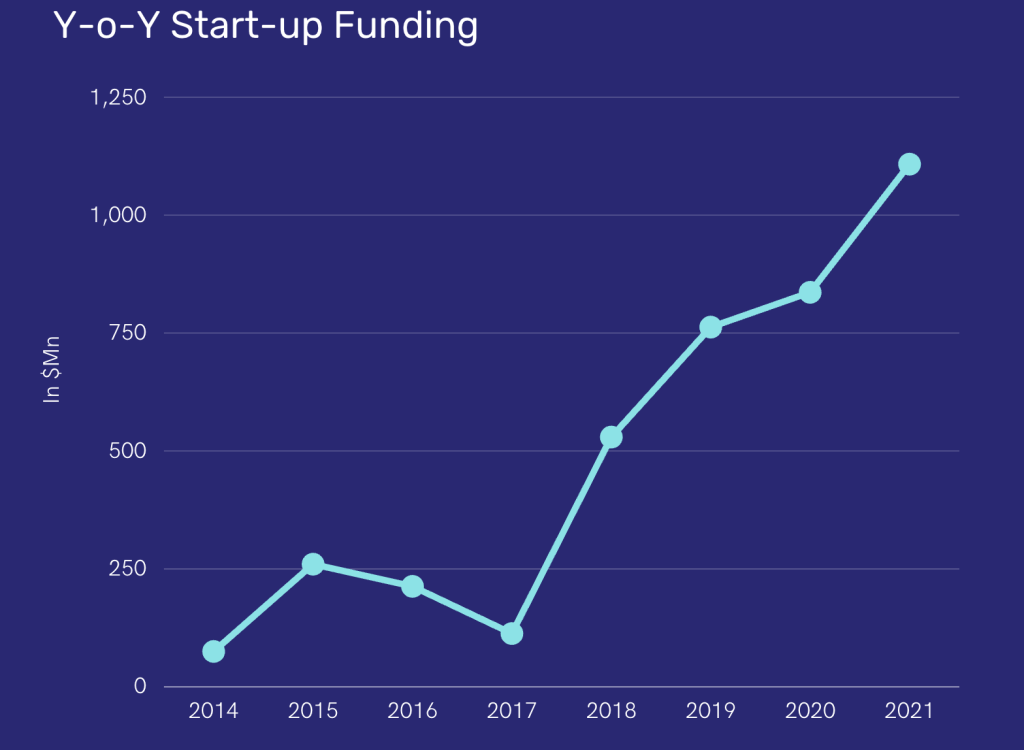

There has been a growing demand for AI and Analytics start-ups throughout the globe and India, which has been fuelled by various industries’ quest to serve their clients better and faster. The technology-driven start-ups using various emerging technologies – NLP, Computer Vision, ML, DL, Automation are at the forefront of helping industries with platforms like automation, Conversational AI, speech recognition, and others. The numbers reflect the demand, with start-up funding increasing to $1,108 million (by 32.5 per cent on a YoY basis) in 2021 compared to $836.3 million in 2020.

This detailed study examines the activities of AI and analytics start-ups in the Indian start-up ecosystem. It assesses the concentration of entrepreneurs on key technologies to solve the range of problems across different industries. It also examines the nature and position of investors’ capital allocation to various start-ups by looking at their investments into multiple industries through different Series of funding. Furthermore, it highlights the funding allocation by the month and cities. This report can be studied by entrepreneurs, analyst firms, industry policymakers, companies, DS experts. They all are leveraging these technologies to increase awareness of their stakeholders about ongoing trends in the industries, scale their businesses, and advance their careers. In addition, this report will assist stakeholders in gaining a better grasp of the industry’s overall market size, potential in key domain areas, technology adoption by industries, start-ups expansion by cities, and other topics.

Also, this study uses a range of parameters, including company valuation, size, industry, the pattern of investment, industry, and potential to determine the funds received from undisclosed sources.

AIMResearch publishes this report annually to analyse received funding by Indian start-ups in the AI & analytics landscape. For reports from the previous year

Overview

The Indian AI and Analytics start-up ecosystem received $ 1,108 Mn in funding at a growth rate of 32.5% on a Y-o-Y basis in 2021.

There has been a constant increase in the overall funding since the last couple of years, demonstrating the investors’ trust in the Indian AI entrepreneurs. The following are the funding and growth rates over the previous few years:

In 2019, funding was $762.5 Mn at 44.0%.

In 2020, funding was $836.3 Mn at 9.7%.

Funding in Supply Chain and Logistics, Customer Service and Healthcare increased significantly over the last year. In addition, the domains like Conversational AI+NLP, Automation, and Analytics also saw a similar rise in their adoption by start-ups to build their solutions.

Even though investors participated less in the first half owing to the effect of the Covid-19 second wave, the second witnessed considerable upside in the participation by the investors due to the bullish outlook of the Indian economy post-second wave.

Investment other than top cities had also seen significant growth in their share of funding. To name a few were Coimbatore, Ahmedabad, Patna, among others.

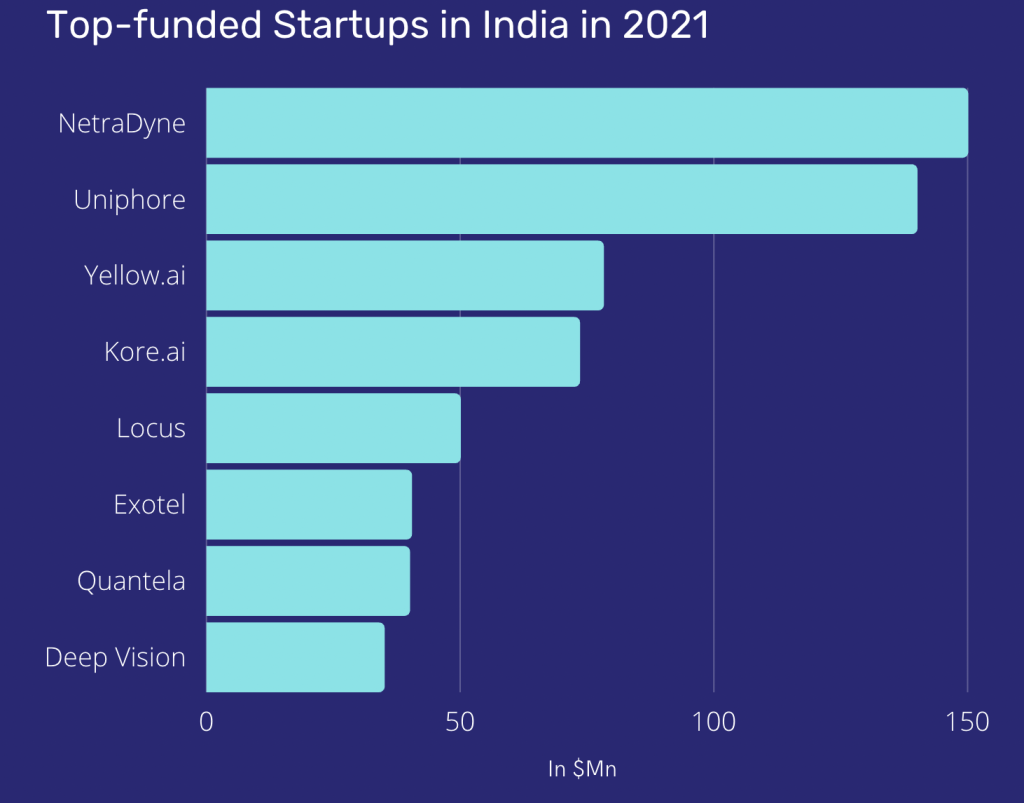

Netradyne, a Bangalore-based start-up, received the highest funding for 2021. SoftBank Vision Fund led the $150 million Series C funding round with existing investors Point72 Ventures and M12.

Key Highlights

- AI and analytics start-ups received $1,108 million in funding in 2021, the highest ever funding in seven years, with a year-over-year growth rate of 32.5 percent.

- The growth in Conversational AI+NLP led start-ups were close to 250% from the previous year.

- Five start-ups received funding above $50 Mn in 2021.

- Supply Chain & Logistics, Customer Service, Digital Media, and Healthcare all had experienced considerable growth in their funding in 2021—the trend continues in 2022 as well. This growth was largely driven by customers’ higher demand for D2C products and services during the Covid-19 era.

- Bangalore continued to be the favourite destination for start-up funding in India, with more than 60% share in the market. However, start-ups from tier 2 and tier 3 cities also saw considerable funding growth.

- Netradyne received the highest funding in 2021, totalling $150 Mn in Series C; SoftBank Vision Fund led the round with participation from others.

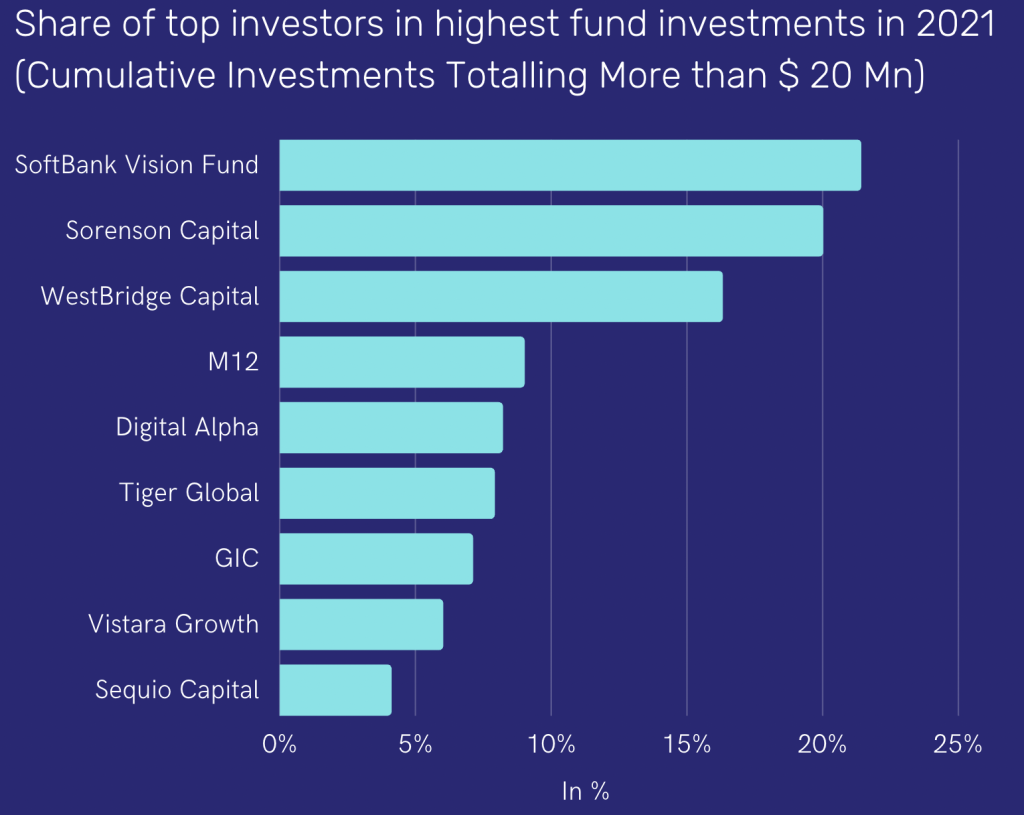

- SoftBank Vision Fund emerged as the biggest investor in 2021. It was followed by Sorenson Capital in Uniphore, other players like Digital Alpha, M12, and WestBridge Capital followed.

- September recorded the highest funding from the investors.

- There were around 40 smaller funded stacks of start-ups that had received funding less than $0.5 Mn in 2021.

- There was also another set of 38 smaller funded start-ups that had received funding between $.5 Mn to $2 Mn in 2021.

Funding for 2021 increased by 32.5 per cent over the last year. The considerable innovation and disruption in supply chain and logistics, customer services, healthcare industries, and other industries during this present pandemic are the key reasons for the surge in funding for AI and Analytics start-ups.

To complement this growth, rapid advancement in predictive analytics, prescriptive analytics, chatbots, and other similar technologies have aided businesses in successfully serving their end-users.

Furthermore, entrepreneurs in India are working on various solutions to solve problems such as autonomous driving, marine transportation, traffic congestion, and others. Companies such as Swaayatt Robots Planys Technologies, to name a few, are leading the path of innovation.

Startups Receiving High-value Investments

NetraDyne has developed a suite of fleet management solutions for the transportation industry using computer vision and deep learning technology. These tools assist businesses in understanding, detecting, and analysing how their employees interact with their fleets. In fact, in case of rule violations, its solutions alert drivers to take corrective action to avert any potential accidents. It raised $150 Mn in Series C led by SoftBank Vision Fund with the participation from existing investors.

Uniphore is a conversational automation platform that combines conversational artificial intelligence (AI), workflow automation with natural language processing (NLP), and robotic process automation (RPA) to deliver frictionless customer experiences and operational efficiencies. Uniphore raised $140 million in series D funding, led by Sorenson Capital Partners, Serena Capital, Sanabil Investments, Cisco Ventures, along with earlier investors to capitalise on the growing demand for enterprise AI and automation solutions.

Yellow.ai is a conversational AI-enabled platform that enables businesses to address and engage customers faster by deploying AI chatbots that can handle numerous self-serve enquiries themselves with multilingual capabilities and loop in live agents when needed. WestBridge Capital led a $78.2 million round of funding for Yellow.ai, with participation from Sapphire Ventures, Salesforce Ventures, and Lightspeed Venture Partners. Total funding has surpassed $102.2 million, including $20 million from the previous year in series B.

Kore.ai is a platform that uses speech and digital channels to improve the customer and employee experience. It can also build, analyse, design, deploy, and test virtual assistants, workflow processes, and conversational digital apps to simplify front and back-office interactions. It secured $73.5 million in total funding from two rounds in series C and debt-financing. Vistara Growth and PNC, together with three other investors, led the first round, and NVIDIA led the second round in series C. Furthermore, Sterling National Bank was in charge of debt financing.

Locus is a technology platform that assists its clients in the supply chain industry in getting end-to-end visibility across all operations to enhance operational efficiency, reduce environmental impact and optimize the customer experience through its suite of solutions. It secured $50 million funding in series C, led by Singapore’s sovereign wealth fund GIC, Qualcomm Ventures, Tiger Global, and five other investors joining in.

Location-wise Distribution of Start-ups

Start-ups housed in Bangalore received the highest funding for the 4th consecutive year. As a result, total funding for the start-ups based in Bangalore saw a steady growth of 26.2% compared to the previous year. In fact, cumulative funding for the Bangalore-based start-ups was $675.1 Mn or roughly 61% of total funding, significantly more than the combined funding for other cities.

In 2021, Hyderabad saw a rapid jump in overall funding largely contributed by Kore.ai C series funding, whilst Delhi NCR witnessed a plunge in the overall funding. As a result, Hyderabad positioned itself as the second-largest city for start-up funding, while Delhi NCR slipped to third place in 2021 from second place in 2020.

Furthermore, Mumbai and Pune also witnessed considerable growth in their share of funding. In terms of percentage, the increase in growth rate for Mumbai and Pune was 86.6 and 82.6 per cent respectively on a Y-o-Y basis.

Interestingly, apart from major tech and BPO centres, cities like Chennai, Kolkata, Ahmedabad, and Tier 2 cities like Patna, Coimbatore, Kanpur, Gandhinagar also saw a sharp jump in their share under the other category. In terms of percentage, the increase in growth rate for the Other segment was more than 500 per cent on a Y-o-Y basis.

Top Investment Funds of 2021

Softbank Vision Fund – the venture arm of one the biggest investment management group (Softbank Group) – led the investment in AI and Analytics start-ups.

The venture arm was the biggest investor in Netradyne, along with the participation of existing investors, computer vision and deep learning technology using start-up for fleet solutions in the supply chain and logistics industry. Though the total investment did not cross the biggest investment of 2020, still it was no less as it was Softbank Group – venture arm. Henceforth, it emerged as the biggest investment firm with a stake of 21.4 per cent in overall funding.

Sorenson Capital, United based venture capital firm, led the round of investment in Uniphore for Series D with other investors. Uniphore is a conversational automation platform. As a result, Sorenson Capital emerged as the second-largest player with a share of 20 per cent in overall funding.

WestBridge Capital, an investment firm primarily focused on India, the third-biggest player with 16.3 per cent share on overall funding, invested in Yellow.ai, a conversational AI-enabled platform, and Skit, a voice automation platform, through Series C and B respectively.

M12 is the Microsoft Venture Fund arm with a share of 9 per cent in total funding, focused on early-stage technology companies, including Netradyne, Salesken, and Nextbillion AI, through Series C, B, and, A respectively.

Digital Alpha, United based venture capital and private equity firm focused on Digital Infrastructure, particularly Cloud, NGNs and IoT. It invested in Quantela through Series B. This technology company empowers customers with the right Digital Infrastructure. Therefore, it acquired 8.2 per cent of overall funding.

Tiger Global, an investment firm focused on the Internet, software, consumer, and payments industries, invested in Deep Vision Locus through Series B and C, respectively. As a result, it had a share of 7.9 per cent in overall funding.

GIC, a Singapore based firm, invested in Locus through Series C, a technology platform that automated supply chain decisions. It had a share of 7.1 per cent in overall funding.

Vistara Growth, an investment firm investing in technology companies, invested in Kore AI through Series C. Kore AI is a conversational AI platform for optimized customer and employee experiences. With this, the firm had a share of 6 per cent in overall funding.

Sequoia Capital was a prominent investor in 2020 and invested across multiple AI and Analytics start-ups in 2021. The fund participated across three start-ups:

- Qure.ai in Series A

- Darwinbox in Series C

- Salesken in Series B

Therefore, it acquired 4.1% in overall funding thanks to the above investments.

Conclusion

The total funding in 2021 was $1,108 Mn, a growth rate of 32.5% on a Y-o-Y basis. This growth indicates a strong outlook of start-ups in the AI and Analytics ecosystem.

However, due to the impact of the second wave of Covid 19 across the country and uncertainty about the future of the Indian economy, investors were less active in the first half. But in the second half, the Indian stock market’s bullish outlook coupled with the waning impact of COVID-19 and prospects of reopening economic activities pulled investors back into the ecosystem.

In addition, investors’ interest in start-ups from other cities was also highlighted in 2021, with an emphasis on the major centres of the start-up ecosystem. This interest can also be noticed with more than 500% growth in start-ups from other cities – Coimbatore, Patna, Kanpur, Ahmedabad, and others.

Furthermore, industries including Supply Chain and Logistics, Customer Service, and Healthcare saw significant growth in the investment. And one of the main reasons was their direct connection with the services to customers, especially during a crisis like Covid-19.

In the end, technologies like NLP, Automation, Analytics, Computer Vision saw a similar adoption by the entrepreneur to build their products to solve different problems. However, the share among mentioned technologies varied between 12% to 7% while covering approximately 43% of the overall market. Though investments AI remained at the top with 49% of the total share of the market.