|

Listen to this story

|

There was little to be happy about with Alphabet Inc’s second-quarter results.

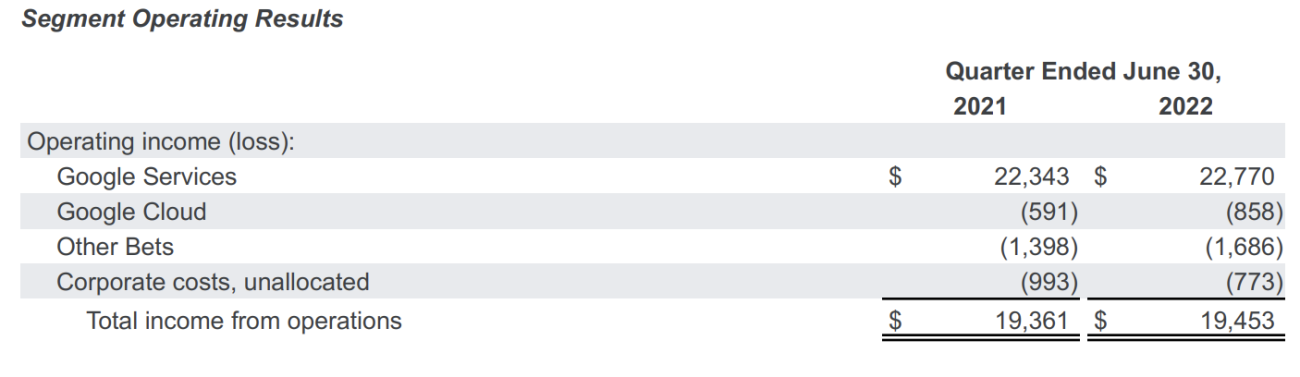

While YouTube generated USD 7.34 billion in ad revenues, lesser than the market-expected USD 7.52 billion, the second-biggest money maker for the internet giant, Google Cloud, raked in USD 6.28 billion, again lower than the USD 6.41 billion expected. Although the cloud business’ revenue was 35% more than last year’s second-quarter revenue of USD 4.6 billion, profitability was still elusive to the segment.

GCP posted a USD 858 million loss this year, which was 45% higher than the USD 591 million deficit registered last year.

Playing catch up

Senior executives of the company believe it is because Google Cloud is still catching up with market leaders in the segment – AWS and Microsoft Azure. In the earnings call with analysts post the earnings release, Alphabet CFO Ruth Porat said that a chunk of investments this quarter was made in data centres, which are an expensive affair. Porat stated that a delay in the investments had pushed the costs from last year.

Speaking on the concerns around Google Cloud’s profitability, she explained, “It’s a long-term opportunity and enterprise customers are still early in their move to the cloud. And so, we do very much have that debate, that same question that you posed is the right one, which is a trade-off between revenue growth and immediate profitability.”

Right route

In the previous quarter, Porat had said that Google Cloud was putting in money to make more money. She underlined the potential behind the mammoth cloud computing business and added that they intended to continue investing aggressively.

Several analysts echoed Google’s statement. Google Cloud was expanding its business despite high overhead costs under CEO Thomas Kurian and moving in the right direction. Profitability was a concern, but only momentarily. John Dinsdale, a chief analyst at Synergy Research, explained how cloud computing was a slow-yielding business in a TechCrunch report. “Google Cloud reporting a loss is not a big deal at all. Businesses of this nature require a lot of upfront investment and buildout of infrastructure and often don’t break even for several years. AWS made a loss for many years and was quite clear that it was making a conscious choice to plough cash being generated back into investing in the business.”

Porat’s optimism isn’t entirely misplaced but could be argued against. Google Cloud posted an operating loss of USD 644 million in the fourth quarter of 2021 as compared to more than USD 1 billion in the same quarter of 2020. This signalled that the losses had dwindled year-on-year. In the third-quarter last year, Google Cloud revenue grew to USD 4.99 billion, 45% higher than the same quarter in 2020. But it posted an operating loss of USD 644 million. This was almost half of the USD 1.2 billion loss posted on a year-on-year basis, but sequentially a little more than the loss of USD 591 million posted in the second-quarter.

Comparison with competition

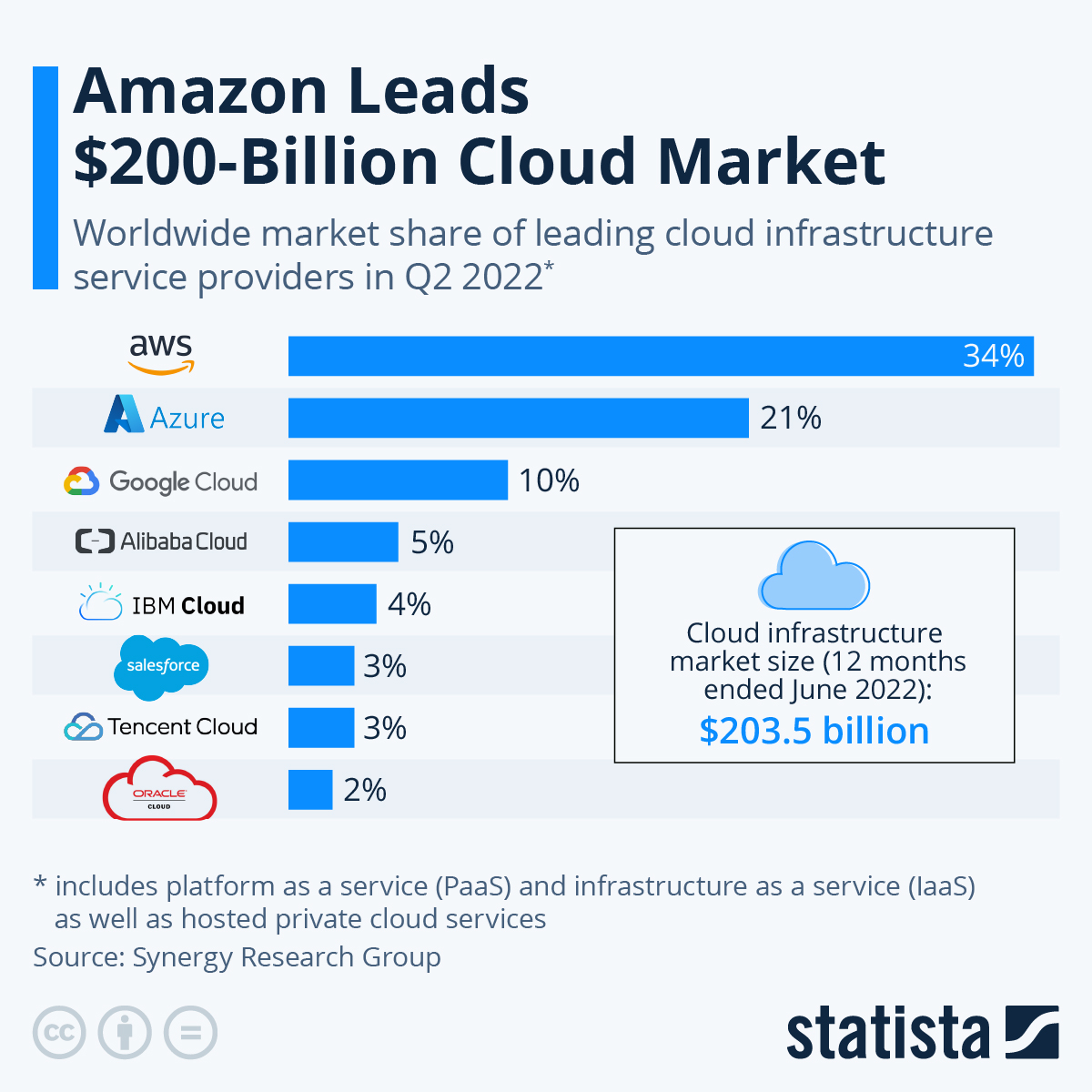

Google Cloud’s margins seem particularly problematic when set up against its much larger adversaries. Revenue for Microsoft Azure climbed up to USD 25 billion, up by 28% on a year-on-year basis.

The wildly profitable AWS too, in contrast to GCP, is a high-margin business. In the second-quarter results released last week, AWS grew 33.3% year-on-year to touch USD 19.7 billion, beating analyst estimates narrowly. Amazon’s AWS generates much higher margins than its mainstay e-commerce segment. For the last year FY 2021, Amazon’s retail business contributed 87.5% to the total revenue while AWS stood at 12.5%. However, these percentages only tell half the story; AWS accounts for nearly two-thirds of the company’s annual total operating income.

AWS has generated more than half of Amazon’s operating profit since 2014. The business was so ably handled that AWS chief Andy Jassy was chosen to replace Jeff Bezos when the latter stepped down as CEO last year.

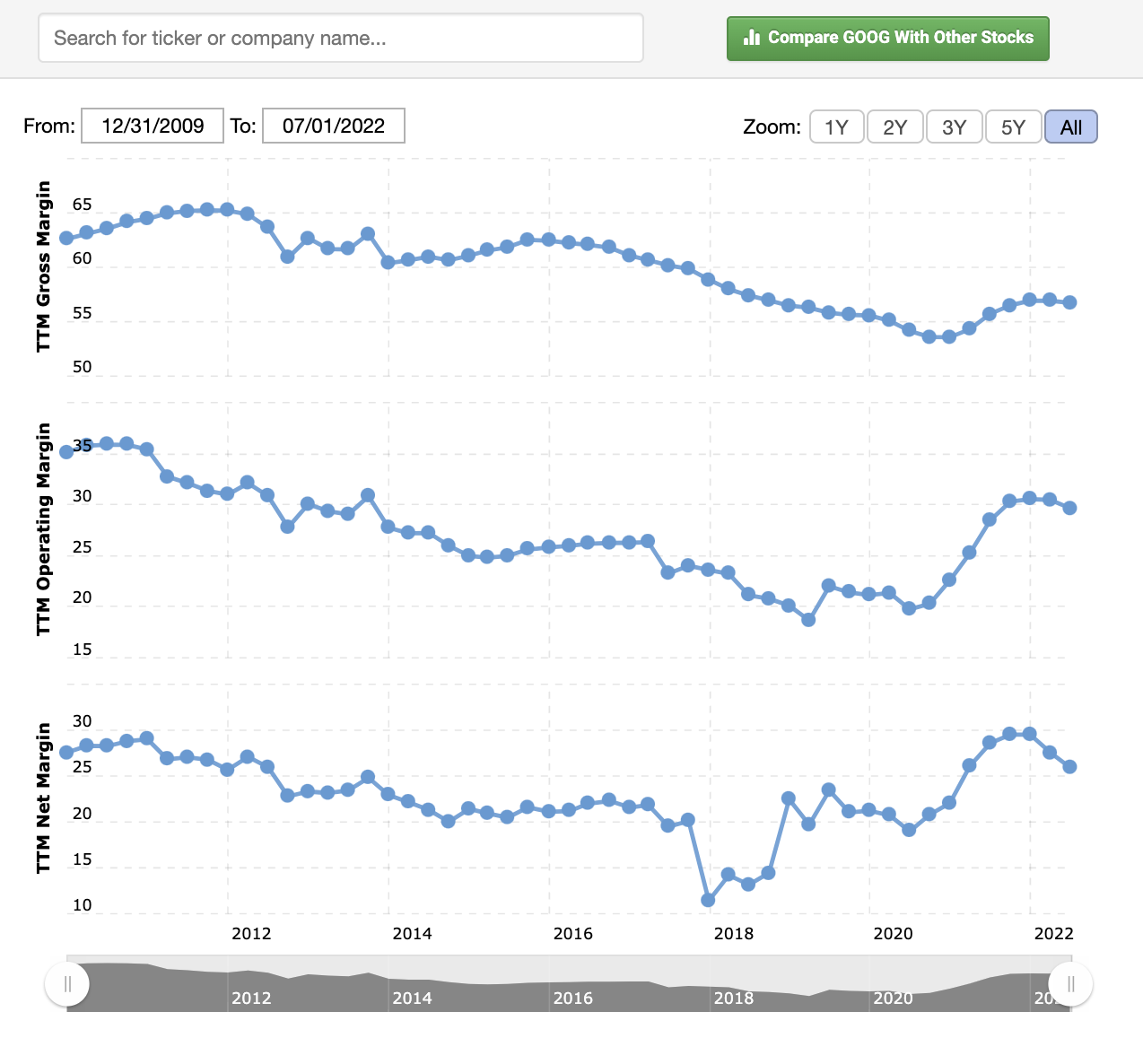

Despite recent financial improvements made by GCP, getting anywhere close to AWS’ profit margins is no mean feat either. Naysayers, including former employees and AWS clients say Google Cloud was facing a host of issues, including offering fewer high-margin services and higher overhead costs.

Some claim that Google did not know how to generate enterprise sales and can only do well as a good product company. AWS was cushioned by a solid retail business, while Microsoft Azure had created a work culture that made them adept at enterprise sales. Both had figured that the formula to become profitable in cloud computing was being frugal and having an efficient engineering culture in the backend. Google, which has largely become dependent on its high-margin advertising business, wasn’t prepared to have a tight reign on its costs.

It is a tall order to convince a client to move their cloud services unless the provider offers something unique. Google is pumping in money to persuade clients (like acquiring cybersecurity company Mandiant for USD 5.4 billion for cloud protection services), but only time will tell if this money will make more money.