|

Listen to this story

|

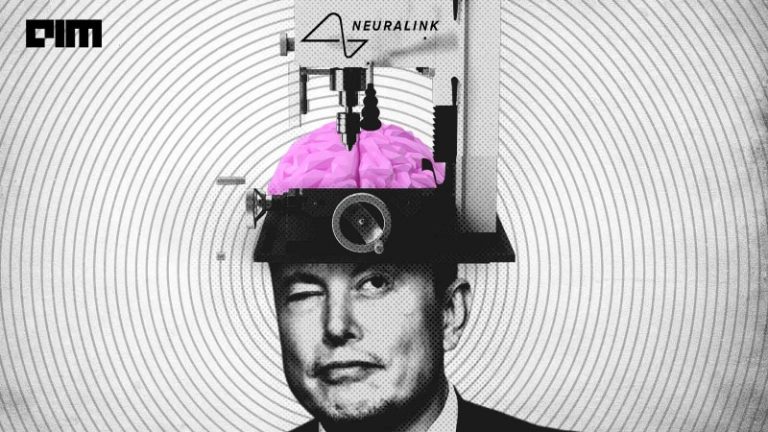

Tesla has the investors worried. The company’s shares fell by over 7% last week after the release of its quarterly deliveries report. In a bid to tackle competition, the EV manufacturer had committed to some aggressive cuts. In January, it slashed the prices of its vehicles in the US, China and Europe by as much as 20%. And yet, Tesla had managed to post deliveries just 4% higher than the last quarter.

Tesla’s lacklustre results

Analysts pointed out that further price cuts for Tesla could end up affecting the company’s profitability. After all, there was a limit to making price cuts. In comparison, things looked even worse. For most other global automakers, the first quarter was largely a hit due to improving sales. Asian counterparts like Honda, Hyundai and Mazda had all reported growth as had US peers like General Motors.

Musk’s own valuation slid in response – he lost USD 14.5 billion sending his net worth to USD 187.9 billion. Granted that he still has several billions to spare and Musk still remains the second-richest person in the world, but there’s some concern around the way things have been unravelling.

Tesla shares have tumbled 52% since April 4, 2022 – the day Musk announced his 9.2% stake in the microblogging platform, Twitter. This remains the biggest decline among companies above the market capitalisation above USD 15 billion listed on the S&P 500, according to FactSet data. Meanwhile, Musk’s worth has fallen over USD 100 billion since April last year. And Tesla’s market capitalisation has sunk from nearly USD 1.2 trillion to less than USD 600 billion.

The Twitter mess

There’s never been a dull moment with Elon Musk around, but ever since he bought Twitter for USD 44 billion, things have been particularly chaotic – and in full public view. Even in its best moments, Twitter was a loss-making company but its problems worsened since Musk’s takeover.

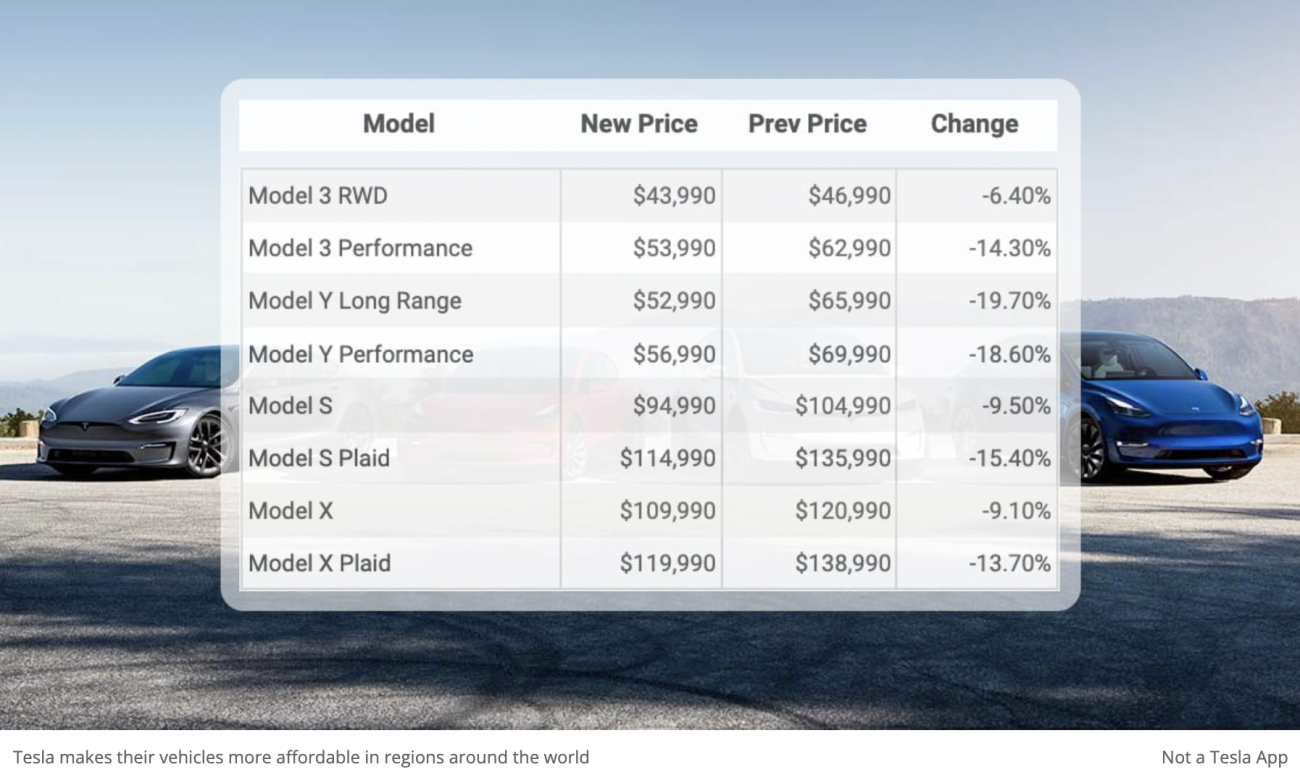

Musk withdrew billions of dollars in loans in October as a part of his endeavour to buy Twitter and take it private. In January-end this year, Twitter managed to make good on its first interest payment for a looming debt of more than USD 12.5 billion. This means Twitter will have to pay around USD 1 billion in debt every year and annual interest alone may exceed USD 1.2 billion. (Before Musk came in, the company was paying around USD 100 million in annual interest). In case Twitter defaults on payments, it will enter Chapter 11 proceedings.

Besides, Musk has admitted to a sharp drop in Twitter’s advertising revenue upon which it was primarily dependent, which accounted for 90% of the company’s turnover. But Musk’s antics — a mangled relaunch of Twitter’s subscription service rules and its moderation standards or lack of them — have shooed away advertisers. In short, given that the company was on the brink of bankruptcy, it would be a mammoth task to turn it profitable.

Musk has already put in a lot of own money into acquiring Twitter. He sold USD 23 billion worth of Tesla shares apart from the USD 20 billion of his own money, along with USD 7.1 billion from associates and USD 4 billion from his existing stake in the company.

Elon Musk's net worth has plummeted by more than half in the largest loss of personal wealth in modern history. #auspol

— PRGuy (@PRGuy17) December 30, 2022

One too many companies

Were the debt-ridden platform and Musk’s controversial behaviour at Twitter offices partly responsible for dragging down Tesla’s share price? Analysts like Dan Ives from Wedbush have said that this wasn’t the case anymore. While last year Musk’s antics were pulling down Tesla stock, Ives said that now it had lost its novelty. “Tesla investors have now become immune to the Musk Twitter drama which remains background noise on the stock,” he stated.

This was obviously better in most ways but indicated that now Tesla’s problems were solely Tesla’s. Almost all of Musk’s fortune and reputation had been built with the EV industry leader. All said and done, Tesla was his most profitable company and up until now had profit margins that led the segment. For Musk to do well, it was imperative that Tesla did well. It is scary that among the companies that Musk leads, the crown jewel is falling into deeper shadows.

For someone who sprouts ideas by the minute, it is natural that not all of them will be as effective. Musk’s tunnel construction company The Boring Company founded in 2016, has a bunch of projects it promised in cities and eventually backed out. The company has since been mired in bureaucratic red tape like obtaining environmental reviews and permits that often plague public construction.

Scarily, there are other commonalities with Twitter. Musk’s habit of spreading his assets across his companies is a risky one. In 2018, investors in SpaceX complained that The Boring Co. was paying for employees and equipment using SpaceX funds. Neuralink, his brain-computer-interface company, had ambitions to start human trials in May this year but this still looks unlikely. Meanwhile, its rival Synchron, backed by Jeff Bezos and Bill Gates, have already received the go-ahead for human trials in July last year.

Musk’s achievements are many as an innovator. He does have a list of firsts to his name, but this also includes being the first person ever to lose USD 200 billion in history. In a conversation on Twitter yesterday, Elon admitted that, “He was dumb more often than I’d like that”. Despite everything, it is apparent that Elon does not always know best.