|

Listen to this story

|

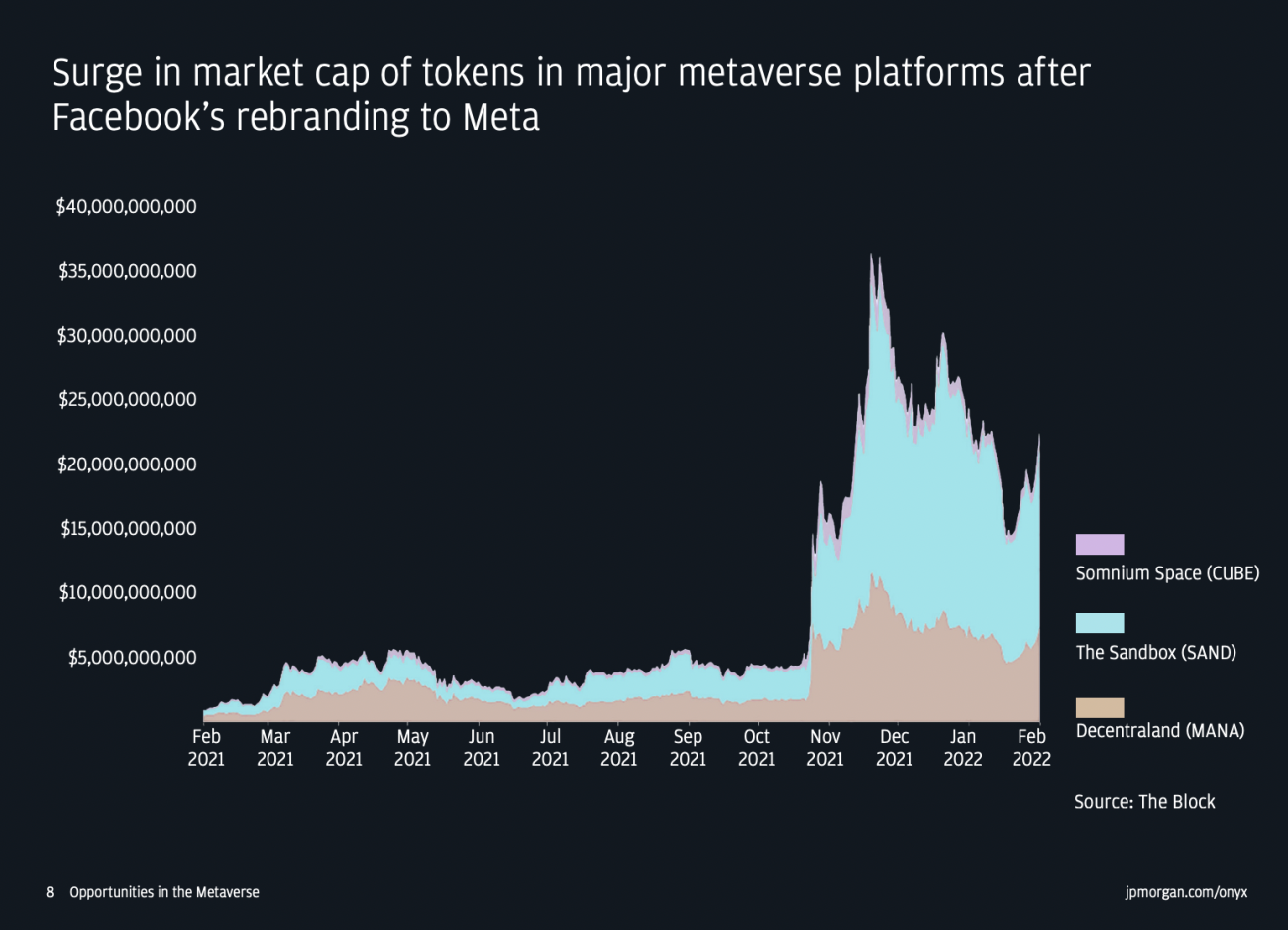

On February 17, JP Morgan became the first bank to enter the metaverse. The largest bank in the US opened a virtual lounge on Decentraland, a metaverse built on the Ethereum blockchain, called Onyx. Set up in Metajuku district, it virtually mimicked the Harajuku shopping district in Tokyo. Anyone entering the lounge was greeted by a prowling tiger and a digital portrait of Jamie Dimon, CEO of JPMorgan that was lit up.

The move was a plain marketing ploy to create hype about the bank’s crypto and blockchain service with the namesake. Along with the announcement, JP Morgan released a report on the metaverse describing it as a money-maker that could generate no less than USD 1 trillion every year. In a segment discussing its skin in the game, JP Morgan stated, “We are building and scaling new emerging technologies to modernize infrastructure and business models including but not limited to tokenization and digital identity, as we strive for perpetual innovation and better ways to organize financial transactions and payments in the decentralized web.”

Herding to the metaverse

Soon after this, other banks and institutional investors followed suit. In March, the UK-based financial services provider, HSBC Bank, bought virtual real estate on the decentralised gaming virtual world, The Sandbox. In a statement to the press, the chief marketing officer of HSBC Asia-Pacific, Suresh Balaji said that the partnership had “great potential” in creating “new experiences through emerging platforms”. Aside from the statement, HSBC posted a promotional GIF showing the HSBC stadium next to a virtual body of water on the metaverse. No other details apart from the statement were released.

Worried about losing first-mover advantage, Indian banks queued up to join the metaverse. By July, the Union Bank of India, or UBI, launched its own version of the Metaverse Virtual Lounge like JP Morgan, called ‘Uni-verse’, as well as an Open Banking Sandbox environment. In the initial phase, UBI said that ‘Uni-verse’ would store information about the bank’s products and instructional videos.

In a statement released to the public, UBI stated that customers can roam around the virtual lounge, get details about the bank’s loans and deposits or government welfare schemes, and other digital initiatives. However, chief technology officer of the bank, Rajiv Mishra explicitly stated that the bank would not “move into the new phase where transactions and other services can be provided” due to regulatory constraints.

Is there an added value?

With all these announcements, there was a common thread running through them. Each one of them mentions “innovative customer experiences” without explaining much. None of them really offered clarity around what exactly customers may be able to do in the metaverse besides visiting a virtual lounge that looked bare bones. As the initial excitement around virtual exploration passes, banks seem to have been exposed—in that their metaverse promises at the moment look very empty.

Theo Priestly, CEO of cloud-based, game economy infrastructure platform, Metanomic questioned the motives behind the banking industry’s presence in the metaverse in a LinkedIn post. “It’s very much a case of ‘you were so preoccupied with whether or not you could, that you didn’t stop to think if you should,” he stated. Describing banks’ recent work on the metaverse as bland, Priestly said, “If you really wanted to create something then partner with Hasbro and build an immersive Game Of Life – Banking Edition experience that leads would-be customers on a financial and educational journey about money.” Instead of just promising innovative experiences, banks could really work on creating them. “Make it fun. Don’t build a bloody bank branch with a poorly animated tiger and expect people to engage it in,” he added.

Studies have also found that besides not adding anything of real value to customers, users also did not find these virtual banks very user-friendly. A Razorfish study noted that even GenZ gamers, who anyway spent a considerable amount of time in the metaverse, did not feel comfortable within these immersive experiences.

A partner at consulting firm Capco, Sandeep Vishnu spoke to ‘Banking Dive’ stating that while the banking industry can’t afford to opt out of the metaverse race, investing in it may not be the appropriate move for all financial institutions. “Banks need to consider their target demographic when considering how involved they want to be in the space,” he noted. Quite naturally, for a bank that caters to an older customer base, the metaverse may not quite sound like the promised land. “If you don’t have the customer base to serve in this interaction model, are you going to pivot and try to draw in a new set of customers? I think this has to be tied very much to the bank’s overall strategy and not be a one off,” he added.

Like many others, banks too have launched avatar creation services and several marketplaces to buy NFTs but in the absence of interoperability, there is nowhere else to take them.

Lured in by the endless possibilities of the metaverse, other institutional investors too have spent millions on buying land in the metaverse. Hong Kong’s Price Waterhouse Cooper (PwC) office also purchased a LAND in Sandbox for USD 10,000. A CNBC report stated that a house in real life costs approximately USD 2,80,000 (USD 287,148 to be exact). Coincidentally, this is the same as buying a virtual piece of land in the metaverse in an upwardly mobile society. This would mean that banks are spending a lot of real money to acquire virtual land to replicate the same experiences for users, virtually. Will these hollow advertisements on a virtual land with hyped value amount to real money?