When mere mortals make ordinary mistakes they falter, when founders make mistakes—it’s a debacle. But a disaster does not necessarily translate into an ending for their careers. Turns out, investors are just as likely to forgive as entrepreneurs are to be persistent.

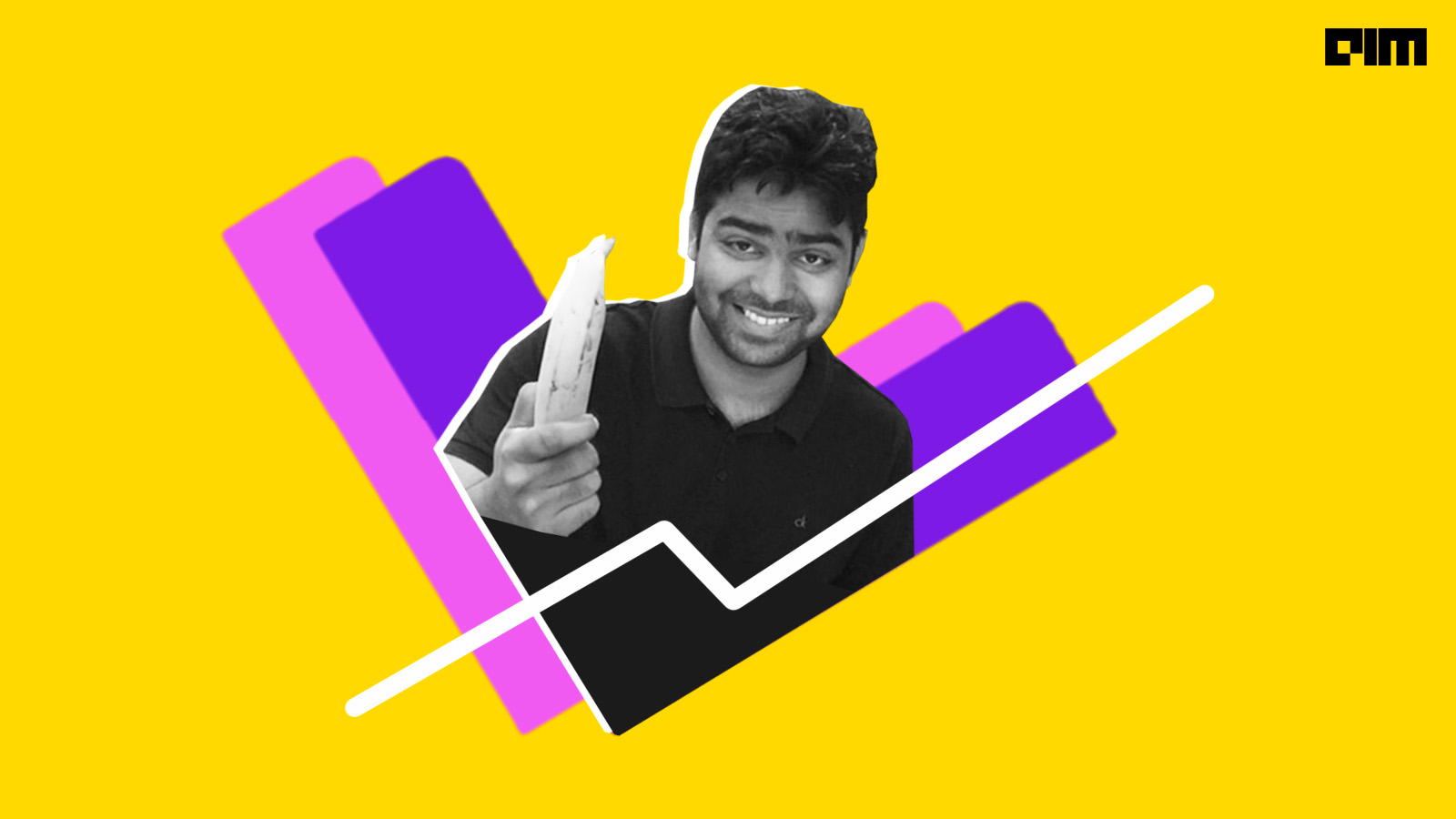

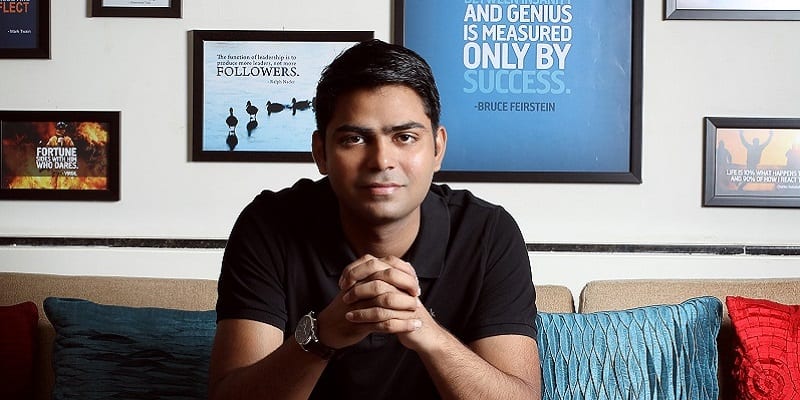

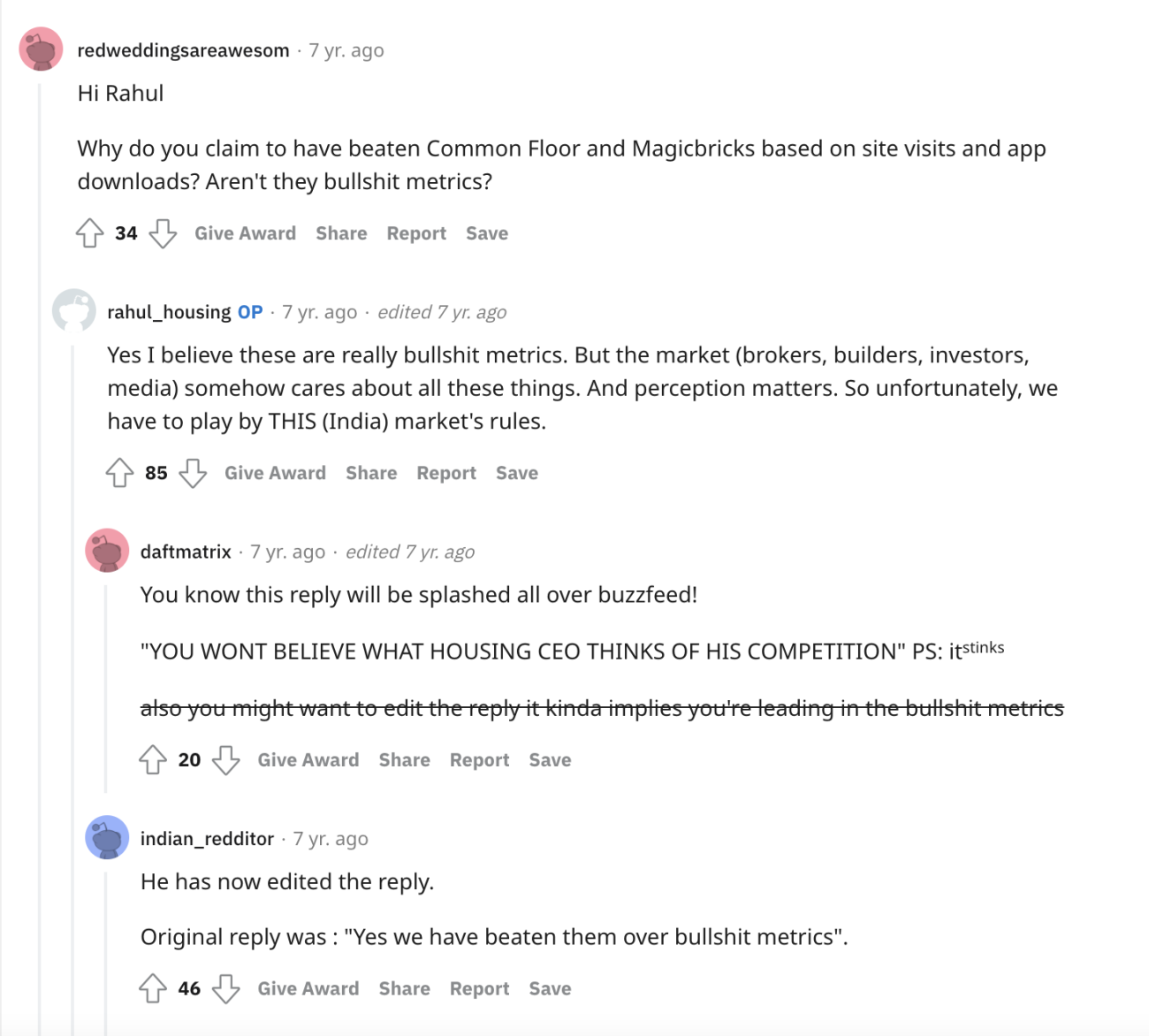

Rahul Yadav and the Housing.com circus

Case in point: The former CEO and co-founder of Housing.com, Rahul Yadav. The 26-year old Yadav became an instant icon after his real estate startup grew at a quick pace back in 2014 when solid tech startups were few and far between. Birthed when he was studying in IIT-Bombay, Housing.com went on to raise USD 90 million from Softbank and was then valued at USD 250 million. Within a span of two years, the search portal had pulled in a total of USD 121 million in investor money.

But things unravelled faster than they had come together. A letter written by Yadav accused Shailendra Singh, the head of Sequoia Capital India of poaching his staff, leaked in the media. The same month, the unguarded Yadav wrote an internal mail accusing competitor MagicBricks of ‘maligning’ his company. Post this, the then Softbank VP Nikesh Arora resigned from Housing.com’s board.

By the end of next month Yadav was running amok. Resigning from the company, Yadav bad mouthed his investors in the letter calling them ‘intellectually incapable.’ The public spectacle ended with Yadav eventually giving away his 4.5% stake in the company valued at between INR 150 and INR 200 crore then. In a written statement, Yadav announced his exit saying, “I’m just 26 and it’s too early in life to get serious about money.”

Eight years later, the Rahul Yadav story has refused to die. He shrunk from the spotlight. His most recent interview was in 2019 with Forbes where he admitted to being ‘young and immature’ earlier.

After the sabbatical, Yadav seems to have quietly crept back into property tech. Just last week, EnTrackr reported that Indian PropTech startup Broker Network raised USD 11 million or INR 90 crore in a round led by a subsidiary of Info Edge, Allcheckdeals India Private Limited. In fact, the Sanjeev Bikchandani-led Info Edge has been investing funds in small portions since December 2021.

According to its LinkedIn account, Broker Network was founded in 2020 and has over 500 employees and is helmed by Rahul Yadav. Funnily, Info Edge is the owner and operator of real estate platform 99acres, a former rival of Yadav.

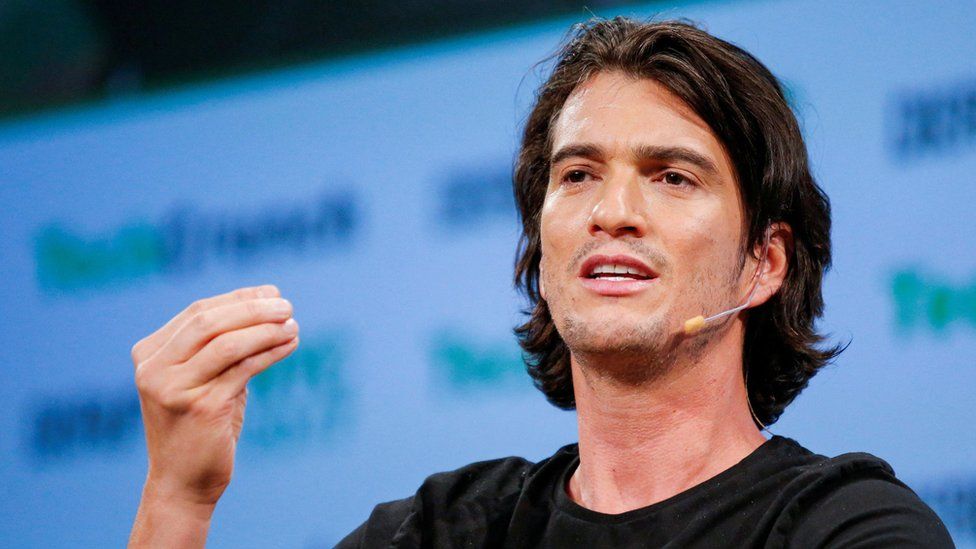

Adam Neumann continues to ‘work’

The Adam Neumann story is more recent in the collective zeitgeist. The founder and former CEO of co-working space provider WeWork saw the startup’s valuation sink from USD 47 billion to a current USD 4 billion. Neumann was accused of mismanagement, fraud and promoting a toxic work culture in a 2019 Wall Street Journal report, botching up WeWork’s highly-anticipated IPO.

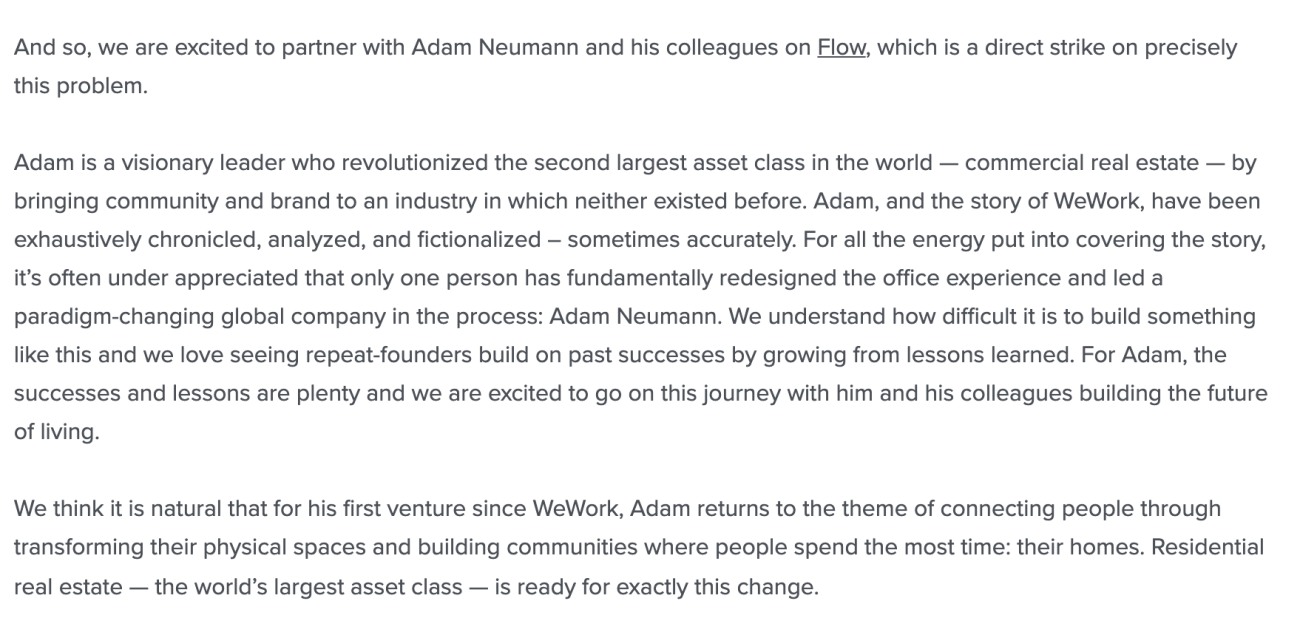

On August 15, in a move that surprised many, prominent Silicon Valley investor Andreesen Horowitz’s venture capital fund a16z announced a USD 350 million pre-seed investment in Neumann’s new startup. Known as Flow, there are few details about the startup apart from claims that it will transform the residential rental real estate market. A report by The New York Times stated that Flow will focus on building a product that includes community features—which sounds suspiciously similar to WeWork’s ethos. Despite the lack of clarity around what the startup will do, Flow has been valued at USD 1 billion.

Horowitz recently wrote a blog about the WeWork saga waxing generously about Neumann. According to the post, Neumann is a “visionary who created a niche in the commercial real space market, the second largest asset class in the world.” Horowitz empathised with Neumann adding, “We understand how difficult it is to build something like this and we love seeing repeat-founders build on past successes by growing from lessons learned.”

This is the second startup by Neumann that a16z has invested in this year. In May, the VC firm invested USD 70 million in Neumann’s blockchain-based carbon credit platform, Flowcarbon.

Evidently, Horowitz seems unswayed about his bet on the controversial Neumann given it is the largest single investment Horowitz has ever made.

Navneet Singh’s comeback in grocery delivery

In a similar trajectory, grocery delivery service PepperTap crashed and burnt within 17 months. Founded by Navneet Singh and Milind Sharma in November 2014, PepperTap was the third-biggest player in its sector. Backed by names like Sequoia Capital and Snapdeal, the startup had raised more than USD 50 million over four funding rounds.

On the face of it, PepperTap looked like a runaway success given it had expanded to 17 cities and was delivering an average of 20,000 orders per day. However, the startup had made the mistake of burning through cash quickly.

A year later, Singh was on to a new venture called GramFactory that would function as a B2B marketplace. Entrackr reported that the firm had raised USD 1 million led by Singapore-based VC BEENEXT and other blue-chip investors. Other participants in Gramfactory’s funding round included PayU’s Amrish Rau, the former Paytm VP Amit Lakhotiya, Boston Consulting Group’s Ranjan Kant and Joshua Kurian of Johnson and Johnson.